It was a week where oil prices moved higher on fading Brexit concerns, while natural gas futures soared to a 13-month high.

On the news front, Energy Transfer Equity L.P. (NYSE:ETE) walked away from the merger with Williams Companies Inc. (NYSE:WMB) , while Kinder Morgan Inc. (NYSE:KMI) agreed to sell a 50% stake in its Utopia Pipeline Project.

Overall, it was a good week for the sector. West Texas Intermediate (WTI) crude futures added 2.8% to close at $48.99 per barrel, while natural gas prices jumped 12.2% to $2.987 per million Btu (MMBtu). (See the last ‘Oil & Gas Stock Roundup’ here: Crude Down on Brexit Vote, Court OKs Energy Transfer's Pullout from Williams Deal.)

Oil prices moved north for the first time in 3 weeks on subsiding fears about the effects of Brexit – the short way of saying Britain’s exit from the EU – on crude demand. A weaker dollar, which made the greenback-priced crude cheaper for investors holding foreign currency, also lent support.

Things were further helped by the U.S. Energy Department's weekly inventory release that showed a large drop in crude stockpiles. However, some of the gains were erased after the Baker Hughes report revealed a rise in the U.S. oil rig count – indicating resurgence in shale drilling activities.

Natural gas gained big following another lower-than-average build and predictions of strong cooling demand with forecasts of warmer temperature across the country over the next few days.

Recap of the Week’s Most Important Stories

1. Texas pipeline operator Energy Transfer Equity L.P. reported that it has ended its merger agreement to buy rival natural gas pipeline company Williams Companies Inc., following the ruling by the Delaware Court of Chancery.

Few days back, the court ruled in favor of Energy Transfer Equity. Notably, the ruling came in a lawsuit filed by Williams to hold Energy Transfer Equity to the deal. In May, Williams took the legal step when Energy Transfer Equity expressed concerns over the merger citing that the deal had not secured the necessary legal opinion to make it tax-free for shareholders.

But much to the dismay of Williams, the Delaware Court concluded that Energy Transfer Equity is contractually entitled to end the merger agreement with Williams in the event that the company’s counsel Latham & Watkins LLP were unable to deliver a required tax opinion prior to the merger deadline date of June 28, 2016. (See More: Energy Transfer Terminates Merger Deal with Williams.)

2. Houston, TX-based energy infrastructure provider Kinder Morgan Inc. announced that it has divested a 50% stake in the Utopia Pipeline Project to private equity firm Riverstone Investment Group LLC.

Per the agreement, Riverstone would provide an upfront cash payment, consisting of the reimbursement to Kinder Morgan for its 50% share prior capital expenditures and a payment in excess of capital expenditure to recognize the value created in developing the project. The total project cost is estimated at $500 million.

The Utopia Pipeline is a common carrier project that will include approximately 215 miles of new, 12-inch diameter pipeline constructed entirely within the state of Ohio - from Harrison County to Fulton County. The pipeline will facilitate the transport of ethane and ethane-propane mixtures to petrochemical companies operating in Ontario, Canada, to be used as a feedstock in the production of plastics. (See More: Kinder Morgan Divests 50% Stake in Utopia Pipeline Project.)

3. Energy producer Hess Corp. (NYSE:HES) tasted success in the Liza-2 exploration well in the Stabroek block, offshore Guyana. The results indicate that Liza prospect is a world-class oil discovery with estimated recoverable resources between 800 million and 1.4 billion barrels of oil equivalent.

Located in the Stabroek block, the Liza wells are about 120 miles (193 kilometers) offshore Guyana. The Stabroek block spans across an acreage of 6.6 million acres (26,800 square kilometers).

Drilled by an affiliate of Exxon Mobil Corp (NYSE:XOM)., the Liza-2 well was drilled to a total depth of 17,963 feet (5,475 meters) in 5,551 feet (1,692 meters) of water. The Exxon Mobil unit is also the operator of the Stabroek block with a stake of 45%. Other partners in the block are Hess Guyana Exploration Ltd. and CNOOC Nexen Petroleum Guyana Ltd. with 30% and 25% interest, respectively. (See More: Hess Announces Positive Exploration Results from Liza-2 Well.)

4. As part of it’s previously announced divestment plan to deal with its massive debt, Brazil's state-run energy giant Petrobras (NYSE:PBR) has put up nine shallow water oil fields in the northeastern states of Ceará and Sergipe for sale. These fields produce a total of 13,000 barrels of oil and equivalent natural gas a day from multiple wells.

The proposed divestment, however, is not expected to result in a significant reduction in Petrobras’ $126 billion debt. This is because the nine fields contribute less than 1% of the total production of the company. Also, the sale is unlikely to draw the same level of interest as the integrated player’s prized deep water, pre-salt oil fields, which will be up for auction in 2017.

5. British energy major BP plc (LON:BP) (NYSE:BP) , on behalf of Tangguh Production Sharing Contract Partners, declared that its Tangguh Expansion Project in the Papua Barat Province of Indonesia has received approval for the Final Investment Decision (FID).

This FID decision follows the Government of Indonesia’s approval of the Plan of Development II in late 2012. The contracts for the project’s key engineering, procurement and construction (EPC) are anticipated in the third quarter of 2016, while the construction is expected to begin soon afterward. The project is scheduled to come online in 2020.

The scope of the project includes construction of a third LNG process train (Train 3). The production capacity will also be augmented by 3.8 million tons per annum (mtpa), thereby increasing the total plant capacity to 11.4 mtpa. This apart, the project has two offshore platforms, 13 new production wells, an expanded LNG loading facility and supporting infrastructure.

Price Performance

The following table shows the price movement of the major oil and gas players over the past week and during the last 6 months.

Company | Last Week | Last 6 Months |

XOM | +4.97% | +21.15% |

CVX | +3.07% | +17.22% |

COP | +1.99% | -7.19% |

OXY | +2.17% | +12.25% |

SLB | +3.16% | +14.95% |

RIG | +6.52% | +1.59% |

VLO | -1.30% | -26.47% |

TSO | +1.04% | -27.63% |

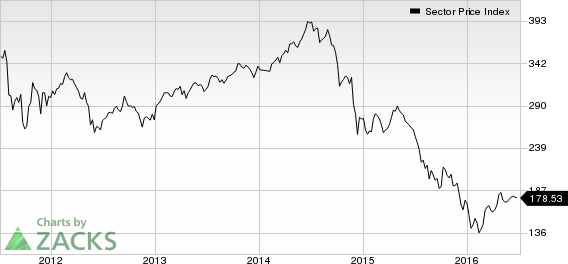

Over the course of last week, ‘The Energy Select Sector SPDR’ was up 1.83% on receding Brexit-related fears. Consequently, investors witnessed buying in most market heavyweights. The best performer was offshore drilling giant Transocean Ltd. (NYSE:RIG) that added 6.52% to its stock price.

Longer-term, over the last 6 months, the sector tracker has jumped 13.76%. The world’s largest publicly traded oil company Exxon Mobil Corp. was the main beneficiary during this period, experiencing a 21.15% price increase.

What’s Next in the Energy World?

As usual, market participants will be closely tracking the regular weekly releases i.e. the U.S. government data on oil and natural gas. Energy traders will also be focusing on the Baker Hughes data on rig count.

PETROBRAS-ADR C (PBR): Free Stock Analysis Report

ENERGY TRAN EQT (ETE): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

TRANSOCEAN LTD (RIG): Free Stock Analysis Report

WILLIAMS COS (WMB): Free Stock Analysis Report

KINDER MORGAN (KMI): Free Stock Analysis Report

HESS CORP (HES): Free Stock Analysis Report

Original post

Zacks Investment Research