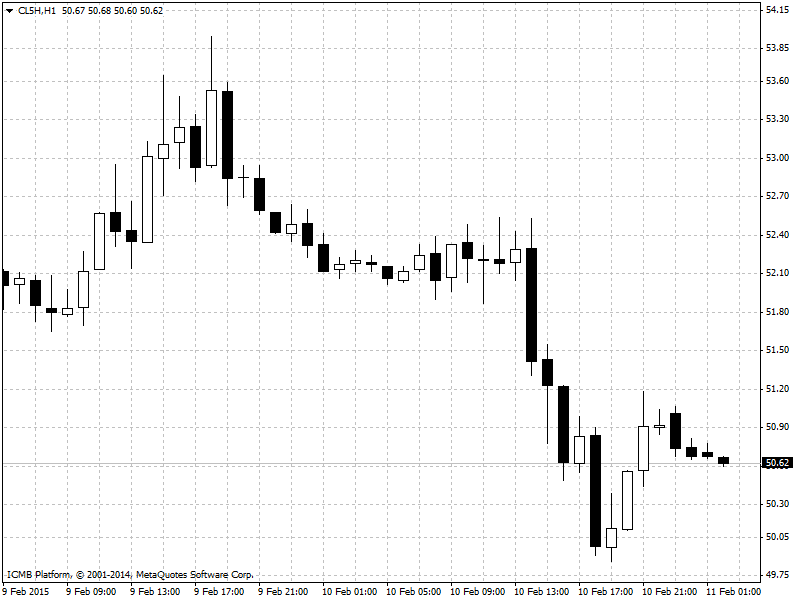

CL

Crude oil prices fell for the first time in four sessions on Tuesday after the International Energy Agency warned that ample supplies will raise global inventories before investment cuts begin to significantly dent production. Oil stockpiles in member countries of the Paris-based Organization for Economic Cooperation and Development may approach a record 2.83 billion barrels by mid-2015, said the IEA, advisor on energy policy to a group of Western nations. U.S. March crude futures fell $2.84, or 5.37 percent, to settle at $50.02 a barrel, after dropping to $49.86. While the supply-demand balance in oil was expected to tighten by end-2015, the IEA cautioned that "downward market pressures may not have run their course just yet." The IEA also predicted that demand for oil from the Organization of the Petroleum Exporting Countries will hold at 29.4 million barrels per day this year, and said U.S. shale oil output growth will pause before regaining momentum. The IEA's outlook was more bearish than OPEC's monthly report on Monday which forecast 2015 demand for oil from its members will rise to 29.2 million bpd, up 430,000 bpd from an earlier forecast.

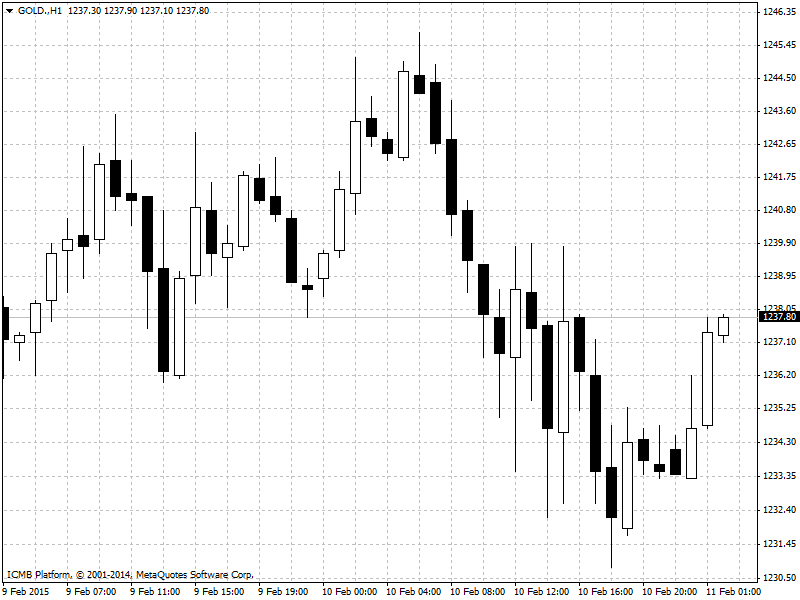

GOLD

Gold edged lower on Tuesday, following rumors of a possible six-month extension on Greece's debt. Gold briefly hit the lowest levels of the session after rumors surfaced that the European Commission could propose a six-month extension to Greece's bailout program, which is due to end on February 28. Athens main stock index rallied nearly 7%, while the yield on Greek 10-Year bonds tumbled sharply to trade below the 11%-level on the report. Prices were slightly higher earlier in the day amid concerns over Greece’s future in the eurozone as negotiations with the European Union over the country's debt and bailout continued. Meanwhile, the growing possibility of an earlier Federal Reserve rate hike also weighed, following last week's robust U.S. jobs report, which saw market players bring forward expectations for the first rate hike to June.