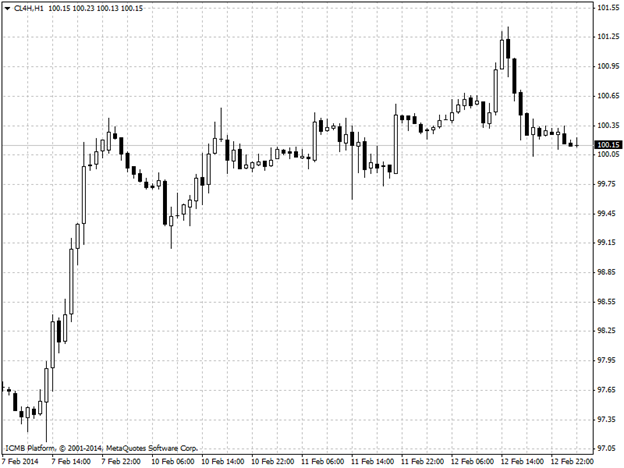

CL

West Texas Intermediate rose to its highest intraday level in seven weeks after an industry report showed U.S. distillate supplies shrank and a potential historic winter storm threaten. Futures gained as much as 0.8%, where heavy snow is forecast. Distillate fuels, including heating oil and diesel, fell by 1.45 million barrels last week, Government data showed a rise of 3.3 Million barrel, while the forecasted was 2.13 million barrels surplus. WTI for March delivery climbed as much as 75 cents to $101.36 per barrel, the highest since December 27.

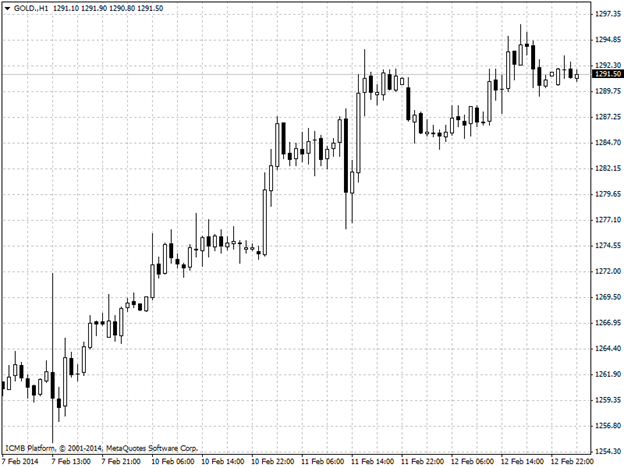

GOLD

Gold keeps on its trend of 2014, climbing to a three-month high as speculation that U.S. stimulus will continue boosted the appeal of alternative assets. Gold, which slid the most since 1981 last year as some investors lost faith in the metal as a store of value, rebounded 7.7% in 2014 amid a slump in emerging-market currencies and rising physical demand. Bullion settled above its 100-day moving average the previous two days. Gold futures for April delivery gained 0.4% to settle at $1,295 per ounce, after reaching $1,296.40 per ounce, the highest since November 8. Prices capped a sixth session of gains, the longest rally since June 2012.