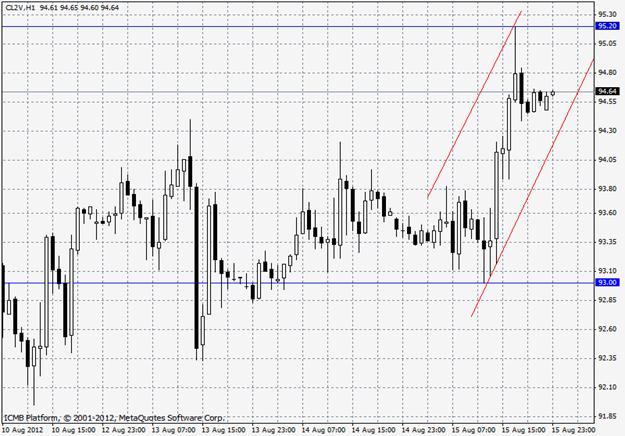

Crude oil prices were bullish yesterday after stockpiles drop, intensifying tensions in Middle East, and better than expected US industrial production. Its September contract climbed $2.21 to $94.89 a barrel from $92.68 after US energy department reported supplies dropped 3.7 million barrels and total oil use reached the highest level in nine months in the seven days ended 10th of August. Oil inventories dropped 1 percent to 366.2 million barrels, the lowest level since 6th of April.

Petroleum consumption jumped 5.7 percent to 20 million barrels a day. Meanwhile, Saudi embassy called its citizens to avoid going to Lebanon under the current circumstances, the Saudi Press Agency reported. The Meqdad clan, an extended family that belongs mostly to Lebanon’s Muslim Shiite community, kidnapped more than 20 Syrians in retaliation for the abduction of one of its members in Syria, the Lebanese Broadcasting Corporation reported, citing a spokesman of the family.

In Syria, a bomb exploded close to the army headquarters as the U.S. accused Iran of training a new militia to ease pressure on Syrian President Bashar al-Assad’s government. The regime is collapsing emotionally and politically, former Prime Minister Riad Hijab said in his first public appearance since defecting to Jordan. In Israel, dozens of people were in panic buying in front of a storefront at a Jerusalem shopping mall Tuesday to pick up new gas masks, part of civil defense preparation in case the military strikes Iran.

Gold

Gold prices reacted a little bit despite US consumer price index came flat for the month of July. US consumer inflation raised hopes for monetary stimulus however; due to a thin volume gold forgot to react heavily. Gold has failed to break out of a range between $1,525 and $1,680 an ounce in the past four months as disappointment over a lack of more aggressive stimulus by the U.S. Federal Reserve and other central banks dampened buying. However, lackluster global economic indicators put a floor under the metal.

The Labor Department said its consumer price index for July showed that prices were unchanged for the second consecutive month with a continued drop in energy prices offset by higher prices for food, shelter and medical care. Energy prices showed a modest decrease for the month, edging down by 0.3 percent in July after tumbling by 1.4 percent in June.

The continued drop in energy prices was largely due to a 1.3 percent decrease in electricity prices, which helped to offset a 0.3 percent increase in gasoline prices. Meanwhile, the report showed that food prices crept up by 0.1 percent in July following a 0.2 percent increase in the previous month. Higher prices for cereals and bakery products and meats, poultry, fish, and eggs contributed to the modest increase in food prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: August 16, 2012

Published 08/16/2012, 07:39 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: August 16, 2012

CL2U

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.