CL

Oil prices shot up on Monday after data revealed that industrial activity in the U.S. and China, the world's largest consumers of crude, beat expectations and painted a picture of a global economy poised to demand more fuel and energy going forward. The Institute for Supply Management reported that U.S. manufacturing activity in November expanded at its fastest pace since April 2011, fueling optimism for more robust economic recovery down the road. Meanwhile in China, the Chinese HSBC Manufacturing PMI came in at 50.8 in November, beating market calls for a 50.5 reading. Meanwhile across the Atlantic, similar indicators beat expectations as well and pumped up crude prices. London-based Markit Economics reported that the euro zone's manufacturing PMI rose to a two-year high of 51.6 in November from October's 51.5 reading, beating estimates for an unchanged figure. Germany's PMI came in at 52.7 compared to market expectations for an unchanged read of 52.5.

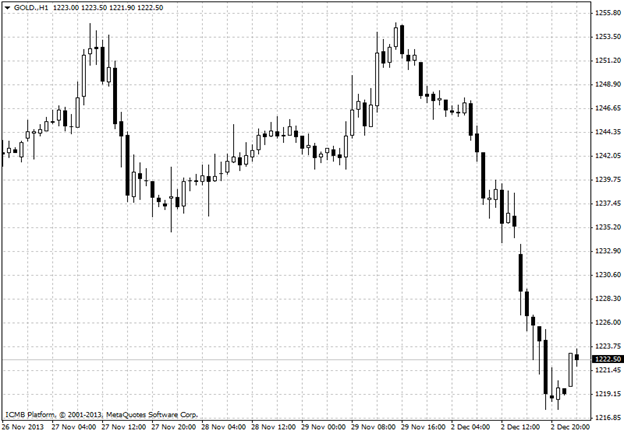

GOLD

Gold prices dropped on Monday after a better-than-expanded U.S. factory report beat expectations and fueled demand for the dollar, by firming expectations for the Federal Reserve to begin scaling back monetary stimulus programs in early 2014. Stimulus tools such as the Fed's USD85 billion in monthly bond purchases aim to drive recovery by pushing down long-term interest rates, weakening the dollar in the process, with talk of their dismantling strengthening the greenback. The dollar saw support earlier after the Institute for Supply Management reported that U.S. manufacturing activity in November expanded at its fastest pace since April 2011, fueling optimism for more robust economic recovery down the road. The ISM manufacturing purchasing managers’ index rose to 57.3 in November from 56.4 in October. Analysts were expecting the index to fall to 55.0, and the surprise uptick sparked demand for the dollar. The report said both production and new orders rose by around 3 points to 62.8 and 63.6, respectively, while the employment component of the index indicated some improvement in the labor market in November, rising by a little over 3 points to 56.5. Better-than-expected U.S. economic indicators bolster the dollar by prompting investors to trade on expectations for the Federal Reserve to begin tapering monthly bond purchases in the coming months, most likely in March, when Fed Chair Nominee Janet Yellen is due to hold her first policy meeting.