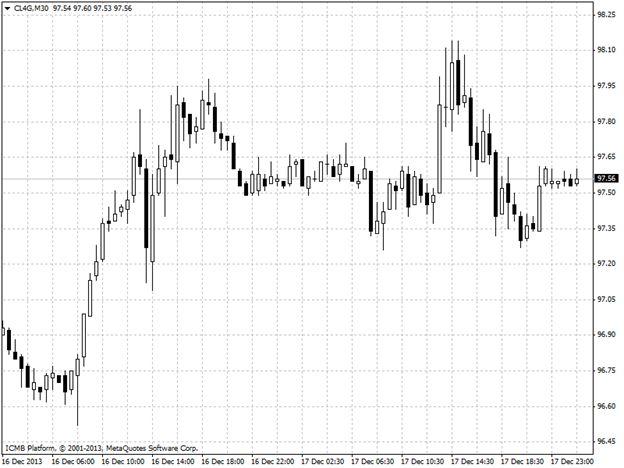

CL

Oil prices traded steady to lower on Tuesday as investors avoided the commodity ahead of the Federal Reserve's Wednesday announcement on monetary policy, hoping for a decision on whether or not the U.S. central bank will taper its USD85 billion in monthly asset purchases. Crude steady to lower as markets brace for Fed policy decision Fed bond purchases aim to spur recovery by driving down interest rates, weakening the dollar while they remain in place. Many investors remained in standby mode ahead of the Fed's Wednesday announcement on monetary policy as well as the fate of stimulus programs such as monthly bond purchases, which have supported oil for over a year by softening the dollar. Lackluster inflation data released earlier gave investors little indication as to whether the Fed will taper asset purchases now or in 2014. The Department of Labor reported earlier that the U.S. consumer price index came in flat in November after falling 0.1% in October. Analysts were calling for a 0.1% uptick.

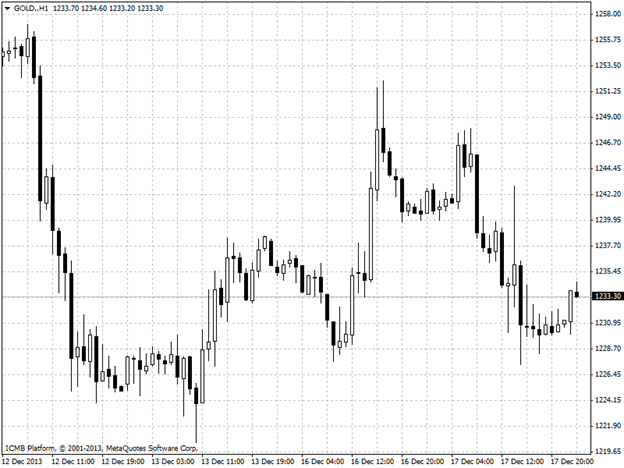

GOLD

Gold prices dropped on Tuesday after less-than-stellar U.S. inflation rates hit the wire, which clouded already murky expectations on whether or not the Federal Reserve will decide to taper its USD85 billion in monthly asset purchases at a policy meeting ending Wednesday. Gold drops on lackluster U.S. inflation data, Fed uncertainty Bond purchases seek to boost recovery by pushing down interest rates, weakening the dollar in the process and making gold an attractive hedge. The Department of Labor reported earlier that the U.S. consumer price index came in flat in November after falling 0.1% in October. Analysts were calling for a 0.1% uptick. The annual rate of inflation rose 1.2% in November, just shy of expectations for 1.3% reading but still up from a four-year low of 1.0% in October. U.S. core inflation, stripped of volatile food and energy items, rose 0.2% in November from October, beating expectations for a 0.1% gain, while the year-on-year rate for November rose 1.7%, which met consensus forecasts. Core prices are viewed by the Federal Reserve as a better gauge of longer-term inflationary pressure because they exclude the volatile food and energy categories. Monetary authorities usually try to aim for 2% core inflation or less. With inflation rates refusing to serve as a clearly visible weather vane pointing to the direction of monetary policy, investors avoided the precious metal until the Fed releases is policy statement on Wednesday..