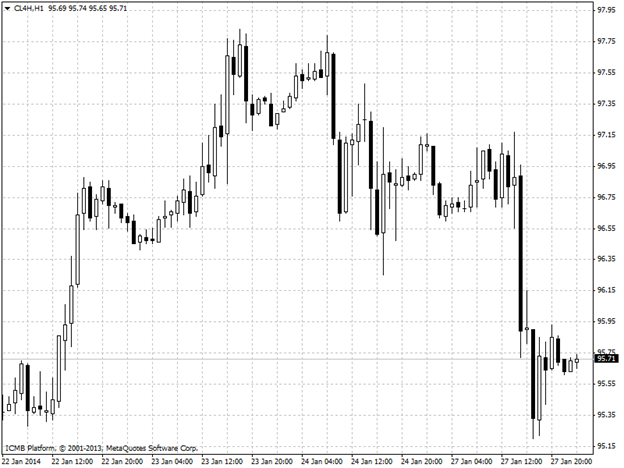

CL

West Texas Intermediate traded near the lowest price in a week amid speculation a government report will show crude stockpiles increased in the U.S., the world’s biggest oil consumer. Futures were little changed after declining for a second session yesterday. Crude inventories probably climbed by 2 million barrels last week. WTI for March delivery was at $95.73per barrel. The contract fell 1% to $95.72 yesterday, the lowest price since January 21st. The volume of all futures traded was about 74% below the 100-day average.

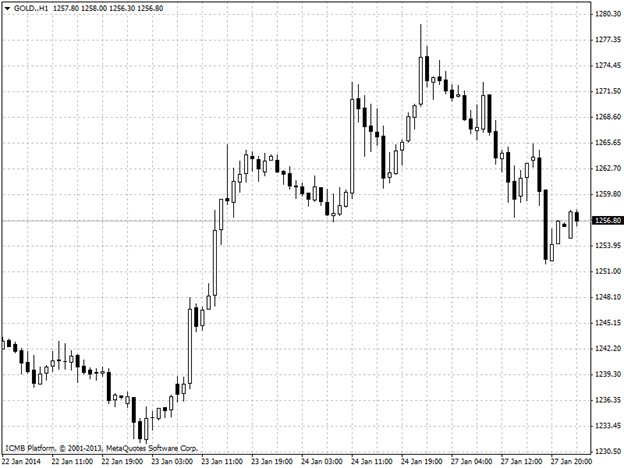

GOLD

Gold rallied to a two-month high, extending the longest run of weekly gains since September 2012, as a rout in emerging-market assets fueled demand for a haven. Bullion for immediate delivery rose as much as 0.8% to $1,279.61 per ounce, the highest level since November 18, and traded at $1,275. The yellow the Federal Reserve will conclude a monetary policy meeting on Wednesday, and investors remained bullish on the greenback amid expectations that monetary authorities will make fresh cuts to its USD75 billion in monthly bond purchases due to several months of improving U.S. economic indicators. Stimulus tools such as Fed purchases of Treasury holdings and mortgage debt suppress interest rates to spur recovery. U.S. housing data prompted a pause in the greenback's gains. And gave the yellow metal a push to gain, The Census Bureau reported earlier that sales of new, single-family houses in December came in at a seasonally adjusted annual rate of 414K, missing market calls for a 475K reading and also below November's revised figure of 445,K. The figure was still well above the December 2012 reading of 39K, and the data also revealed that inventories remain lean and prices continue rising, which softened the report's bearish impacts on the dollar.

Harsh winter weather may have affected sales in December as well. Gold rose yesterday gaining about 0.2% just after the release of the home sales data.