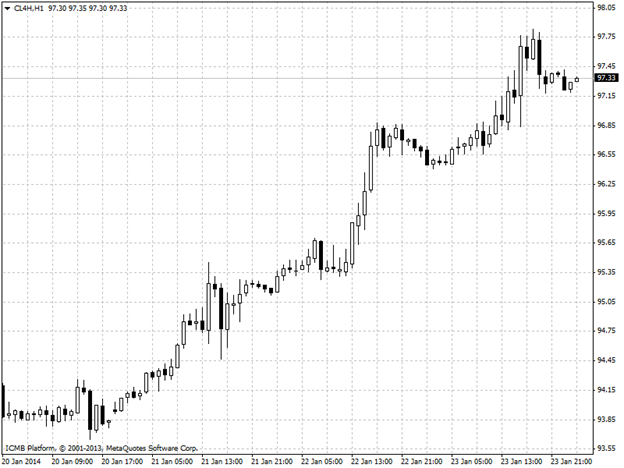

CL

Oil prices rose on Thursday after weekly U.S. inventory data revealed demand for distillates remains robust despite gains posted in oil and gasoline stockpiles. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories rose by 990,000 barrels in the week ended Jan. 17, outpacing expectations for an increase of 588,000 barrels. Total U.S. crude oil inventories stood at 351.2 million barrels as of last week. The report also showed that total motor gasoline inventories increased by 2.1 million barrels, broadly in line with market expectations. Meanwhile inventories of distillates, which include diesel fuel and heating oil, fell by 3.2 million barrels compared to market calls for a loss of 851,000, which supported crude prices. The data came out one day later than usual due to the Martin Luther King Jr. Day holiday earlier in the week. Elsewhere, prices rose on reports that the Keystone XL pipeline linking Cushing, Oklahoma, to the U.S. Gulf Coast began making deliveries this week, which should ease bottlenecks that have depressed prices at times.

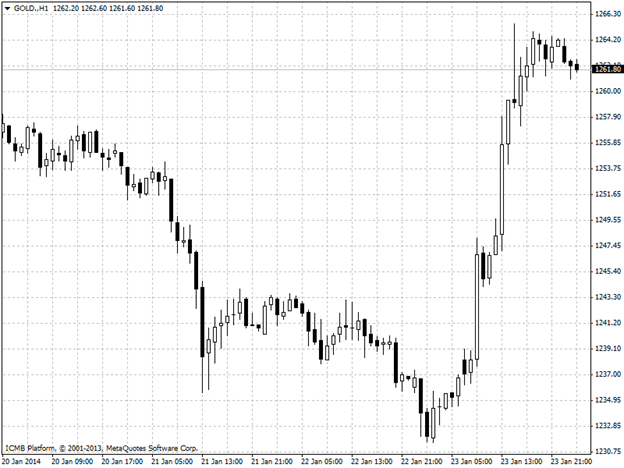

GOLD

Gold prices jumped up on Thursday after weekly jobless claims data revealed the U.S. labor market still faces potholes along its road to recovery and will enjoy support from Federal Reserve stimulus programs and low interest rates for the foreseeable future. Gold gains as weekly jobless report reveals labor market soft patch In the U.S. earlier, the Labor Department reported that weekly initial jobless claims rose in line with expectations last week, but the number of continuing jobless claims remained above the 3 million mark for a second successive week. Elsewhere, U.K.-based Markit Economics reported that U.S. factory output fell to a three-month low in January, mainly due to the impacts that wintry weather had on commerce. The U.S. manufacturing PMI declined to 53.7 this month from a final reading of 55.0 in December. Analysts had expected the index to hold steady.