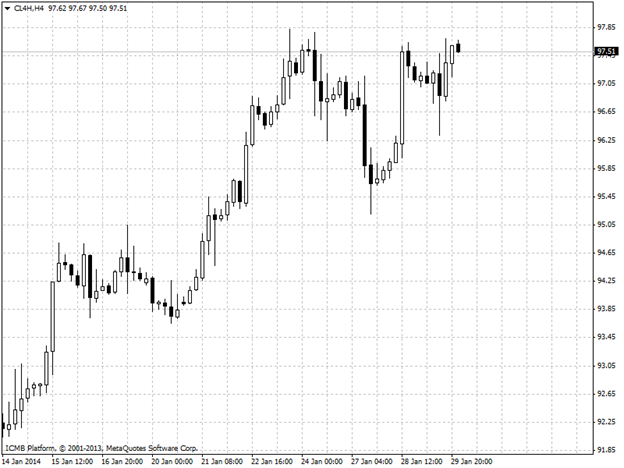

CL

West Texas Intermediate rose, trimming the biggest monthly decline for January since 2010, as demand for distillate fuel countered a second weekly increase in U.S. crude stockpiles. Futures advanced as much as 0.3% after slipping 5 cents yesterday. Demand for distillates, which include heating oil, surged to the highest level in almost six years amid colder weather in the U.S., data from the Energy Information Administration show. Crude inventories climbed by 6.4 million barrels last week, said the EIA. They were projected to gain by 2.25 million. WTI for March delivery was at $97.59 a barrel, up 23 cents. The volume of all futures traded was about 55% below the 100-day average. Prices are down 0.9% this month.

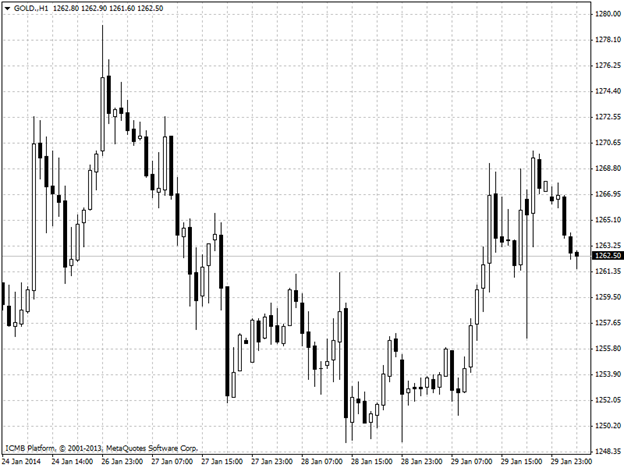

GOLD

Gold recorded its biggest advance in a week on concern that a rout in emerging-market assets may deepen, fueling demand for a haven as the U.S. Federal Reserve further reduced the pace of asset purchases. Immediate delivery traded at $1,266.27 per from $1,267.24 yesterday, when prices climbed 0.8%, the most since January 23. The yellow metal is headed for the first monthly advance since August as stocks and currencies from India to South Africa slumped. The Federal Open Market Committee said yesterday that it will cut monthly bond buying pace by $10 billion to $65 billion, trimming purchases for a second straight meeting, as the U.S. economy improved. Increased physical demand in Asia has helped gold rebound from a six-month low on December 31, when prices capped the biggest annual decline since 1981. This support is waning just before the Lunar New Year, which begins tomorrow.