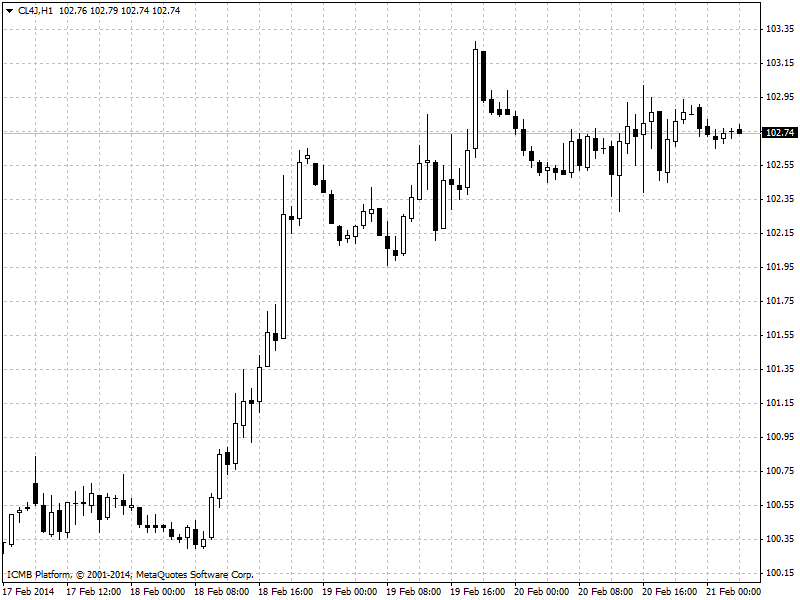

CL

West Texas Intermediate crude headed for a sixth weekly gain, the longest rising streak in a year, as cold weather in the U.S. bolstered demand for heating fuels in the world’s biggest oil consumer. Futures rose by 2.5% this week. Distillate supplies, including heating oil and diesel, shrank by 339K barrels to 112.7 million in the seven days through February 14, the Energy Information Administration reported yesterday. WTI for April delivery was at $102.73 per barrel yesterday. The March contract expired yesterday after falling 39 cents to $102.92 per barrel. The volume of all futures traded was about 75% below the 100-day average. Today, April contract headed at $102.82 per barrel as morning trades high, rising from $102.78 when the session started.

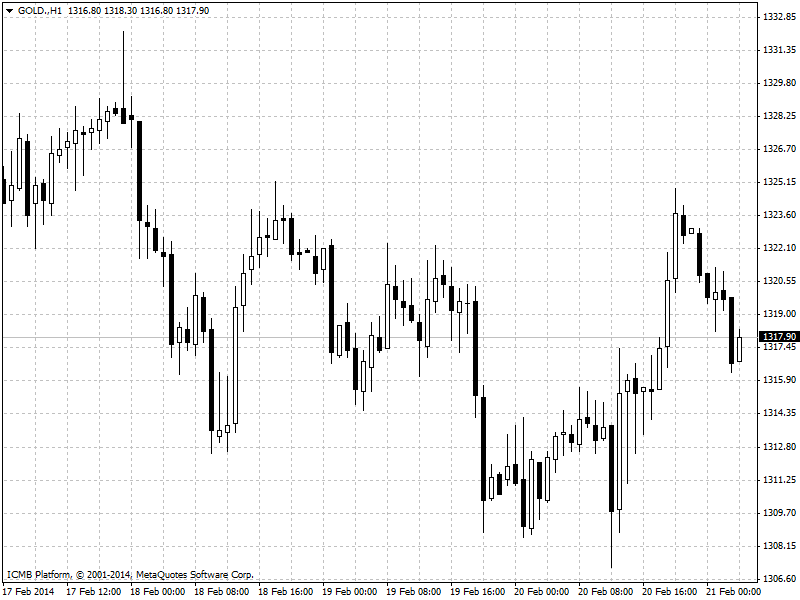

GOLD

U.S. jobless claims releases almost as expected at 336K, 1K higher than the forecasted and 3K lower than the week before. Gold for immediate delivery gained 0.3% to $1,315.72 per ounce yesterday. Prices rose to $1,332.45 per ounce on February 18, the highest since October 31, and are headed for a second monthly climb. Today, the precious metal started the day with 0.1% decline to $1316.53 as morning’s electronic trading low. April contract hit the high of $1325.00 as day’s high yesterday, to lose about 0.15% this morning to $1316.40 per ounce just after reaching the high of $1323.20 per ounce.