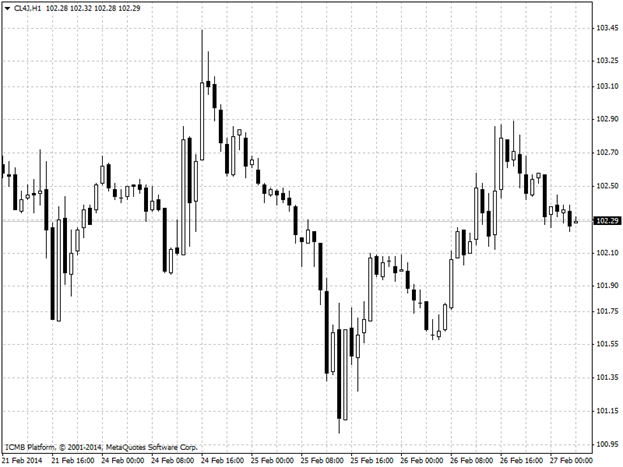

CL

WTI headed for a monthly advance as reports showed inventories declined for a fourth week at the delivery point for U.S. crude contracts. Futures rose yesterday the most in a week by 0.8%. Supplies at Cushing, Oklahoma, fell by 1.08 million barrels to 34.8 million last week, as the report said. That is the lowest level since October. The volume of all futures traded yesterday was 61% below the 100-day average. Futures for April deliveries advanced to $102.60 per barrel during the early morning trades, losing 0.22% since open to $102.26 per barrel, morning’s lowest price.

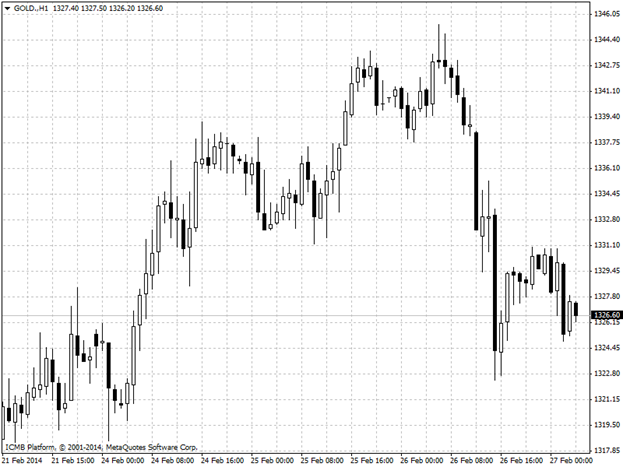

GOLD

Gold dropped from the highest level in 17 weeks when U.S. housing data beat estimates supporting expectations the the Federal Reserve will keep its plan to reduce stimulus. Yesterday, the metal was traded at $1, 3345.50 per ounce, the highest level since October 30. Prices erased gains to end 0.8% lower after a report showed new home sales in the U.S. unexpectedly rose to a five-year high. Gold is headed for a second month of gains, the longest such run since August, as concern that the U.S. recovery may be faltering and unrest in emerging markets boosted demand for a store of value. Gold for April delivery lost about 2% just after the last mentioned report to be traded at $1,322.30 per ounce falling from $1,341.40 per ounce on the morning. Today, Gold for Electronic trading fall 0.4%to $1326.90 per ounce during the Asian Session, while April futures was traded at $$1,326.70 per ounce.