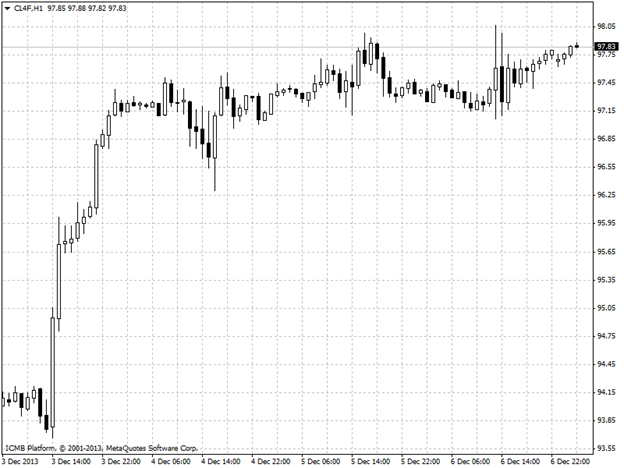

CL

Crude oil futures rose to a five-week high on Friday, as upbeat U.S. economic data boosted optimism over the health of the world’s largest oil-consuming nation. On the week, U.S. oil futures surged 5.04%, the biggest weekly gain since July. Oil traders have long been taking cues from the monthly U.S. jobs report because it offers insight into the economic health of the world's biggest crude-oil consumer. The U.S. Energy Information Administration reported Wednesday that crude oil inventories fell by 5.6 million barrels last week to 385.8 million, the first weekly decline in 11 weeks. Market players will also look ahead to a raft of Chinese economic data later in the week, including reports on inflation, industrial production and retail sales. Official data released on Sunday showed that China’s trade surplus widened unexpectedly in November as exports rose more-than-expected, easing concerns over global growth prospects.

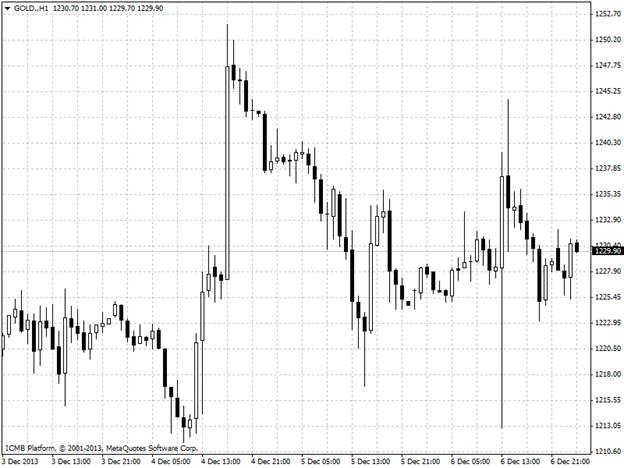

Gold

Gold futures declined on Friday, after stronger-than-expected U.S. nonfarm payrolls data underlined speculation the Federal Reserve will start to taper its asset purchases at one of its next few meetings. The U.S. economy added 203,000 jobs in November, above expectations for jobs growth of 180,000, the Labor Department said. The unemployment rate fell to a five year low of 7.0% from 7.3% in October. The report came one day after official data showed that the U.S. economy grew at an annual rate of 3.6% in the three months to September, well above the preliminary estimate for 2.6%. The robust data raised the possibility that the Fed may start to scale back its USD85 billion-a-month asset purchase program as soon as its next monthly meeting on December 17 - 18. In the week ahead, investors will be focusing on retail sales data out of the U.S. to further gauge the strength of the economy and the need for stimulus. Prices of the precious metal are down approximately 27% this year, heading for the first annual loss in 13 years.