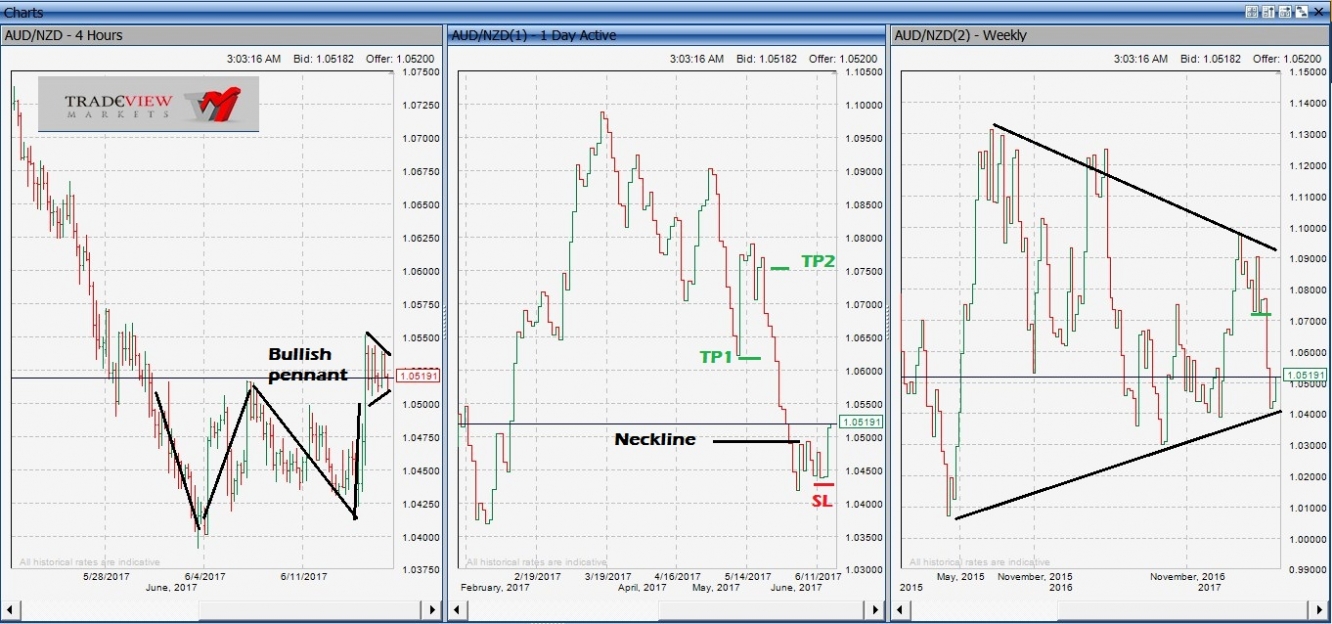

Many maybe wondering how high Aussie and Kiwi will rally, and when should we short; but earlier this month, our group foresaw a coming trade in the commodity currency AUD/NZD as the pair approached the weekly up trendline.

At that point in time, the exchange rate was around 1.0400-50 level and we were patiently watching price action because the trade can go both ways. Now with they key New Zealand GDP data already out, which was worst than market expectation; we look forward to add to our long with stop loss 1.0400 and take profit around 1.0600 and 1.0750

Technically, the pair is on a weekly consolidation at the base of a triangle with evident double bottom on daily and four hour, plus a flag is forming as of this writing. Fundamentally, the recent labor strength in the Australian market and the soft New Zealand GDP, should some what be supportive of this trade, plus the spreads of 2 year swap rates for the pair are widening.

However, negative development from China might stall any sharp move to the upside. Next week RBNZ rate decision should give a clue, to what the central bank think of the recent soft GDP report.

On the institutional side we have 2 major banks backing the trade - Societe Generale (PA:SOGN) at 1.0460, targeting 1.0900 and Credit Agricole (PA:CAGR) targeting 1.0800 with stop loss at 1.0290.

As of this writing, the exchange rate is around 1.0520 and some of us have closed partially as the market goes into weekend. As a trader, there is no better feeling than to be profitable and flat. But we are still in the ride for this trade, so let’s see how far it will go. Cheers!

Please read my risk warning disclaimer