CL

Oil prices slid on Monday after investors locked in gains from Friday's robust economic growth data and sold the commodity for profits, especially after a widely-watched U.S. consumer sentiment report missed expectations. The Commerce Department reported on Friday that the U.S. gross domestic product expanded by 4.1% in the third quarter, well above consensus forecasts for 3.6% growth, which sent oil prices rising on hopes for faster economic recovery. The Federal Reserve's Wednesday decision to trim its USD85 billion monthly bond-buying program by USD10 billion beginning in January also bolstered prices as well by further stoking expectations for more pronounced economic growth down the road. By Monday, however, profit taking sent the commodity edging into negative territory, especially after a widely-watched consumer sentiment gauge missed expectations. Elsewhere, the Bureau of Economic Analysis reported that U.S. personal spending rose 0.5% last month, in line with consensus forecasts. Personal spending for October was revised up to a 0.4% gain from a previously reported increase of 0.3%.

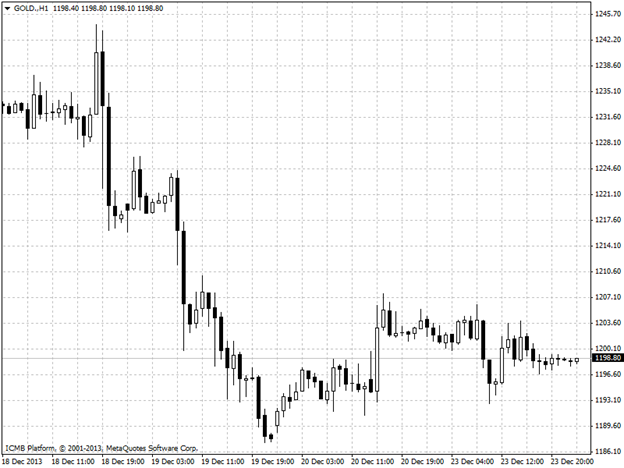

GOLD

Gold prices edged lower on Monday as markets braced for the Federal Reserve to begin tapering its USD85 billion in monthly bond purchases by USD10 billion beginning in January. Gold extends losses on the Fed taper move, ignoring soft U.S. data Bond purchases that seek to boost recovery by pushing down interest rates, and weakening the dollar in the process and making gold an attractive hedge. Gold took a beating after the Fed on Wednesday announced that it would reduce its USD85 billion-a-month bond-buying program by USD10 billion in January. While bottom fishing sent gold back up on Friday, investors resumed selling the metal on Monday amid sentiments that 15 months of gold-supporting Fed asset purchases are eventually on their way out. The Thomson Reuters/University of Michigan's overall consumer sentiment index held at 82.5 in December, unchanged from an initial estimate, though analysts were hoping for the index to climb to 83.0. The Michigan consumer sentiment index stood at 75.1 in November.