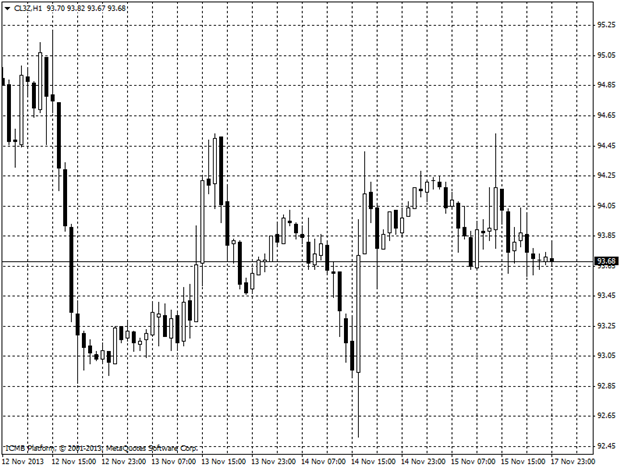

CL

Crude capped a sixth weekly decline, the longest stretch of losses in 15 years, as rising U.S. supplies countered speculation that the Federal Reserve will maintain stimulus of the economy. Crude fell 0.8 percent this week, poised for the longest streak since December 1998. U.S .crude stockpiles climbed for an eighth week as output expanded to the highest level since January 1989, data yesterday from the Energy Information Administration showed. WTI rebounded earlier after Janet Yellen, the nominee for Fed chairman, said yesterday the central bank shouldn’t end its asset-purchase program too soon. Crude advanced 8 cents to settle at $93.85 a barrel.

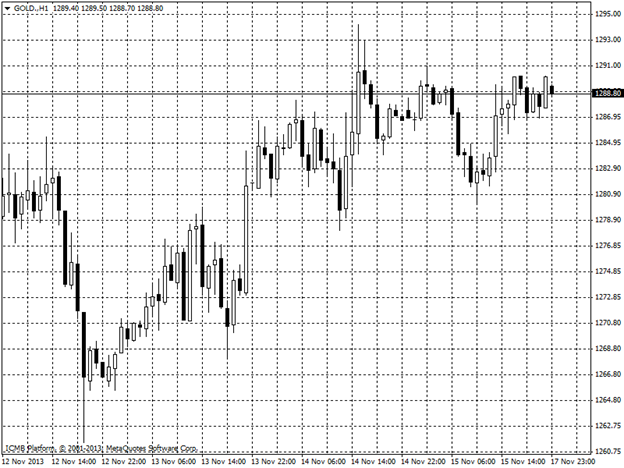

GOLD

Gold is heading for the first annual loss since 2000 after some investors lost their faith in the metal as a store of value. Global equities advanced to the highest in almost six years last week and U.S. inflation is running at 1.2 percent, half the rate of the past decade. Bullion reached a record in 2011 as the Fed pumped more than $2 trillion into the financial system. Gold rallied as Yellen said Nov. 14 she’s ready to back stimulus until she sees robust economic growth. Gold tumbled 3.7 percent in the five sessions before Yellen’s testimony before the Senate Banking Committee. Prices rebounded 1.5 percent in the next two days, erasing the week’s losses and capping the biggest two-day rally since Oct. 22.