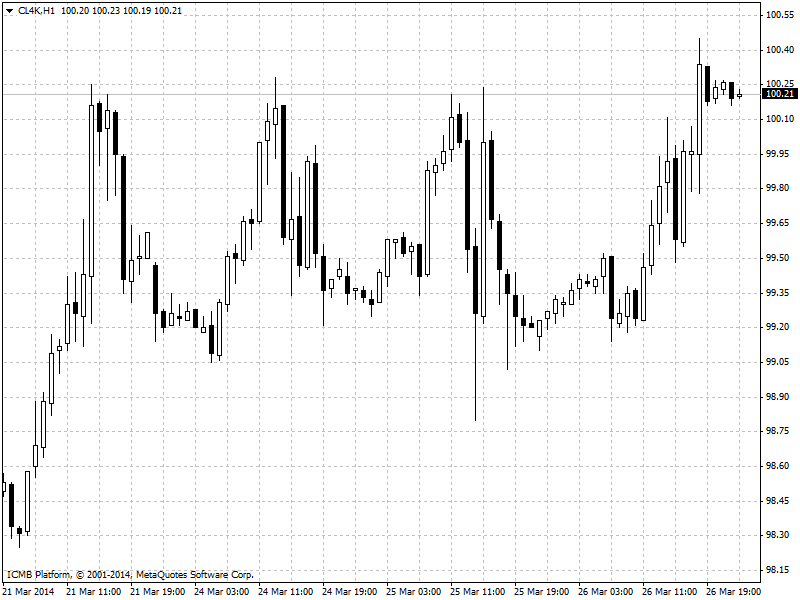

CL

Better-than-expected reports on U.S. durable goods and oil inventories sent crude futures rising on Wednesday. Crude gains on U.S. durable goods data, weekly stockpile report Oil prices firmed after the Commerce Department reported that U.S. durable goods orders rose 2.2% in February, wiping out two months of declines and surpassing expectations for a 1.0% increase. Core durable goods orders, which exclude transportation items, inched up 0.2%, slightly below forecasts for a 0.3% gain. The numbers fueled expectations for a more sustained pickup in the U.S. economy, which should hike demand for more fuel and energy. Weekly inventory data gave oil prices a boost as well. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories rose by 6.6 million barrels in the week ended March 21, above expectations for an increase of 2.8 million barrels.

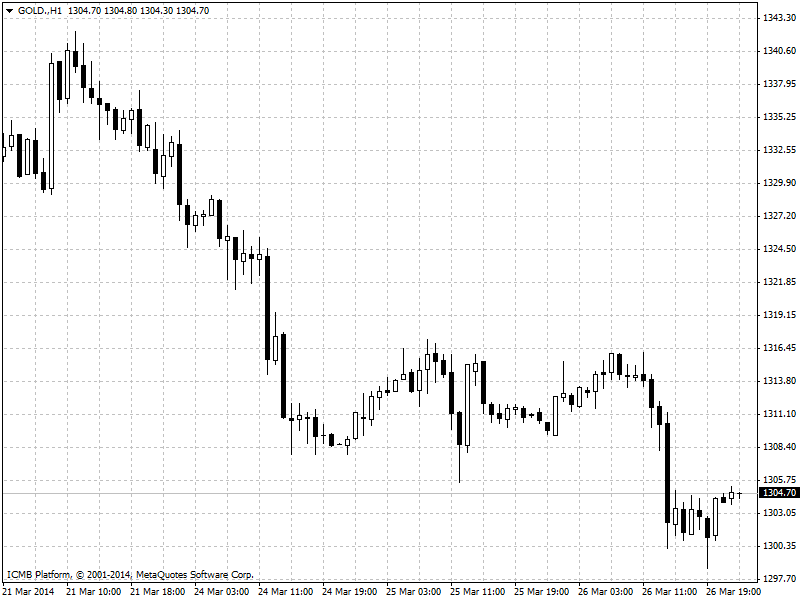

GOLD

Gold prices fell on Wednesday after a strong report on U.S. durable goods solidified expectations for the Federal Reserve to wind down monthly asset purchases this year and begin raising benchmark interest rates in 2015. Gold dips on robust U.S. durable goods orders Fed asset purchases, currently set at $55 billion a month, weaken the dollar to spur recovery, thus bolstering gold's appeal as a hedge as long as the Fed intervenes. The dollar rose after the Commerce Department reported that U.S. durable goods orders rose 2.2% last month, wiping out two months of declines and surpassing expectations for a 1.0% increase. Meanwhile across the Atlantic, the euro continued to come under pressure stemming from dovish comments from ECB officials on Tuesday, indicating that the monetary authority is mulling policy options to stave off deflationary risks. Also on Wednesday, a widely-watched German consumer climate gauge remained unchanged last month. In a report, research group Gfk said that its forward-looking index of Germany’s consumer climate remained unchanged at 8.5 for April from March, in line with market expectations.