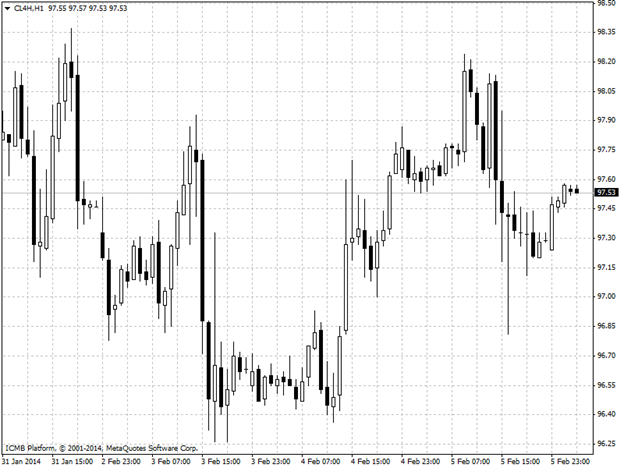

CL

West Texas Intermediate oil was little changed after a U.S. government report showed U.S. crude stockpiles increased last week while inventories of distillate fuel dropped. Prices moved in a $1.46 range. Crude supplies rose 440K barrels to 358.1 million barrel. The report was projected to show a 2.55 million barrel gain. WTI for March delivery increased 25 cents to $97.60 a barrel. The volume of all futures traded was 6.2% higher than the 100-day average. U.S. crude production was unchanged at 8.04 million barrels a day. It rose to 8.16 million in the week ended January 10, the highest level since 1988. Refineries operated at 86.1% of capacity, down 2.1% points from the prior week, the report showed.

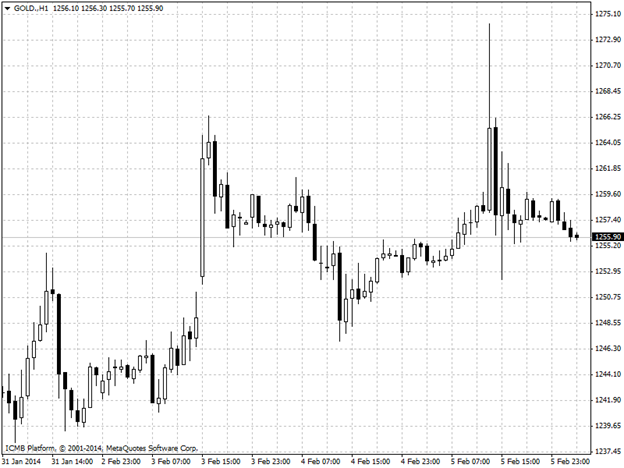

GOLD

Gold held gains after climbing to the highest level in more than a week as speculation that the U.S. economic recovery may be stalling boosted haven demand. Immediate delivery traded at $1,257.96 per ounce from $1,257.92 yesterday, when prices reached $1,274.74, the highest since January 27. Gold gained 3.2% in January, the first monthly advance since August, on concern that a rout in emerging markets may worsen. A private report yesterday showed weaker-than-forecast jobs growth in the U.S., fueling speculation government data tomorrow will trail estimates. The Federal Reserve said last week it will trim monthly bond buying by $10 billion after deciding in December to reduce purchases by the same amount as the economy improved.