Office Depot, Inc. (NASDAQ:ODP) , which is slated to release second-quarter 2017 results on Aug 9, has seen shares jump 16.2% in the past three months. The stock has comfortably outperformed the industry that declined 9.6% and the broader Retail-Wholesale sector that gained 2.8%. In fact in the past five days, the stock has climbed roughly 1.7%. This gives us a fair idea that the stock is favorably placed among the list of companies that defines the industry.

Per the Earnings Preview report, Retail-Wholesale sector is likely to witness earnings decline of 1.6% but revenue increase of 4% this reporting cycle. Let’s take a closer look as to how Office Depot is expected to contribute to the sector’s performance.

What to Expect from Office Depot?

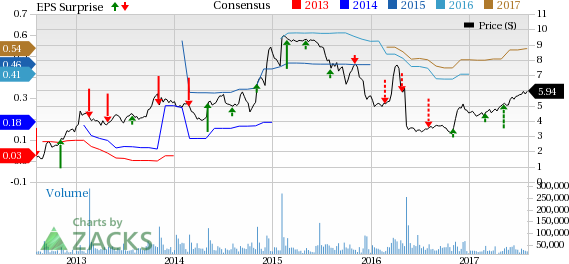

The question lingering in investors’ minds is whether this supplier of a range of office products and services will be able to post positive earnings surprise in the quarter to be reported. The company’s past performance reveals that it had surpassed the Zacks Consensus Estimate in the preceding three quarters.

The current Zacks Consensus Estimate for the quarter under review is 9 cents compared with 3 cents reported in the year-ago period. We note that the Zacks Consensus Estimate has remained stable in the past 30 days. Analysts polled by Zacks expect revenues of $2,460 million, down about 23.6% from the prior-year quarter.

Factors at Play

Office Depot is closing underperforming stores, reducing exposure to higher dollar-value inventory items, shuttering non-critical distribution facilities, concentrating on eCommerce platforms as well as focusing on providing innovative products and services. Moreover, the company is increasing penetration into adjacent categories. The company now intends to focus solely on core North American market.

With respect to the cost containment effort, Office Depot is employing a more efficient customer coverage model, focusing on lowering indirect procurement costs along with general and administrative expenditures. Further, it is gaining from its U.S. retail store optimization plan. Management expects these endeavors to result in annual benefits of over $250 million by the end of 2018.

Analysts pointed out that demand for office products (paper-based) has been decreasing due to technological advancements. Smartphones, tablets and laptops are fast emerging as viable substitutes for paper-based office supplies. Further, stiff competition from online retailers has been playing spoilsport for Office Depot.

Office Depot continues to battle a dismal top-line that missed the Zacks Consensus Estimate for the 11th consecutive quarter, when it reported first-quarter 2017 results. Management expects total sales to be lower in 2017 in comparison with 2016, due to the store closures, tough market conditions and losses of contract customers in the prior year. However, management anticipates the rate of decline to decelerate throughout 2017 taking into consideration higher customer retention and improvement in the contract channel sales pipeline, along with the implementation of new customer wins.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Office Depot is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Office Depot has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 9 cents. The company carries a Zacks Rank #3, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Gap, Inc. (NYSE:GPS) has an Earnings ESP of +3.85% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

J. C. Penney Company, Inc. (NYSE:JCP) has an Earnings ESP of +42.86% and a Zacks Rank #3.

Costco Wholesale Corporation (NASDAQ:COST) has an Earnings ESP of +0.50% and a Zacks Rank #3.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Office Depot, Inc. (ODP): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Original post

Zacks Investment Research