- Is big oil the new tech? No, but it’s doing a pretty good imitation so far in 2021

- Floating-rate bonds are having a good year

- Will commercial real estate recover from the pandemic? It’s off to a good start

Energy stocks continue to run hot

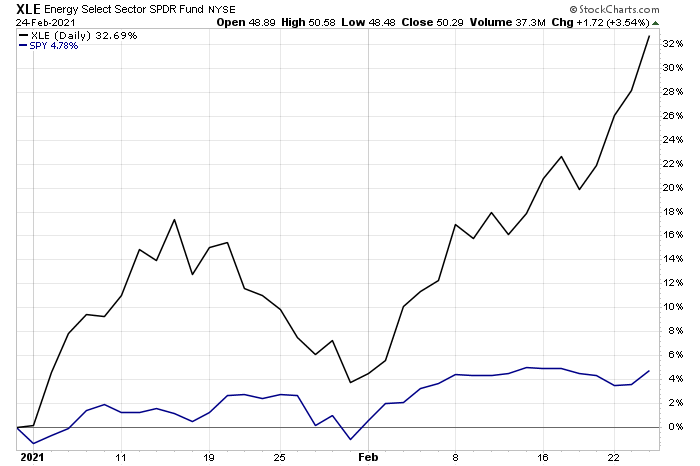

Energy Select Sector SPDR (NYSE:XLE) closed up 3.5% yesterday (Feb. 24), widening the outperformance gap against the broad market year-to-date, based on SPDR S&P 500 (NYSE:SPY). After suffering through much of last year, XLE’s on the rebound in a non-trivial degree.

Year-to-date, XLE’s up a sizzling 32.7%—a world above SPY’s 4.8% increase so far in 2021.

The reflation trade that’s sweeping through markets is a factor by driving all things energy higher. There’s also the bounce-back effect that’s driven by expectations that the worst of the pandemic is behind us.

Is old-school energy the new tech? No, although it may temporarily appear otherwise. Big-cap tech, by the way, is trailing the broad market via Technology Select Sector SPDR® Fund (NYSE:XLK), which is up a modest 3.6% this year.

The likes of ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX)—XLE’s two biggest holdings at roughly 45% of the portfolio—will remain victims of the green revolution in the years ahead. But for the near term, the horizon looks favorable.

There’s still no escaping the reality that these behemoths of fossil fuels are toiling in a sunset industry. Nonetheless, there will be periods when the long fade gives way to the short bounce. Exhibit A is the current environment.

Float ‘em if ‘ya got ‘em

The floating-rate niche corner of the bond market has been a yawn in recent years, but as the reflation factor kicks in it’s on the short list to be the new new thing.

Floating-rate debt, of course, is so-named because the yield on these bonds varies with the prevailing wind of yield trends. That’s a plus when interest rates are rising, as they have been recently.

In turn, floating-rate debt has been a rare bright spot in fixed income this year, which has generally suffered as rates have increased. The 10-year Treasury yield, for instance, ticked up to 1.38% yesterday—a one-year high.

The iShares Floating Rate Bond ETF (NYSE:FLOT), the largest ETF in this space by far, is up fractionally year to date—0.3%. A trivial gain, except when you compare it to the US investment-grade benchmark via an ETF proxy: Vanguard Total US Bond Market (NASDAQ:BND), which was down 2.4% this year through Wednesday’s close.

Pandemic? What Pandemic?

The pandemic will reportedly create a permanent (or semi-permanent) workforce operating out of their bedrooms, at the expense of the usual arrangement. As one wag recently observed: We don’t work at home, rather, we live at work.

That’s bad news for office buildings and other commercial real estate properties. But real estate investment trusts (REITs) didn’t get the memo.

Vanguard US Real Estate (NYSE:VNQ) continued to break above its trading range that prevailed for much of last year. The REIT-focused ETF closed higher for the fourth straight day on Wednesday and is up 7.0% year-to-date, a comfortable margin above the broad market’s 4.8% gain (SPY).

The fund is still roughly 5% below its pre-pandemic high, but if recent history is a guide this ETF seems to be saying that rumors of commercial real estate’s death are premature.