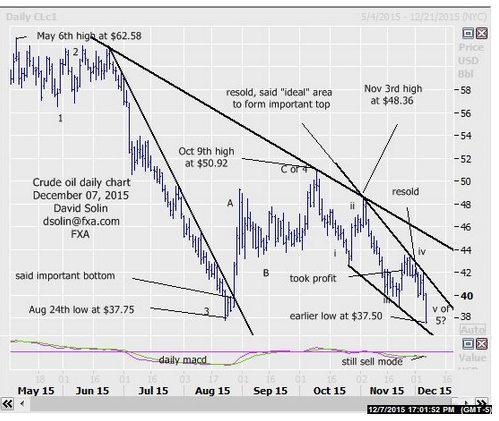

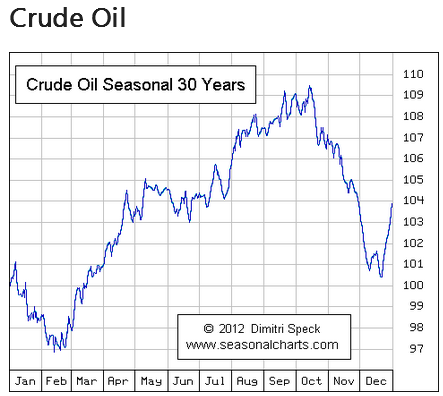

Bigger picture, bearish view over the last few months of declines below that Aug low at $37.75, "ideally" into the mid/late Dec timeframe playing out right on schedule. Note too as been discussing, also "fits" the broader view of declines/potentially final washout into that timeframe across a number of other commodities (copper for example, see my blog at www.fxa.com/solin/comments.htm) as well as commodity currencies (AUD, final upside in dollar/cad, etc.). Today oil took out that $37.75 low, reaching $37.50 and a level not seen since Feb 2009. At this point, there are still no firm signs of even a shorter term low "pattern-wise" (5 waves up for example) arguing further downside ahead. But the market is near term oversold, seen within the final downleg in the decline from the Oct 9th high at $50.92 (wave v, as well as the final downleg from May, wave 5), and the seasonal chart bottoms in late Dec (see 3rd chart below). So would not be surprised to see more and more near term positives starting to appear over the next week or 2 (slowing downside momentum, etc.). Further support is seen at the falling trendline from early Nov (currently at $36.50/75) and that longer term base of the year long falling wedge (currently at $34.00/50, see longer term below). Nearby resistance is seen at the bearish trendline from Nov 3rd (currently at $41.75/00). Bottom line: finally below that long discussed Aug low at $37.75, still no bottom seen.

Strategy/position:

Short from the Dec 2nd resell at $40.97 and for now, would stop on a close $0.25 above the bearish trendline from Nov 3rd.

Long term outlook:

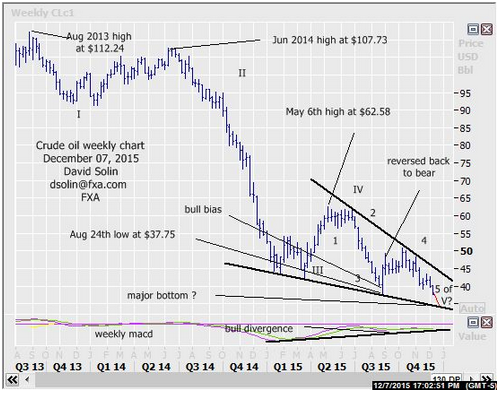

As discussed above, the market has finally broken below that Aug 24th low at $37.75. However as been warning, such a move in the bigger picture may be more limited and versus the start of a longer term, major new tumble. Note that the market is seen within the final downleg in the fall from that May high and also the larger decline from the Aug 2013 high at $112.24 (wave V). Also, technicals did not confirm that Aug low (never mind today's new low, see bull divergence on the weekly macd for example), may be forming a falling wedge/reversal pattern over the last year and sentiment is widely bearish (contrary indicator). Also, potentially major support is seen at that year long falling trendline/base of the potential wedge (currently at $34.00/50) and would an "idea'" area to form a more major bottom (see weekly chart/2nd chart below). But remember, this is the "ideal" scenario and at this point, there is still no confirmation of even a shorter term low (never mind a more substantial) bottom. So for now suffice to say that the longer term, bearish downside view remains in place. Bottom line: have finally achieved those new lows below that Aug $37.75 bottom but magnitude of further, big picture declines below here a question.

Strategy/position:

Reversed the longer term bullish bias that was put in place on Aug 27th at $40.00 to bearish on Sept 3rd at $48.00, and with no confirmation of even a short term low (so far), would stay with that bias.

Current:

Nearer term : resold Dec 2nd at $40.97, still no confirmation of even a short term bottom.

Last : resold Nov 3rd at $47.92, took profit Nov 24th at $42.87 ($5.05 profit).

Longer term : bear bias Sept 3 at $48.00, magnitude of further big picture declines a question.

Last : bull bias Aug 27th at $40.00, to neutral Sept 3rd at $48.00.