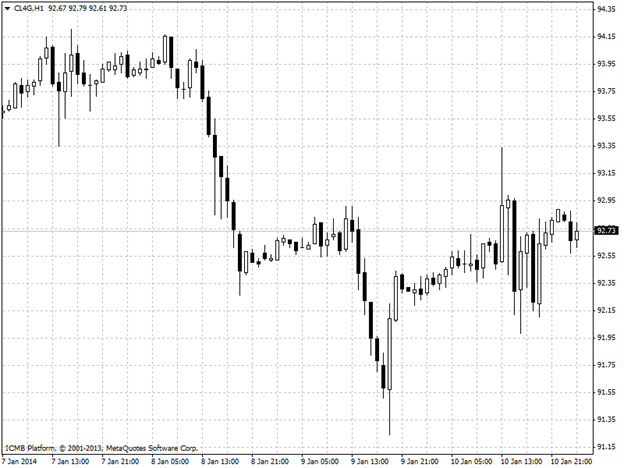

CL

Crude oil futures moved off the previous session’s eight-month low to end up more than 1% on Friday, after weaker-than-expected U.S. jobs data fanned speculation that the Federal Reserve will scale down its bond-buying program at a slower pace than previously anticipated. The unemployment rate fell to a five-year low of 6.7% from 7% in November, but this was due in part to people dropping out of the labor force. The labor participation rate fell to an almost 35-year low of 62.8%. The disappointing data tempered expectations that the Fed would cut its stimulus program again this month. The central bank cited a stronger labor market in its decision to taper its asset purchase program by USD10 billion in December to USD75 billion-a-month. Minutes of the Fed’s December meeting released earlier in the week showed that officials were keen to stress that further reductions in stimulus were not on a “preset course” and would be undertaken in “measured” steps. The central bank is scheduled to meet January 28-29 to review the economy and assess policy. The dollar index, which tracks the performance of the greenback against a basket of six other major currencies, declined 0.41% on Friday to end at 80.74, the lowest since January 2.

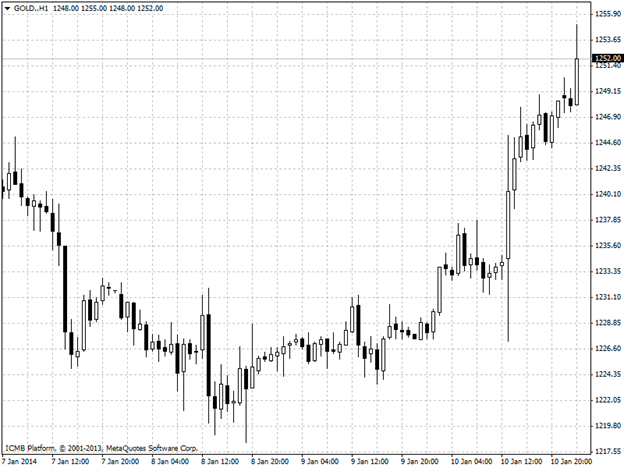

GOLD

Gold futures shot up on Friday after data revealed the U.S. economy added far fewer payrolls in December than expected, which fanned expectations for the Federal Reserve to scale down its bond-buying program at a slower pace than once anticipated. The Bureau of Labor Statistics reported earlier that the U.S. economy added 74,000 jobs in December, well below expectations for a 196,000 increase and below an upwardly revised 241,000 rise the previous month. The U.S. private sector added 87,000 jobs last month, disappointing expectations for 195,000 rise, after an upwardly increase of 226,000 in November. The report also showed that the U.S. unemployment rate fell to 6.7% in December due to a weak participation rate, down from 7.0% in November. Analysts had expected the rate to remain unchanged last month. The numbers weakened the dollar by fueling expectations for the Federal Reserve to trim its USD75 billion monthly bond-buying program at a slower pace than once expected. Fed asset purchases tend to weaken the dollar by suppressing long-term interest rates, thus making gold an attractive hedge as long as monetary stimulus programs remain in place.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Crude Oil Moves Higher, Gold Futures Up

Published 01/13/2014, 03:19 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Crude Oil Moves Higher, Gold Futures Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.