Iraq took the headlines last week as the ISIS splinter cell (that even al-Qaeda is afraid of), started taking over Iraqi cities faster than Grant took Richmond, as a result, crude moved higher and looks even higher.

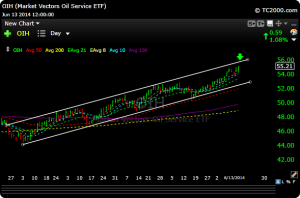

Taking a look at SPDR Energy Select Sector Fund (ARCA:XLE) and Market Vectors Oil Services (ARCA:OIH), you will see tha both are approaching the top of a channel. This doesn’t mean it dies at the top, but its time to use caution. If things resolve in Iraq (I doubt it) then you may see a pullback. If things get worse,( probably), then they can break through the top of the channel and go higher. Probably best not to chase and see what happens first See charts below.

- XLE

Semiconductors (NYSE:SMH)) have been in bull mode and got even more validation last week after Intel (NASDAQ:INTC) said great things about the business.

Biotech (NASDAQ:IBB) took a bit of a rest last week (traded sideways) after its nice recovery bounce, and still remains above all of its key moving averages. Individual names within the group though had some terrific moves.

Materials (ARCA:XLB) pulled back a little, but still remains well within its bullish channel as it went back and tested its uptrend line.

Higher crude prices didn’t help the airline stocks, which dragged down the transports. The airlines haven’t really ever made consistent money since the Wright Brothers. I’ve never been a fan, but the action has been good. (ARCA:IYT)

Here are some short term gains that my subscribers realized last week.

(NYSE:NBG) +17&, (NASDAQ:ISIS) +17.0%, (NASDAQ:IACI) +5.0%, (NASDAQ:FANG) +9.5%, (NYSE:CODE) +10%, (NASDAQ:TQNT) +4.5%, (NASDAQ:CYTR) +15.0%, (NASDAQ:GTAT) +8.2%