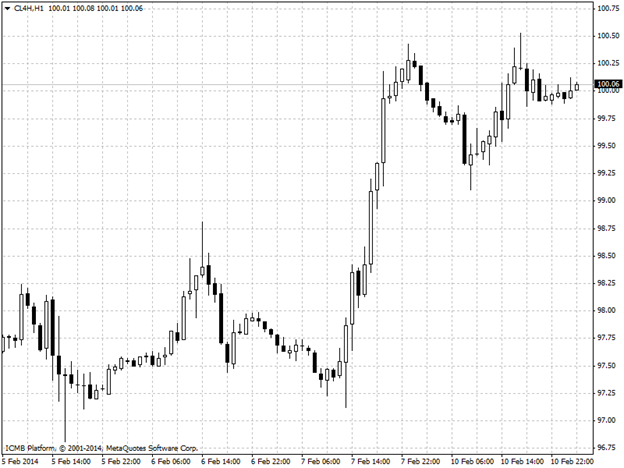

CL

West Texas Intermediate crude gained for a fifth day, gaining 18 cents to six weeks high. Supplies at the delivery point for futures may have dropped for a second time. WTI for March delivery climbed to $100.12 per barrel, the highest settlement since December 27. The volume of all futures was 12% above the 100-day average. Crude has risen 3.8% in five sessions.

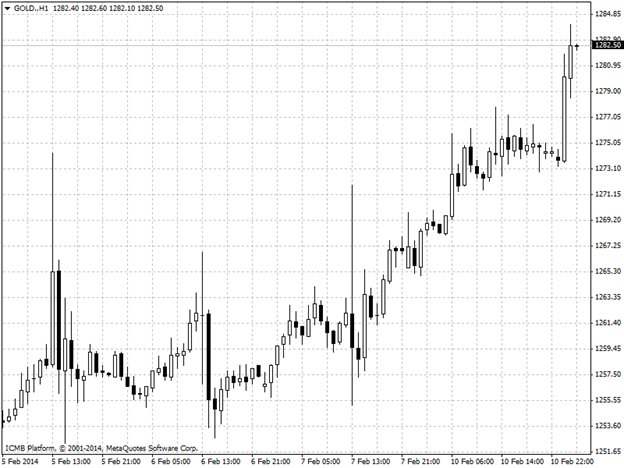

GOLD

Gold consumption and production in China expanded to records as prices that slumped into a bear market spurred sales of jewelry and bars, underlining a shift in global demand from west to east. Bullion increased. Usage rose 41% to 1,176.4 metric tons in 2013 from the year before. Output rose by 6.2% to 428.16 metric tons, making China the largest producer for the seventh year. Gold for immediate delivery sank by 28% last year to end a 12-year rally as the Fed decided in December to trim monthly bond buying. Prices rallied to a two-week high yesterday at $1277.80. Spot Gold advanced 3.2% in January, the first monthly gain since August, while Gold futures for April delivery rose 0.9% to $1,274.70 an ounce. Today Gold gained 0.2% during the morning trades to hit the level of $1286.50per ounce.