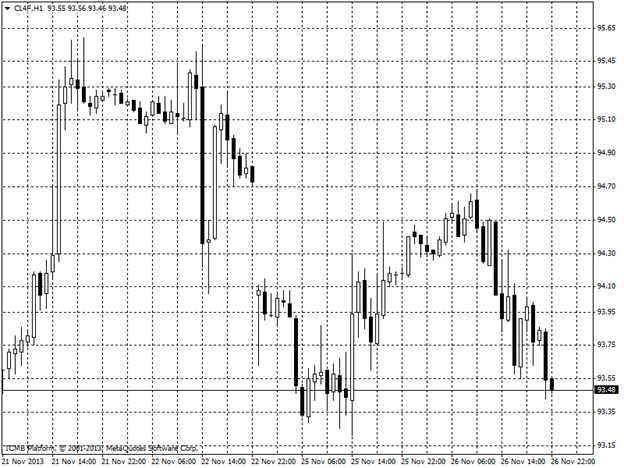

CL

Crude declined for a third day in New York on projections that U.S. crude inventories advanced for a 10th week. WTI declined in the six weeks through Nov. 15, the longest losing streak in 15 years, as U.S. crude inventories expanded amid a surge in production. Stockpiles have risen to 388.5 million barrels, the most since June, according to the EIA, the Energy Department’s statistical arm. Supplies rose 750,000 barrels last week, before an Energy Information Administration report. U.S. crude fell 0.4 percent. To 93.40.

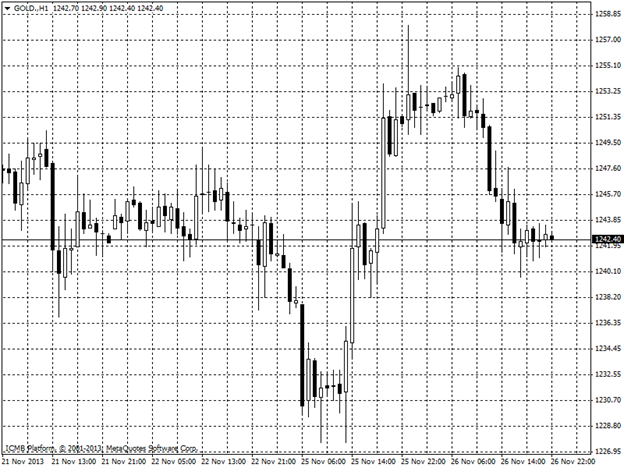

GOLD

Gold rebounded from a four-month low to the highest level in almost a week as the dollar weakened and lower prices spurred demand in China, the second-largest consumer, countering outflows from exchange-traded products. ,gold rose as much as 0.6 percent to $1,258.30 an ounce, the highest level since Nov. 20 Gold tumbled 25 percent this year, entering a bear market in April. Investors sold metal from ETPs at a record pace as inflation failed to accelerate and on expectations the Federal Reserve will begin scaling back its $85 billion-a-month of asset purchases that helped bullion cap a 12-year bull run in 2012.