Global stock markets have generally trended up since June as the anticipation of monetary stimulus prompted a return of risk-taking. While liquidity injections by central banks in Japan and China and a more responsive European Central Bank were all welcome developments, it was arguably the Fed’s third round of unsterilized asset purchases (QE3) that captured the headlines and largely extended the rally into the fourth quarter. But this Bernanke rally could face strong headwinds over the coming months.

Not only is the US earnings season turning into a major dud, but the earnings outlook isn’t looking any better with a global economy that remains stuck in low gear. The resulting scale-back of risk by investors could help support the US dollar and the yen through mid-2013, at the expense of the euro and commodity currencies including the Canadian dollar.

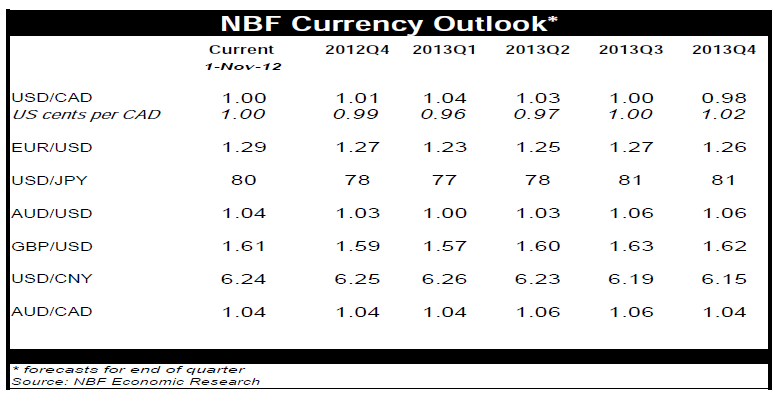

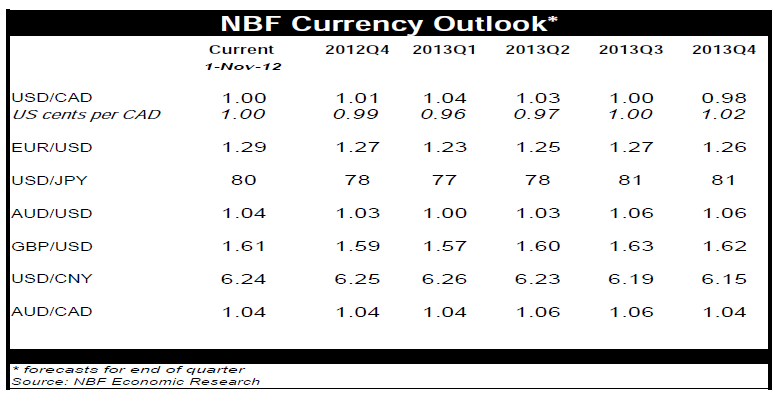

After being temporarily spooked in October by the Bank of Canada’s insistence in keeping a tightening bias, markets are slowly coming to a similar conclusion to our own — the BoC’s threat to raise interest rates is non-credible in an environment of inexistent inflation and below-potential GDP growth. With the loonie hitting parity with the greenback a bit earlier than we had expected, we’ve made some room to allow for further CAD weakness over the near- to medium-term. We now expect the loonie to test 1.04 CAD/USD in the first quarter of next year.

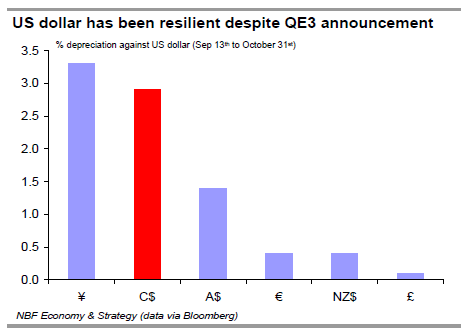

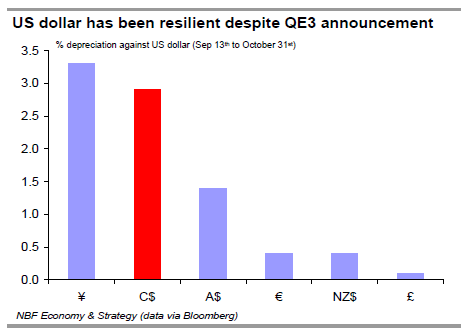

Greenback holds firm despite QE3 The greenback hasn’t collapsed the way many had predicted right after the Fed announced QE3. The dollar’s resilience is even more impressive considering that speculators ditched the currency at a record pace after the Fed’s move in September, something which ought to have been USD negative. Part of the dollar’s resilience can be explained by the factors that we mentioned in last month’s Forex.

For one, the Fed’s third round of asset purchases is smaller than the first two programs in terms of monthly asset purchases. Moreover, the weak economic backdrop has prevented risk taking from escalating the way Chairman Bernanke would have wanted when he deployed QE3.

But one can’t really blame investors for being cautious in the face of persistent problems with Europe and sputtering growth in North America and emerging markets. The weak economy is impacting corporate bottom lines as evidenced by a disappointing US earnings season. Worse is the increased likelihood of another weak earnings season in Q4.

The bleak economic outlook has indeed prompted a string of downgrades to US earnings estimates. So much so, that the ratio of negative to positive preannouncements for Q4 now stand at a record high. In other words there’s never been as many US companies revising down their earnings estimates compared to those revising up.

So investor disappointment is likely not over and the resulting scale-back of risk-taking could be supportive of the US dollar in coming months. That’s even more likely if economic data remain weak. While US economic growth picked up in the third quarter to 2% annualized, the details of the GDP report were less impressive.

To Read the Entire Report Please Click on the pdf File Below.

Not only is the US earnings season turning into a major dud, but the earnings outlook isn’t looking any better with a global economy that remains stuck in low gear. The resulting scale-back of risk by investors could help support the US dollar and the yen through mid-2013, at the expense of the euro and commodity currencies including the Canadian dollar.

After being temporarily spooked in October by the Bank of Canada’s insistence in keeping a tightening bias, markets are slowly coming to a similar conclusion to our own — the BoC’s threat to raise interest rates is non-credible in an environment of inexistent inflation and below-potential GDP growth. With the loonie hitting parity with the greenback a bit earlier than we had expected, we’ve made some room to allow for further CAD weakness over the near- to medium-term. We now expect the loonie to test 1.04 CAD/USD in the first quarter of next year.

Greenback holds firm despite QE3 The greenback hasn’t collapsed the way many had predicted right after the Fed announced QE3. The dollar’s resilience is even more impressive considering that speculators ditched the currency at a record pace after the Fed’s move in September, something which ought to have been USD negative. Part of the dollar’s resilience can be explained by the factors that we mentioned in last month’s Forex.

For one, the Fed’s third round of asset purchases is smaller than the first two programs in terms of monthly asset purchases. Moreover, the weak economic backdrop has prevented risk taking from escalating the way Chairman Bernanke would have wanted when he deployed QE3.

But one can’t really blame investors for being cautious in the face of persistent problems with Europe and sputtering growth in North America and emerging markets. The weak economy is impacting corporate bottom lines as evidenced by a disappointing US earnings season. Worse is the increased likelihood of another weak earnings season in Q4.

The bleak economic outlook has indeed prompted a string of downgrades to US earnings estimates. So much so, that the ratio of negative to positive preannouncements for Q4 now stand at a record high. In other words there’s never been as many US companies revising down their earnings estimates compared to those revising up.

So investor disappointment is likely not over and the resulting scale-back of risk-taking could be supportive of the US dollar in coming months. That’s even more likely if economic data remain weak. While US economic growth picked up in the third quarter to 2% annualized, the details of the GDP report were less impressive.

To Read the Entire Report Please Click on the pdf File Below.