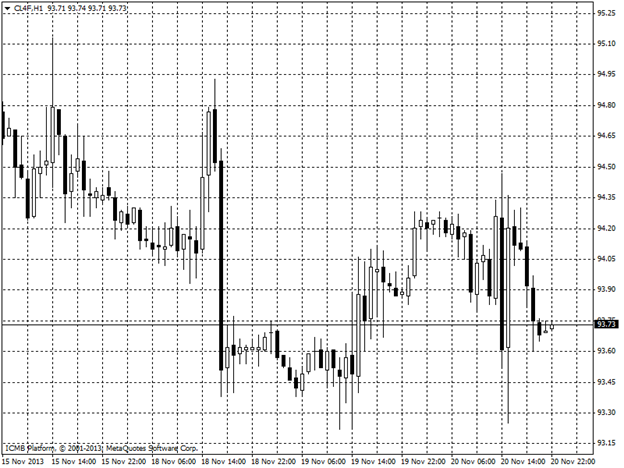

CL

Crude was little changed as the Federal Reserve said it might reduce stimulus “in coming months,” countering a report that showed fuel consumption climbed to a five-year high. Prices dropped 1 cent. The Fed may pare the $85 billion in monthly bond purchases as the economy improves, the Energy Information Administration said. Crude stockpiles grew 375,000 barrels, below the 1 million-barrel increase; Supplies went up for a ninth week to 388.5 million barrels. While the crude inventory build came in lower than expect, climbed to 39.9 million, the most since July 26.

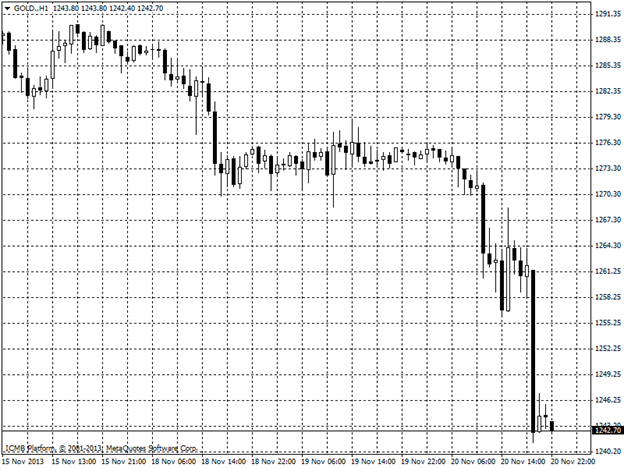

GOLD

Gold extended losses while the dollar strengthened. As the Federal Reserve indicated it may reduce monetary stimulus in coming months as the U.S. economy improves. Fed policy makers expected economic data to signal ongoing improvement in the labor market and “thus warrant trimming the pace of purchases in coming months,” according to minutes of the Federal Open Market Committee’s Oct. 29-30 meeting released. Stocks pared gains earlier as Fed Bank of St. Louis President James Bullard said a reduction in bond purchases is “on the table” for the next policy meeting in December. The gold drop to 1242.00.