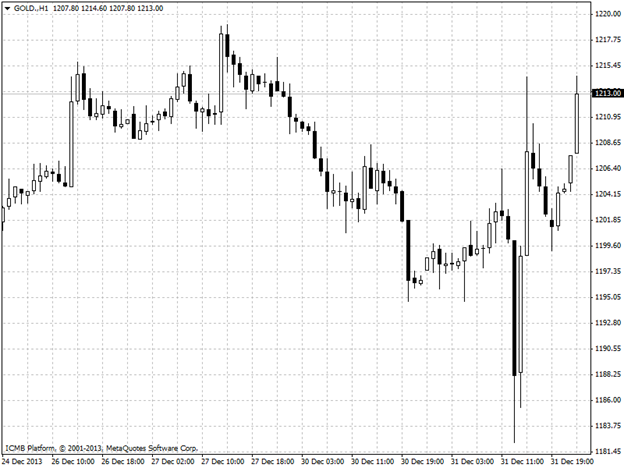

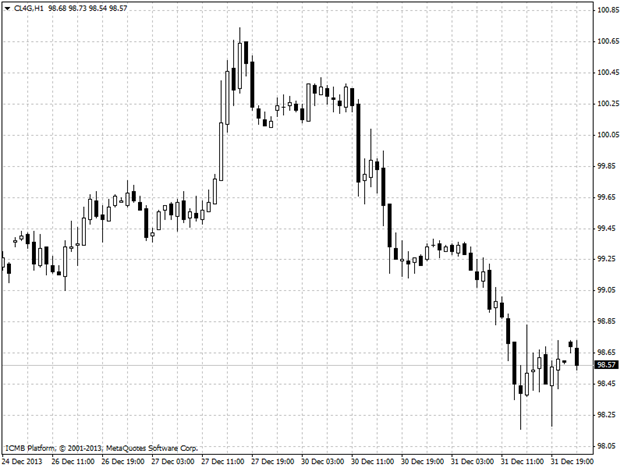

CL

Oil prices edged lower on Monday on expectations for Libya to increase its oil exports, while investors shrugged off a solid U.S. consumer confidence report in a quiet session. Expectations for Libyan oil exports to resume to near normal levels sent prices falling Tuesday due to the added supply they'd bring to the global market. Libyan oil operations faced glitches recently due to protesters disrupting production at various oilfields. Expectations for increased exports from South Sudan also nudged prices lower. Trading volumes were thin as many investors already closed books before the end of the year, reducing liquidity in the market and increasing volatility, which helped exaggerate market moves. Elsewhere, solid consumer confidence data did little to boost the commodity, which was still on track to finish 2013 up around 6%. The Conference Board reported earlier that its index of U.S. consumer confidence improved to 78.1 in December from 72.0 in November, beating consensus forecasts for a 76.0 reading.

GOLD

Gold prices edged lower in quiet trading on Tuesday as investors avoided the metal on the likelihood it will close 2013 with its deepest plunge in over three decades. The Standard & Poor’s/Case-Shiller 20-city home price index rose at an annualized rate of 13.6% in October from a year earlier, the strongest pace since February of 2006 and above forecasts for an increase of 13.0%. The data confirmed expectations for the Federal Reserve to continue winding down stimulus programs such as its USD75 billion in monthly bond purchases next year and let the economy stand on its own feet. Fed bond purchases tend to weaken the dollar by driving down interest rates to spur recovery, thus bolstering gold's image as a hedge, though less monetary support can send gold falling. The Fed has rolled out multiple rounds of bond purchase since the 2008 financial crisis, and the increasing likelihood that 2014 will see less and less monetary intervention has sent gold prices plunging this year. Gold prices were set to finish 2013 contracting by about 29%, which would be the steepest decline for the yellow metal since 1981.