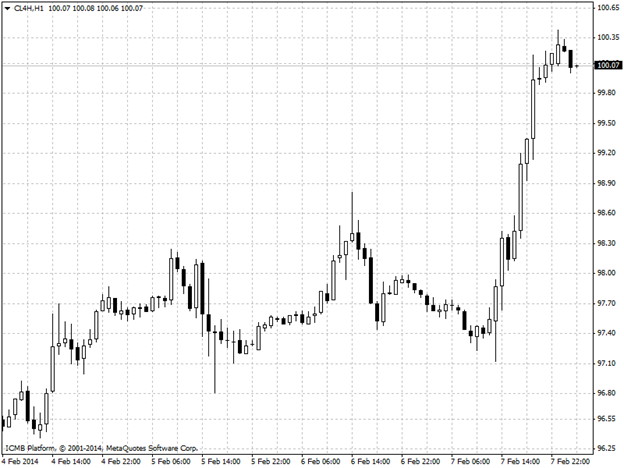

CL

West Texas Intermediate crude rose for a fifth day amid speculation that weaker-than-forecast jobs growth may prompt the U.S. Federal Reserve to halt tapering of economic stimulus in the world’s biggest oil consumer. Futures climbed as much as 0.6% in New York after advancing the most in two months on February 7. Payrolls gained 113K in January, according to the Labor Department. Libyan oil output increased to about 600K barrels a day after protests that shut a pipeline ended, according to Mohamed Elharari, a spokesman for the state-run National Oil Corp. WTI for March delivery gained as much as 58 cents to $100.46 a barrel. The contract rose 2.1% to $99.88 on February 7, the highest since December 27. The volume of all futures traded was about 26% above the 100-day average. Prices gained 2.5% last week.

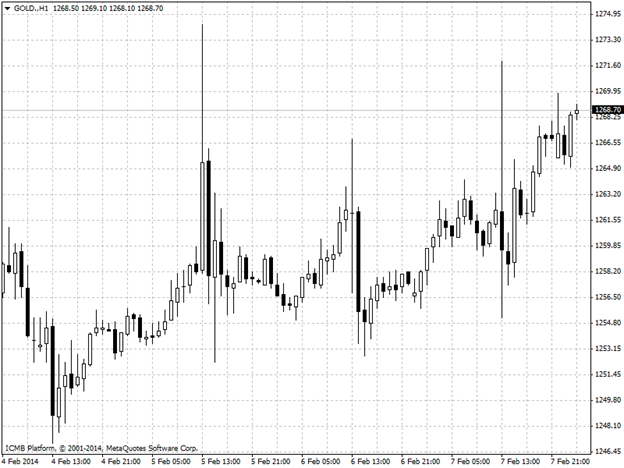

GOLD

Gold gain for the third day amid the report of The Labor Department said last week hiring in the U.S. rose by 113K in January, fewer than the 180K gain that was the forecasted, and following a 75K increase in the prior month. Unemployment fell to 6.6%, the least since October 2008, from 6.7% in December, according to the Federal Reserve, which last month said it will trim monthly bond buying by $10 billion to $65 billion. A separate report showed 262K Americans were not at work because of bad weather during the month of January, little changed from the same period last year. The yellow metal headed the week at $1267.10 per ounce rising by 0.2% to $1270.00 per ounce.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Gold Gains For Third Day

Published 02/10/2014, 06:01 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Gold Gains For Third Day

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.