Crude Oil

The price of a barrel of crude oil has fallen 1.6% since the start of Monday, bringing the decline over the last two trading sessions to 4%. Pressures on the oil price include signals from the ceasefire talks between Israel and Lebanon (reducing supply risks) and disappointment over the size of China's stimulus package (revising expected demand).

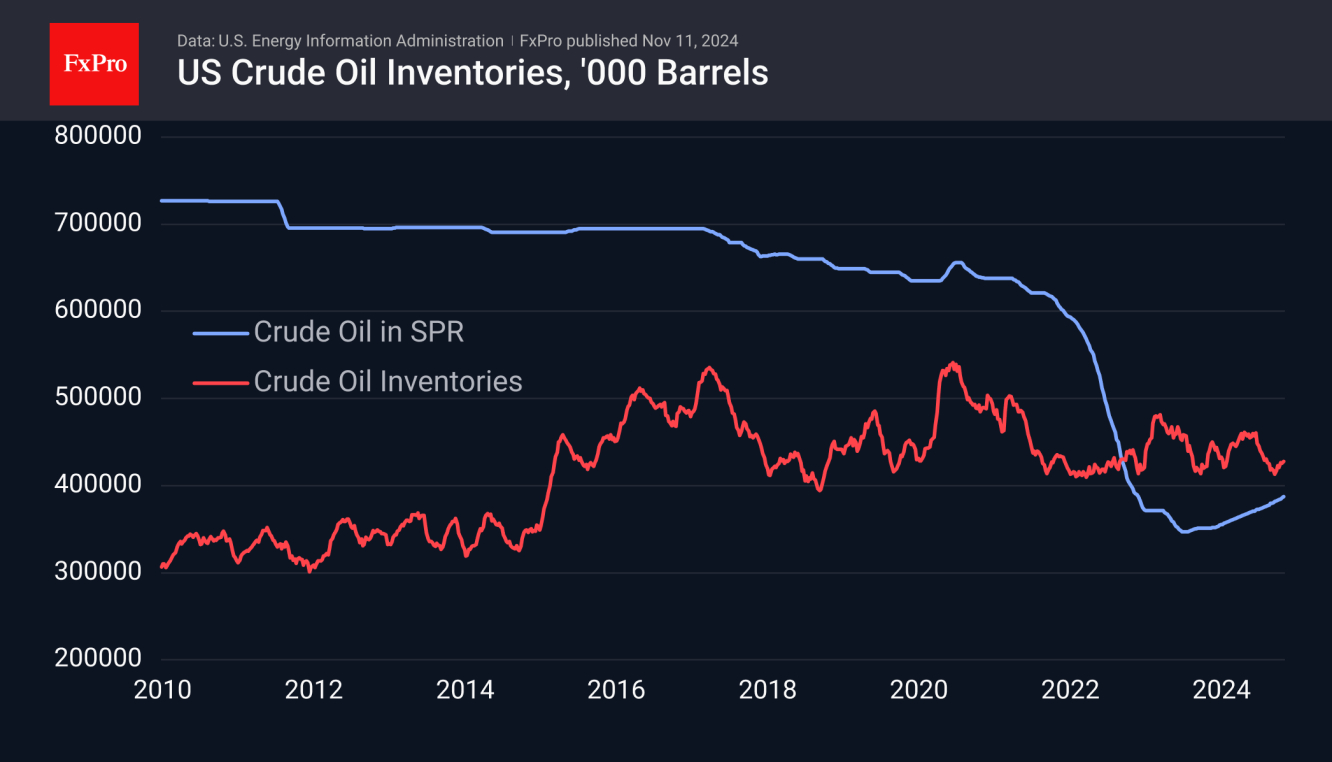

Among the longer-term factors, the upward trend in US oil inventories has continued. The strategic reserve has increased by 1.4 million barrels, maintaining the pace in recent weeks and accelerating from the average rate of 750k barrels per week since the beginning of the year. The acceleration appears to be driven by lower prices, which also help to provide soft support.

Commercial inventories have been on an upward trend since the end of September, with oil producers adding at a record pace of 13.5 mb/d over the past four weeks. However, the current level of commercial inventories (427.7 mb/d) is at the lower end of the range of the past 5 years, and this factor is unlikely to seriously worry the markets as long as inventories remain below 500 mb/d.

The markets expect the Republican party's political dominance to favour oil producers. However, we doubt this will lead to an increase in production. Instead, the focus will be on optimising profits (with equal emphasis on price and volume) and reducing subsidies for alternative energy sources.

A Republican administration may step up purchases of oil reserves after January, but that's still more than two months away.

Technically, oil continues to be dominated by the bears, with a sharp reversal below the 50-week moving average in early October and trading near the lower end of its range over the past three years. The price also closed below its 50-day moving average last week and is now actively declining after falling below $69/bbl WTI.

We will be watching the price dynamics and OPEC+ comments with interest in the event of a pullback to $65-66, as this would take Brent back to $70-71, which looks like an informal floor for the major cartel members.

Natural Gas

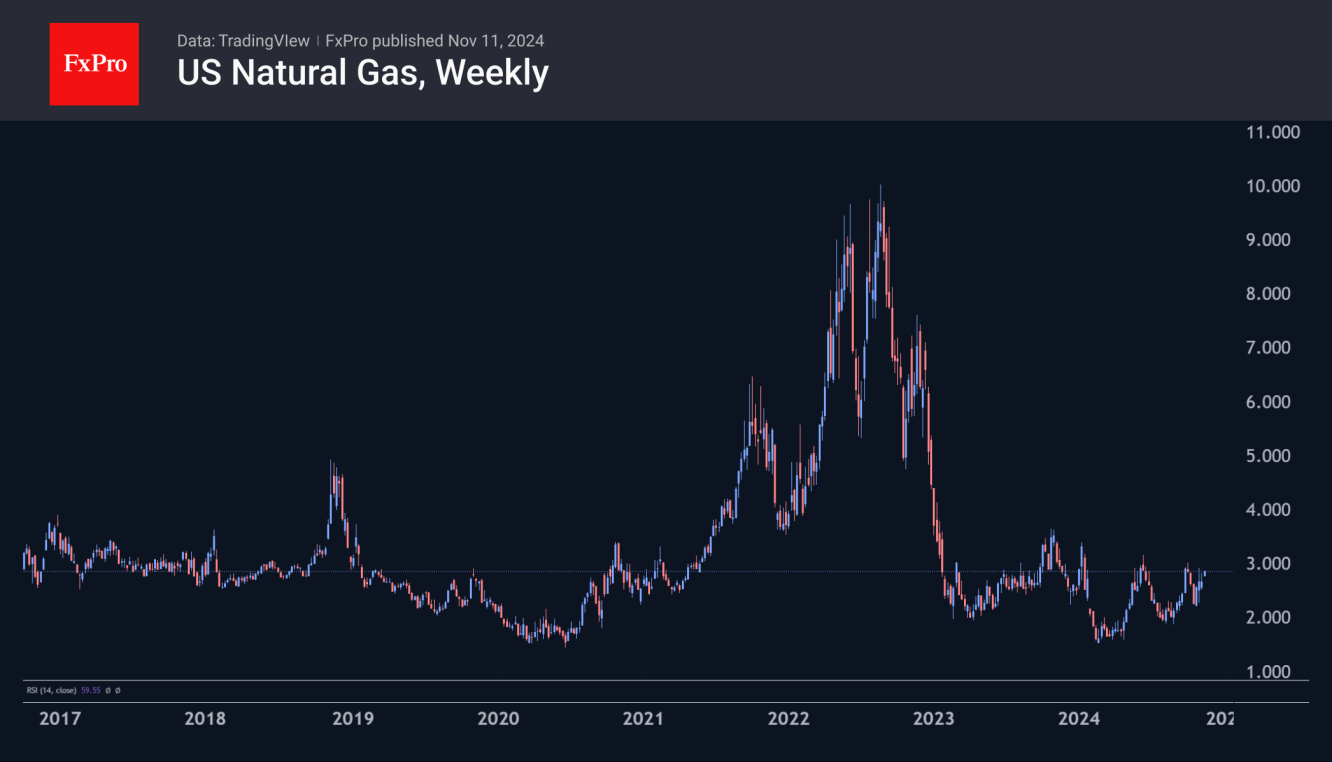

On Monday, the US Natural Gas price rose more than 5% since the start of the day due to the temporary shutdown of 16% of gas production capacity in the Gulf of Mexico.

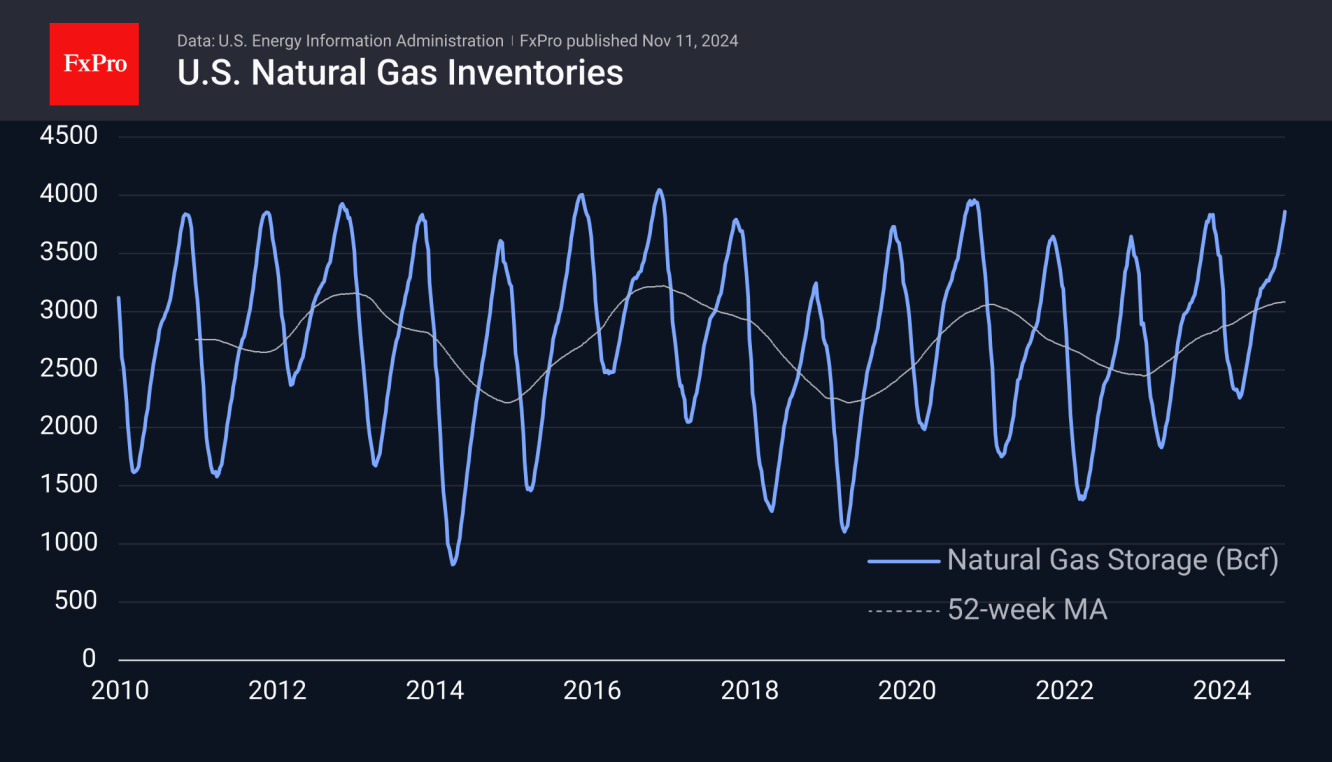

This doesn't seem to be a problem for the US now, with the latest data showing the highest gas inventories in 4 years and close to historical highs for the index.

The price has returned to the $3.0 area - highs in just under two weeks. The $3.0-$3.20 area has acted as pivot resistance more than once this year, and it will be interesting to see if this pattern continues. Given the inventory levels and dynamics of oil, a new downtrend is more likely for now. In the case of gas, however, a break of resistance could trigger a dramatic rise.

The FxPro Analyst Team