Badger Meter Inc.’s (NYSE:BMI) third-quarter 2017 earnings declined 10% year over year to 27 cents per share. Earnings for the quarter were affected by elevated brass costs, and other costs. It also missed the Zacks Consensus Estimate of 35 cents by a wide margin of 22.9%.

Sales in the quarter increased 3.9% year over year to a record $100 million, but fell short of the Zacks Consensus Estimate of $103 million. Municipal water sales, which represent around 75% of total third-quarter sales, inched up 0.3% year over year on the back of higher commercial water meter sales and additional sales from D-Flow, partly offset by lower sales of residential meters and related technologies. Some of the decline in residential sales was due to lower international sales, particularly in the Middle East.

Flow Instrumentation products accounted for around 25% of total sales for the third quarter, increased 16.1% to $25.3 million from $21.8 million last year. Improvement across most of the company’s product lines, including meters for the oil and gas market, valves and magnetic meters drove the results.

Cost and Margins

Cost of sales increased 9.3% year over year to $63 million. Gross profit in the quarter came in at $37 million, down 4.2% from $38.6 million in the year-earlier quarter. Gross margin was 37%, a 310 basis points (bps) contraction from the year-ago quarter owing to higher brass and other costs compared to the same period last year.

Selling, engineering and administration expenses decreased marginally to $24.6 million from $24.7 million in the prior-year quarter. Operating income dropped 11% to $12.4 million from $13.9 million in the year-earlier quarter. Consequently, operating margin contracted 210 bps to 12.4%.

Financial Position

Badger Meter reported cash and cash equivalents of $13.4 million at the end of third-quarter 2017, up from $7.3 million at year-end 2016. Receivables were pegged at $68.9 million at the third quarter end, higher than $59.8 million as of Dec 31, 2016. Inventories were $77 million at the end of third quarter compared with $78 million as of Dec 31, 2016.

Badger Meter anticipates significant increase in sales of new products, both the E-Series Ultrasonic meters and the ORION Cellular radios. Several major municipal water projects, which initially slated for the third quarter, are now expected in the future, as customers upgrade their systems to take advantage of new ORION Cellular LTE technology. Thus, the company projects that the strength of the latest products and the rebound in industrial markets, including oil and gas, remain tailwinds which will bolster sales in 2018.

Also, the company is currently working to integrate the technology of its recent acquisition, D-Flow, into Ultrasonic meters and estimates that the project will be completed later next year. The acquisition will help Badger Meter to further enhance its successful E-Series Ultrasonic product line, lower production costs and provide a platform for further advancement of ultrasonic capabilities.

Badger Meter is poised to gain from significant rebound in the Flow Instrumentation business, driven both by continued improvement in the oil and gas markets and the impact of sales channel reorganizations. It’s recently announced distribution agreement with DNOW L.P. for global sales into the oil and gas industry is anticipated to drive growth in future.

Nevertheless, Badger Meter remains focused on price increases to offset higher material costs, as well as expected price increases in resin due to the impacts of Hurricane Harvey on resin producers in the Houston area.

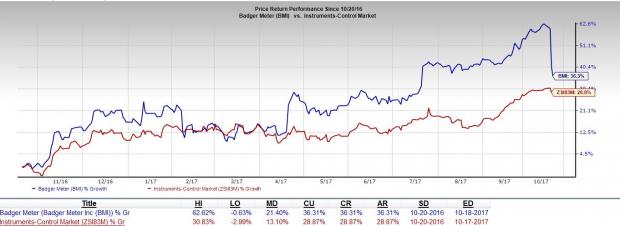

Over the past year, Badger Meter has outperformed the industry with respect to price performance. The stock has gained around 36.3%, while the industry recorded 28.9% growth during the same time frame.

Zacks Rank & Key Picks

Badger Meter currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the same sector are Autohome Inc. (NYSE:ATHM) , Canon Inc. (NYSE:CAJ) and eGain Corporation (NASDAQ:EGAN) . All three stocks flaunt a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Autohome has an expected long-term earnings growth rate of 18.8%.

Canon has an expected long-term earnings growth rate of 3%.

eGain Corporation has an expected long-term earnings growth rate of 10%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Autohome Inc. (ATHM): Free Stock Analysis Report

eGain Corporation (EGAN): Free Stock Analysis Report

Badger Meter, Inc. (BMI): Free Stock Analysis Report

Canon, Inc. (CAJ): Free Stock Analysis Report

Original post