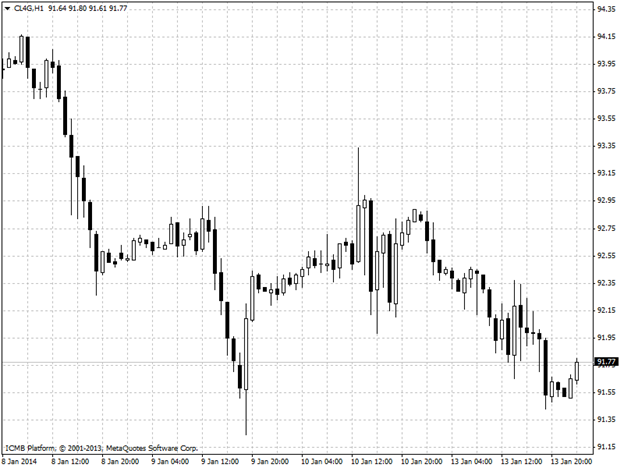

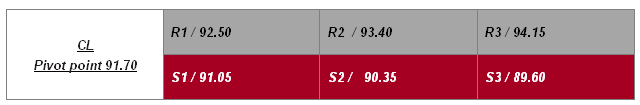

CL

Oil prices fell on Monday in reaction to weekend reports that Iran agreed on a multilateral plan that would curb Tehran's nuclear ambitions in a deal that could end sanctions on the Middle East country and allow it to resume exports and add to global supply. Talks among the U.S., Russia, China, Britain, Germany, France and Iran ended in agreement on a six-month deal that will limit advancements in Iran's nuclear program in exchange for easing economic sanctions against Tehran starting Jan. 20. In November, Iran pledged to eliminate its stocks of 20% enriched uranium within six months and limit the enrichment of uranium to 5%. Trade sanctions slapped on Iran due to its alleged nuclear ambitions have taken out more than 1 million barrels of oil per day from the global market over the past two years. Soft U.S. jobs numbers released Friday also pressured prices lower. The Bureau of Labor Statistics on Friday reported that the U.S. economy added 74,000 jobs in December, well below expectations for a 196,000 increase and below an upwardly revised 241,000 rise the previous month. The report also showed that the U.S. unemployment rate fell to 6.7% in December due to a weak participation rate, down from 7.0% in November. Analysts had expected the rate to remain unchanged last month.

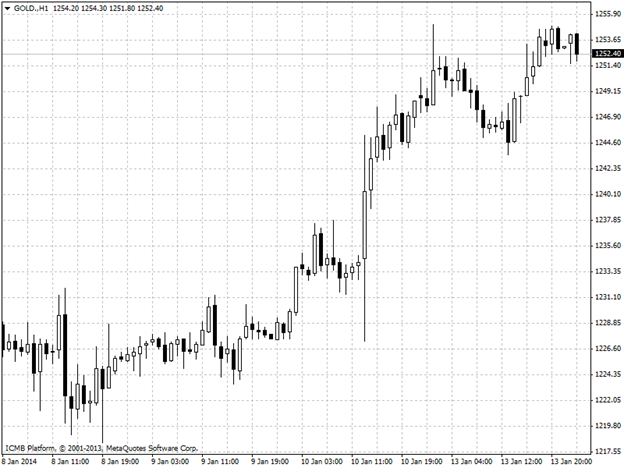

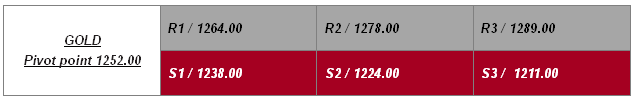

GOLD

Gold futures rose during Asian trade on Tuesday as investors weighed the prospects for the Federal Reserve to scale down its bond-buying program at a more gradual pace after the U.S. economy added fewer jobs than expected in December. Gold futures gain during Asian trade as market digests U.S. jobs data On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at USD1,253.40 a troy ounce during Asian trading, up 0.06%. Fed asset purchases tend to weaken the dollar by suppressing long-term interest rates, thus making gold an attractive hedge. Gold saw added demand ahead of Tuesday's release of U.S. retail sales, with concerns that a disappointing figure just day after a poor jobs report will increase the chances of a more gradual Fed tapering. Capping gold's gains were sentiments among many that the December jobs report may be an anomaly and the product of bad winter weather that put off hiring.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Gold Futures Rose During Asian Trade

Published 01/14/2014, 05:31 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Gold Futures Rose During Asian Trade

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.