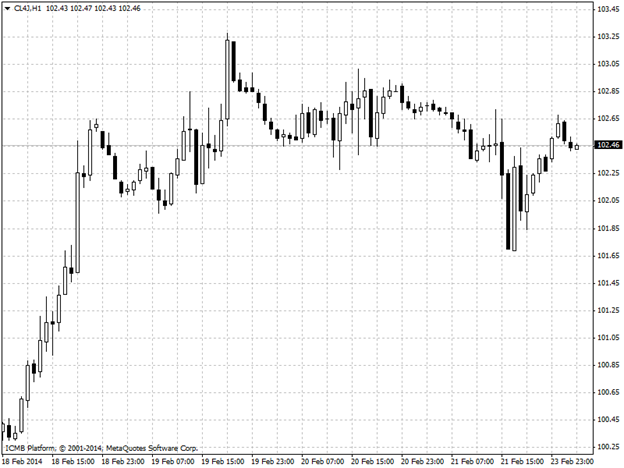

CL

West Texas Intermediate crude rose from the lowest price in a week amid speculation that cold weather in the U.S. will boost demand for heating in the world’s biggest oil consumer. WTI for April delivery rose as much as 50 cents to $102.70 a barrel in electronic trading. The contract fell to $102.20 on February 21, the lowest close since Feb. 14. The volume of all futures traded was about 1 percent below the 100-day average.

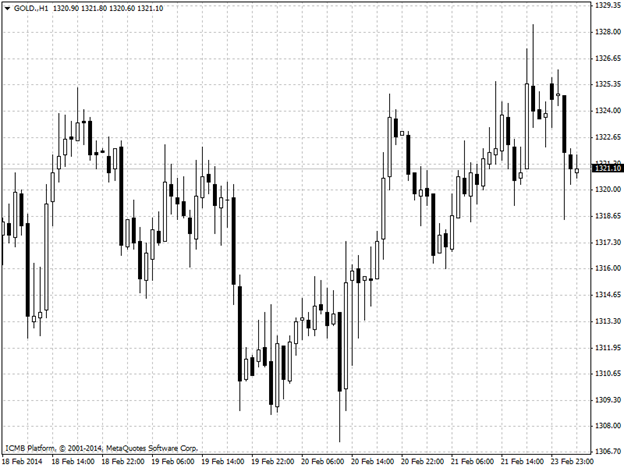

GOLD

Gold declined after three weeks of gains as a technical gauge signaled a reversal and on concern that higher prices will hurt physical demand in Asia. Bullion for immediate delivery lost as much as 0.4% to $1,318.79 per ounce and was at 1,321.57. Prices reached 1,332.45 on February 18, the highest level since October 31. Gold is headed for a second monthly advance after weaker-than-expected data spurred concern that the U.S. recovery may be losing momentum just as the Federal Reserve scales back asset purchases. Sales of previously owned U.S. homes dropped in January to the lowest level in more than a year amid harsh winter weather. Gold for April delivery declined 0.2% to $1,318.70 per ounce.