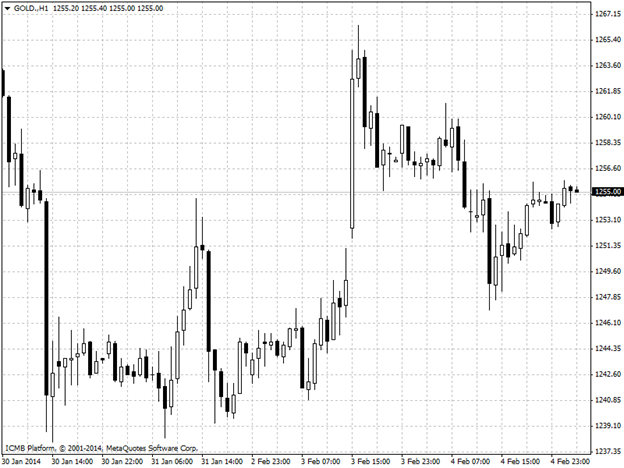

CL

West Texas Intermediate crude rose for a second day on speculation a U.S. government report will show distillate inventories fell amid cold weather in the country, the world’s biggest oil consumer. Futures climbed as much as 0.7%. Distillate supplies, including heating oil and diesel, probably shrank by 2.5 million barrels to 113.7 million last week. WTI for March delivery increased as much as 69 cents to $97.88 per barrel. The contract gained 0.8% to $97.19 yesterday, halting a two-day loss. The volume of all futures traded was about 23% below the 100-day average. WTI has risen the past three weeks as distillate demand expanded and inventories decreased amid cold weather. U.S. crude stockpiles climbed by 384,000 barrels in the week ended Jan. 31.

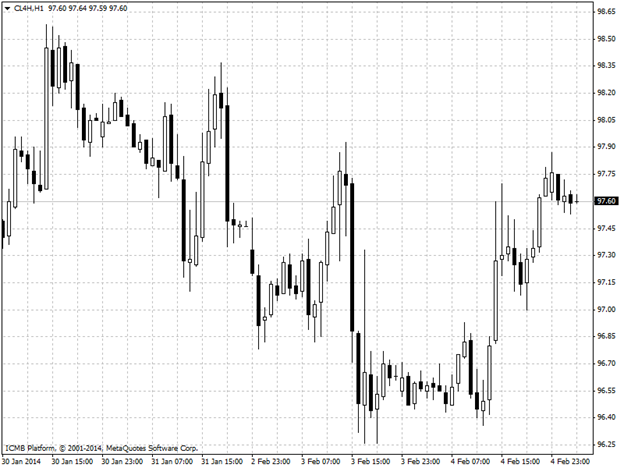

GOLD

Gold held a decline as a rebound in equity markets damped haven demand amid slower physical purchases during the Lunar New Year holiday. Bullion for immediate delivery fell as much as 0.2% to $1,252.74 per ounce, and traded at $1,255.20. Gold retreated 0.2% yesterday, while emerging-market currencies from Turkey’s lira to Hungary’s forint rallied. Markets in China, which probably overtook India as the largest gold consumer in 2013, are shut through February 6. Gold for April delivery added 0.3% to $1,254.70 per ounce, after declining 0.7% yesterday. Trading volumes were 73% lower than the average for the past 100 days for this time of the day.