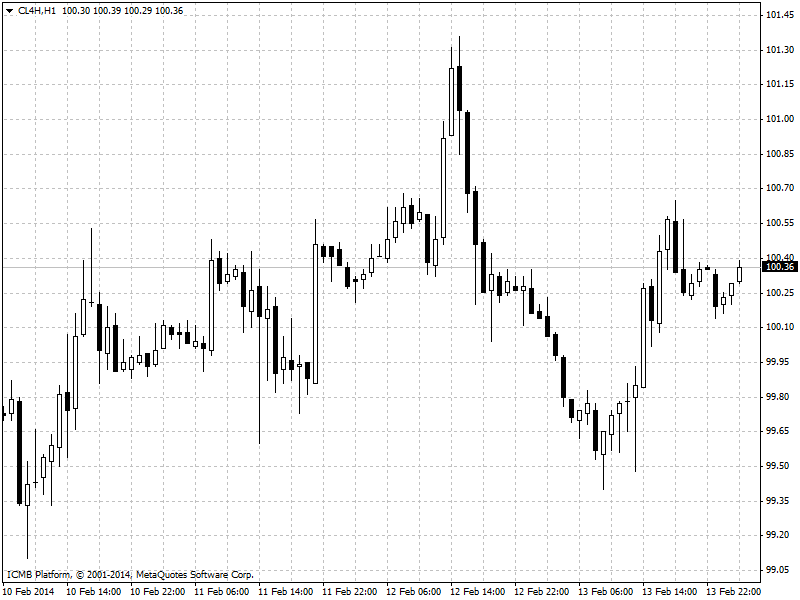

CL

West Texas Intermediate crude headed for a fifth weekly gain as cold weather in the U.S. bolstered demand for energy in the world’s biggest oil consumer. Futures were little changed while poised for the longest weekly rally in a year. Distillate inventories, a category that includes heating oil and diesel, last week dropped to the lowest level for that time of the year since 2003, according to the Energy Information Administration. January was the coldest start to the year in more than a decade and more snow is sweeping across the U.S. Northeast. Libyan output decreased after protesters closed a pipeline, a government official said. WTI for March delivery was at $100.20 a barrel, down 15 cents. The contract is up 0.3% this week, heading for the longest rising streak since February 2013. The volume of all futures traded was about 18% below the 100-day average.

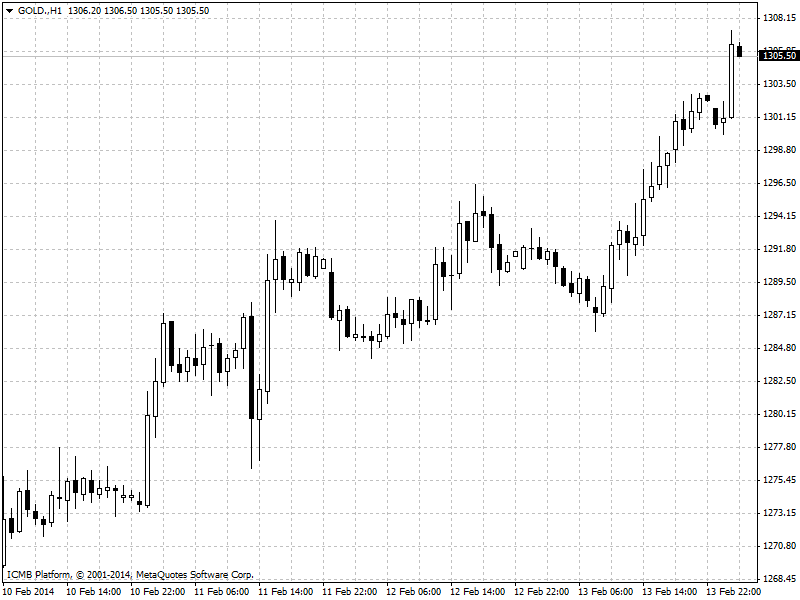

GOLD

Gold posted the longest rally since July 2011, topping $1,300 an ounce for the first time since November, after signs of faltering U.S. economic growth added to the increasing investor appetite for haven assets. U.S. retail sales fell in January by the most since June 2012, and jobless claims unexpectedly rose last week, government data showed yesterday. Gold futures for April delivery rose for the seventh straight session by 0.4% to close at $1,300.10. After the settlement, the price reached $1,302.40, the highest for a most-active contract since November 8. Today the immediate delivery gold rose to $1303.06 during the morning trades confirming the three months high.