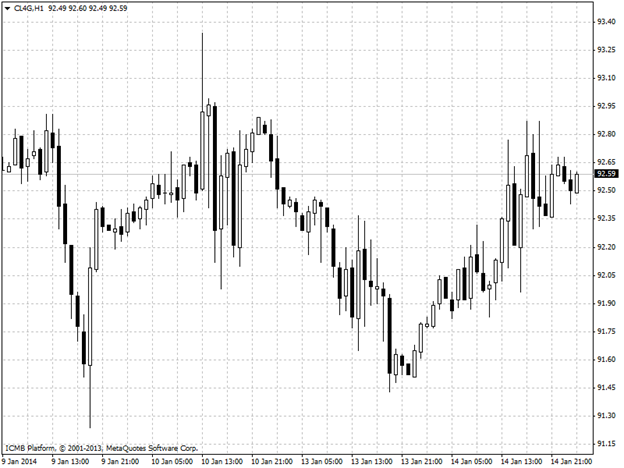

CL

Crude oil swung between gains and losses as U.S. crude inventories declined and retail sales increased more than forecast last month in the world’s biggest oil consumer. Futures were little changed in New York after advancing 0.9 percent yesterday. Crude stockpiles shrank by 4.14 million barrels last week, the industry-funded American Petroleum Institute said. An Energy Information Administration report today may show supplies slid by 1.3 million, according to a Bloomberg News survey. Retail purchases rose 0.2 percent in December, the Commerce Department reported, surpassing the 0.1 percent gain projected by economists in a separate survey. WTI for February delivery was at $92.58 a barrel, down 1 cent, in electronic trading on the New York Mercantile Exchange at 10:50 a.m. Sydney time. The contract rose 79 cents to $92.59 yesterday. The volume of all futures traded was about 75 percent below the 100-day average.

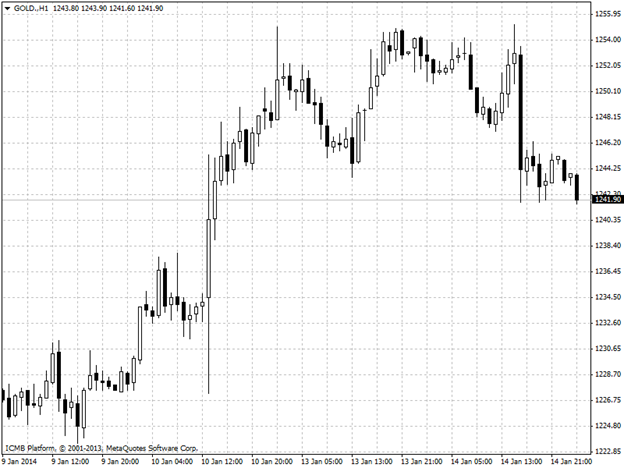

GOLD

China Gold Says Allied Nevada Bid Announced in Error. China Gold Stone Mining Development Ltd., a Chinese company that announced a $779.6 million offers for U.S. miner Allied Nevada Gold earlier today, said the statement was published in error and was retracted. The statement about a $7.50-a-share bid was issued “without the advice of counsel,” closely held China Gold Stone said in a separate release posted on the website of PR Newswire. The stock gained as much as 52 percent to $6.55 in pre-market trading in New York before the company halted trading. Allied Nevada received a letter from China Gold Stone yesterday, which included the proposed offer, the Reno, Nevada-based company said in a statement today. Allied Nevada “seriously questions the credibility” of the bid and said that investors should review the Chinese company’s announcements with caution.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis:

Published 01/15/2014, 05:55 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.