Analyzing the new developments on the international front on Friday, natural gas and WTI crude oil could start the upcoming week with a gap down opening as the weather could turn favorable.

Western sanctions against Russia over its invasion of Ukraine have led to a sharp collapse in Russian imports, hitting its domestic production hard. In contrast, foreign companies have exited the country in droves.

The price cap plan agreed by G7 wealthy nations calls for participating countries to deny insurance, finance, brokering, navigation, and other services to oil cargoes priced above a yet-to-be-determined price cap on crude and oil products.

On Friday, U.S. Treasury issued new guidance on a proposed Western price cap on Russian oil exports, saying that maritime services providers would not be held liable for false pricing information provided by buyers and sellers of Russian crude. The Treasury said these service providers should retain records on Russian oil shipments for five years.

On Friday, U.S. Treasury Secretary Janet Yellen underscored the need for a broad coalition of partners to help Ukraine recover and rebuild after Russia's invasion, focusing on near-term, high-impact projects.

On the other hand, Ukraine is also negotiating for a $1.5 billion loan tranche from the U.S. Export-Import Bank to purchase natural gas, Ukraine's Prime Minister Denys Shmyhal wrote on Telegram on Saturday in a summary of a call with US Treasury Secretary Janet Yellen.

On the weather front, demand for natural gas will ease in the coming days as record-breaking heat ends over California and the West, aided by heavy showers from Hurricane Kay off Baja arriving over California and the Southwest.

It is still hot over most of Texas with highs of 90s, although relatively comfortable over the South as a weather system stalls with showers and highs of 80s. National demand is expected to be light next week as weather systems track across much of the US, resulting in comfortable highs of 60s to 80s besides locally hotter 90s over Texas, Florida, and Southwest deserts.

The strong upper high that’s brought record heat to the West will begin to ease today, although still hot with highs of 90s and 100s, including highs of 90s across Texas and the central Plains. The northern and eastern US remain mostly comfortable with highs of 60s to 80s as weak weather systems track through.

California will cool into the 80s this weekend, aided by showers from Hurricane Kay. The South will also cool Fri-Sun as a stalled weather system brings highs in the 80s. Overall, national demand will ease this weekend through next week.

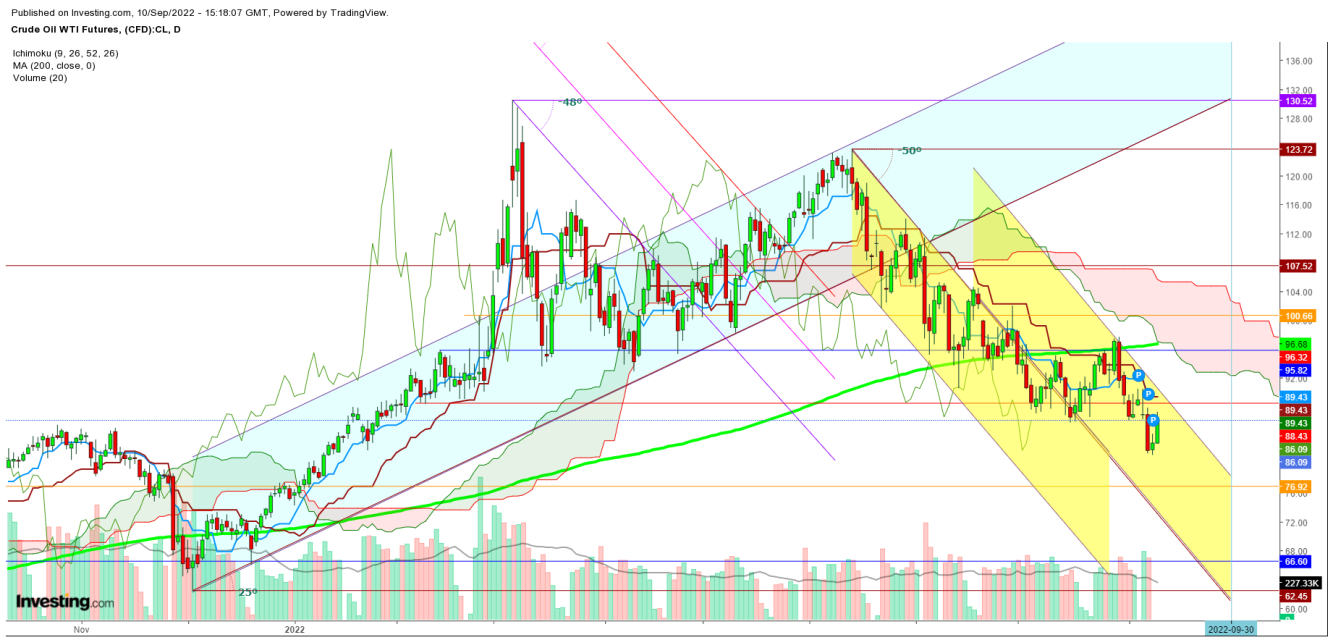

The latest developments could encourage energy bears to set new targets for the rest of September. The natural gas futures could experience more wild price swings during the upcoming week as short-covering could follow every downward move, but the overall price trend is set to see a steep slide till the end of this month.

Disclaimer: The author of this analysis does not have any position in natural gas and WTI crude oil futures. Readers are advised to take any position at their own risk, as natural gas is one of the most liquid commodities in the world.