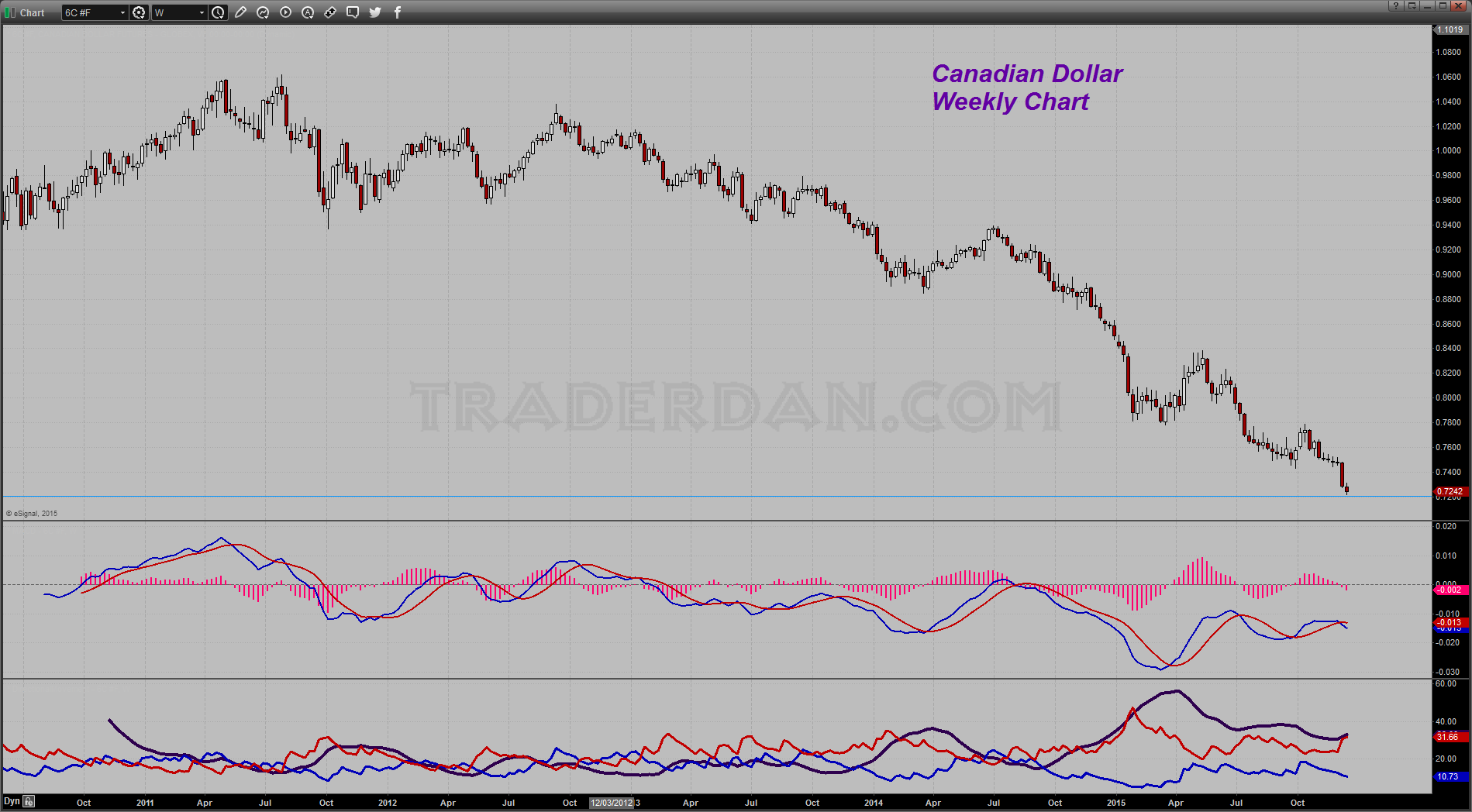

That double whammy was too much for the Cando in yesterday’s session, as the currency broke down into a fresh ELEVEN YEAR LOW. Though it too did manage to bounce off the session lows as the US dollar experienced a round of selling pressure, the Cando still ended the day lower. Currently, in Asian trade, it is trading lower again.

As of yet, the currency shows no sign of halting the steep decline that has been ongoing since early 2011. Based on the long-term chart, there looks to be some psychological downside support just above the .70 level. If the unit failed to hold there, it is not a stretch of the imagination to expect it to visit the .66 level or even lower.

Looking in a bit closer at the Weekly chart, you can see that the bears still have control of this market with the currency on course for another poor finish to end the week.

I have said it many times here – the fortunes of the Canadian dollar are tied directly to the fortunes of the broad commodity sector and even more directly to the price of crude oil. As long as oil remains weak, expect the Cando to remain weak as well.

There have not been a lot of markets that have exhibited well behaved trending moves. This currency has been the exception, with a solid downtrend in place and moves higher being of short duration. Must be Manipulation, eh ?