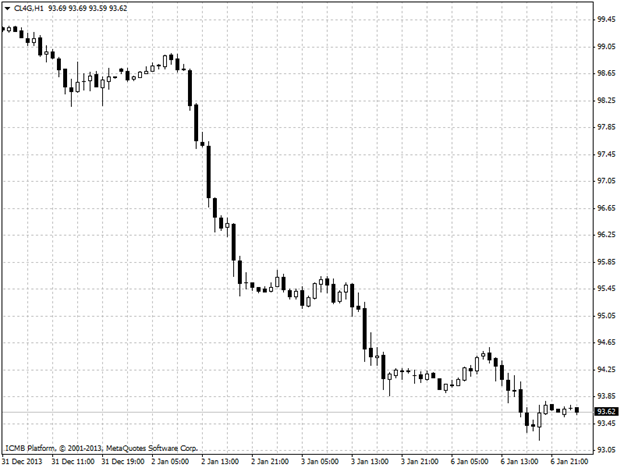

CL

Crude oil gain despite negative clues The markets were also not affected by an expected increase in U.S. domestic oil supplies for the first time in six weeks, figures for which will be released on Wednesday. Ongoing expectations for Libyan oil exports to resume to near normal levels sent prices falling due to the added supply they'd bring to the global market. Libyan oil operations faced glitches in the recent past due to protesters disrupting production at various oilfields, and expectations for the country to possibly double its output to around 600,000 barrels per day soon pressured prices lower on Monday. Expectations for increased exports from South Sudan also nudged prices lower. Prices also slumped after the Institute of Supply Management said its non-manufacturing purchasing managers' index fell to 53.0 in December from 53.9 in November. Analysts were expecting the index to increase to 54.5, and the disappointing reading stoked concerns that the U.S. economy still faces potholes along its road to recovery and may demand less fuel and energy than once anticipated.

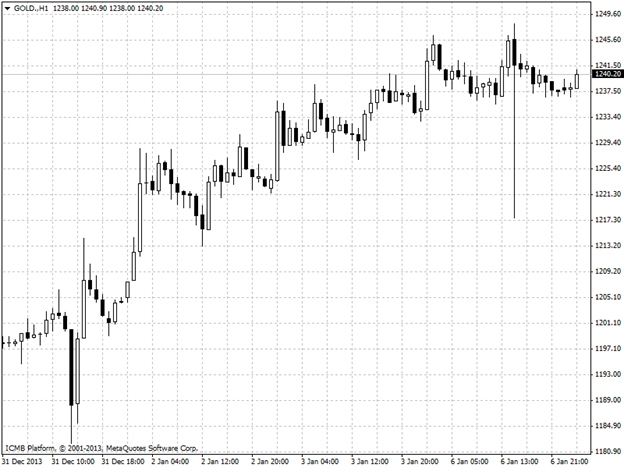

GOLD

Gold prices jumped in and out of positive territory on Monday on bullish reports of rising physical demand in Asia, while soft U.S. service-sector data weakened the dollar and also gave the yellow metal room to rise. Gold trades sideways on soft U.S. data, Fed monetary concerns Long-term concerns that the Federal Reserve remains on track to continue scaling back monthly bond purchases that have supported the yellow metal since September of 2012 pressured prices lower. Reports of rising demand for gold bars and jewelry in Asia pressured prices up on Monday, especially among bargain hunters who viewed the yellow metal as an attractive buy. Gold prices fell about 29% in 2013 amid growing expectations that the Federal Reserve will taper its USD75 billion in bond purchases this year. Past and present rounds of Fed bond purchases aim to drive recovery by suppressing long-term borrowing costs, weakening the dollar in the process and making gold an attractive hedge.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Gold Prices Jump In And Out Of Positive Territory

Published 01/07/2014, 04:30 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Gold Prices Jump In And Out Of Positive Territory

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.