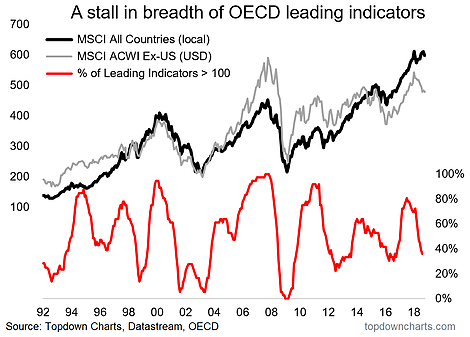

The latest round of OECD leading indicator data showed ongoing softness in the breadth across countries - which is an interesting and innovative indicator we track as part of a suite of indicators on global equities. The punchline of course is that this is the kind of thing we usually see during a major correction or bear market. Like all indicators it is not without its short-comings, but it shows the wobbles currently being experienced by the global economy, and in particular the global equity ex-US index reflects the weakness which has been more pronounced outside of America.

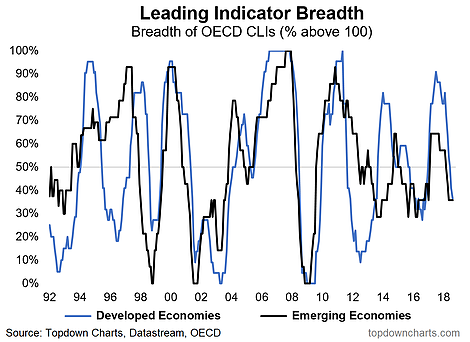

As a bonus chart, this one shows that same indicator, but specifically for emerging vs developed economies. You can see that EM never really caught up to DM, and then were the first to fall... but importantly, it wasn't just an EM issue (although the news headlines might lead some to conclude that).

Anyway, that's it for this quick update - focus from here is whether growth momentum picks back up again (my base case) or continues to soften (need to listen to what the data tells us in the coming weeks and months for that!).