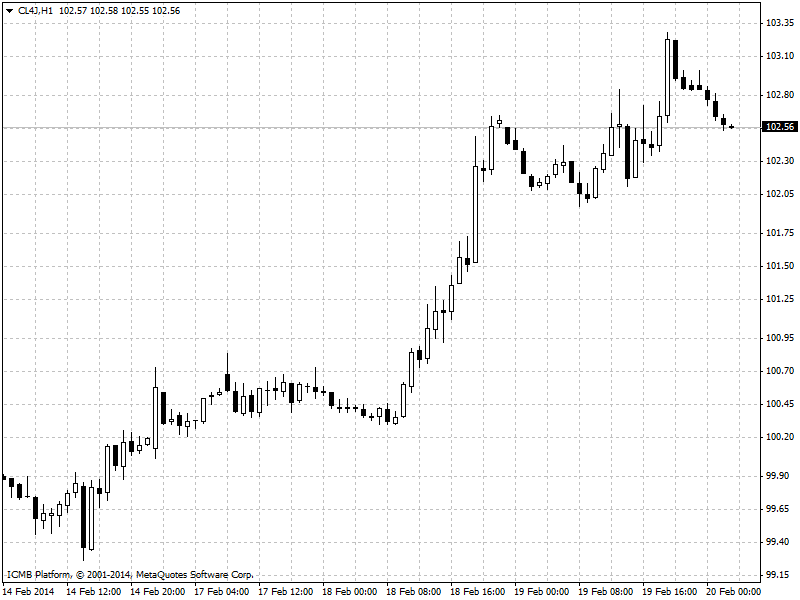

CL

West Texas Intermediate oil traded near the highest price in more than four months after an industry report showed inventories fell at the delivery point for benchmark U.S. crude contracts. Futures were rose for the second day yesterday. Supplies dropped by 1.82 million barrels last week, the American Petroleum Institute said. WTI for March delivery was at $103.32 per barrel. The contract, which expired yesterday, climbed 0.9% to $103.80 before closing, the highest settlement since October 8. The volume of all futures traded was about 54% below the 100-day average. The more-active April future was down 9 cents at $102.75. Distillate inventories, including heating oil and diesel, declined by 676,000 barrels in the week ended February 14, the API said in Washington yesterday. An Energy Information Administration report today is projected to show supplies declined by 2.1 million, according to the estimates.

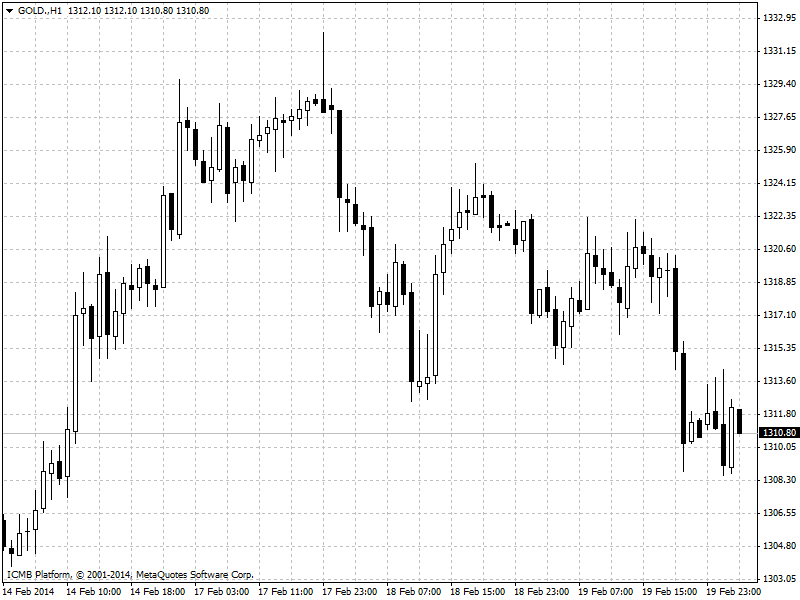

GOLD

Gold fell from a three-month high as minutes from the Federal Reserve’s last meeting indicated stimulus cuts would likely continue, crimping demand for the precious metal as an alternative investment. Several policy makers said that in “the absence of an appreciable change in the economic outlook, there should be a clear presumption in favor of continuing to reduce the pace” of bond purchases at each meeting, according to minutes released yesterday. Some officials raised concern that inflation is too low. Gold futures for April delivery declined 0.8% to $1,308.50 per ounce. Prices settled at $1,320.40 at the end of regular trading before the minutes were released. The metal reached $1,322.50 yesterday, 0.8% lower than the three months high recorded on February 17.