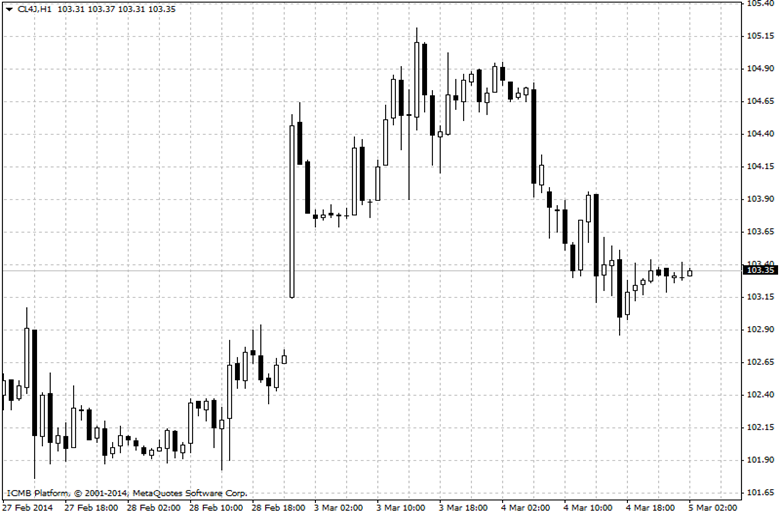

CL

West Texas Intermediate swung between gains and losses near $103 a barrel after falling the most in two months as crude stockpiles increased in the U.S., the world’s biggest oil consumer. Futures were little changed in New York after declining 1.5 percent yesterday amid speculation tension was easing between Ukraine and Russia. U.S. crude inventories rose by 1.17 million barrels last week, according to the American Petroleum Institute. A government report today may show supplies expanded by 1.3 million, a Bloomberg News survey of analysts show. Stockpiles at Cushing, Oklahoma, the delivery point for WTI contracts, fell 2.63 million, the industry-funded API said. WTI for April delivery was at $103.27 a barrel in electronic trading on the New York Mercantile Exchange, down 6 cents, at 11:25 a.m. Sydney time. The contract slid $1.59 to $103.33 yesterday, the most since Jan. 3. The volume of all futures traded was about 81 percent below the 100-day average. U.S. distillate inventories, including heating oil and diesel, shrank by 270,000 barrels, the API reported yesterday. Energy Information Administration data today will probably show supplies decreased by 1 million, according to the median estimate of nine analysts in the Bloomberg survey.

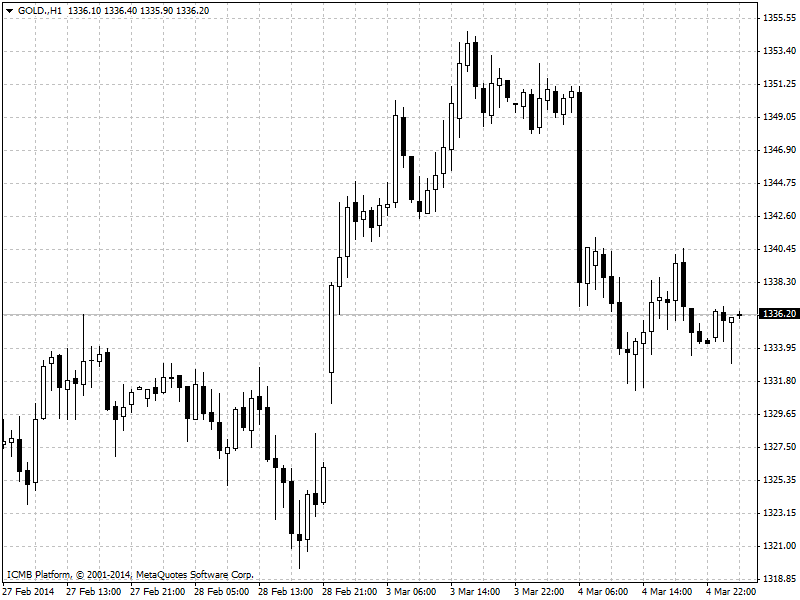

GOLD

Gold traded below the highest level in more than four months as tension between Ukraine and Russia eased, curbing demand for a protection of wealth. Putin said he while he reserved the right to use force to defend ethnic Russians, there’s no such necessity at present, in his first public remarks since Ukraine said the region of Crimea had been taken over by Russian forces. The U.S. and its European allies are racing to help the new government in Kiev avoid bankruptcy while threatening sanctions against Russia. “Short term, the uncertainty’s still here and gold fulfills its purpose as an insurance asset, and as a diversifier,” Dominic Schnider, head of commodities research at UBS AG’s wealth-management unit, said from Singapore. “The medium to long term is still negative for gold as we get more clarity on growth and move toward U.S. monetary policy normalization.” Gold rallied 11 percent this year, rebounding from the biggest annual loss since 1981, even as the Federal Reserve reduced stimulus. Holdings in the SPDR Gold Trust, the biggest exchange-traded product backed by bullion, were unchanged yesterday for a fifth day, the longest stretch assets have held steady in almost a year.