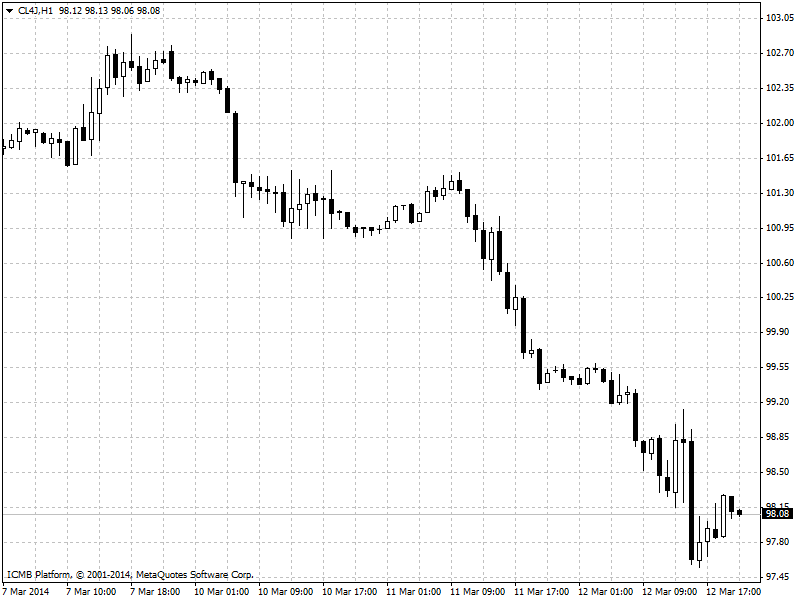

CL

Crude prices dropped on Wednesday after data revealed U.S. stockpiles shot up last week, stoking concerns the U.S. economy remains awash in crude oil. Crude drops as U.S. inventories surge The U.S. Energy Information Administration said in its weekly report earlier that U.S. crude oil inventories rose by 6.2 million barrels in the week ended March 7, well above market expectations for a 2.2-million barrel increase. Total U.S. crude oil inventories stood at 370 million barrels as of last week. The report also showed that total motor gasoline inventories decreased by 5.2 million barrels, compared to forecasts for a drop of 2 million barrels, while distillate stockpiles decreased by 533,000 barrels, below expectations for a withdrawal of 867,000 barrels. Oil prices came under additional pressure on reports that the U.S. plans to release up to 5 million barrels of oil from its Strategic Petroleum Reserves, according to a government source. The release will serve as a test sale to check the operational capacity of system infrastructure. The timing of such a release remains unclear.

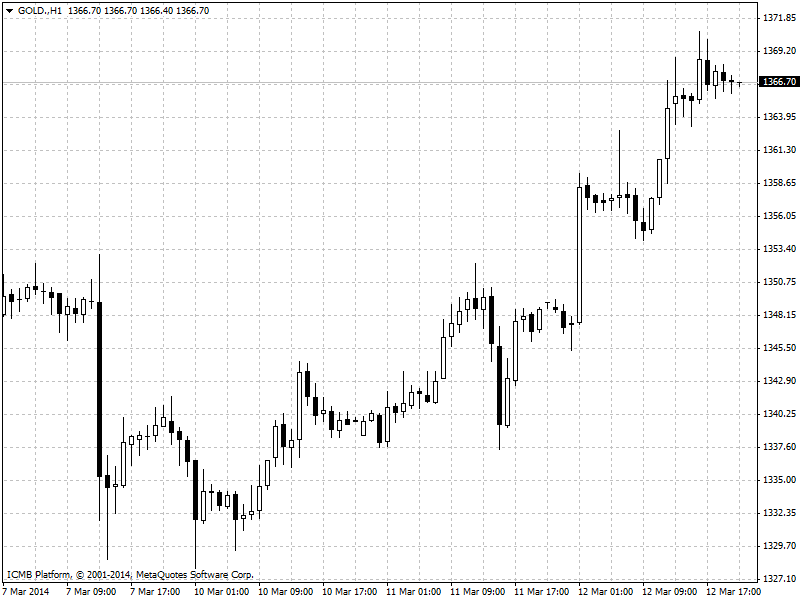

GOLD

Gold prices shot up on Wednesday as the Russian standoff in Ukraine escalated and bolstered gold's appeal as a safe-haven during times of crisis. Gold extends gains as Ukraine standoff heats up anew Ongoing geopolitical tensions in Ukraine bolstered gold's appeal as a hedge on Wednesday. Leaders of the Group of Seven largest industrial nations warned Russia on Wednesday not to annex Crimea. In a joint statement, the leaders said Russian annexation of Crimea "could have grave implications for the legal order that protects the unity and sovereignty of all states." Should Russia take the step, the G-7 said it would respond with further action "individually and collectively." Ukraine’s interim Prime Minister Arseniy Yatsenyuk will meet with U.S. President Barack Obama later in the day, as diplomatic efforts to resolve the crisis continued.