Odyssey Marine Exploration’s (NASDAQ:OMEX) dumping its shipwreck business is like rearranging the deck chairs on the Titanic.

And -- like members of the orchestra valiantly playing as the ocean water laps at the hems of their trousers -- Odyssey is playing sweet tunes designed to convince investors that the inevitable won’t happen.

Odyssey is a Tampa, Florida company that has changed course from shipwreck recovery to undersea mineral exploration. In light of a messy controversy over the HMS Victory shipwreck, a former UK official calling the company a "scam," and a consistent record of losses other than one small net income blip in 2004, the company finally determined that its shipwreck recovery business was a wreck. So now the company hopes its unproven mineral exploration idea will someday tip the ship upright.

TheStreetSweeper is not buying it. We look at seven reasons investors should expect more troubles long before Odyssey can ever get to work on a single seabed mineral deposit.

*1. Cash Poor

The company is running out of cash fast. Cash and equivalents had dwindled down to $2.2 million at year's end. And Odyssey burns through more than $17 million per year.

That means Odyssey burns through about $4.3 million in cash each quarter.

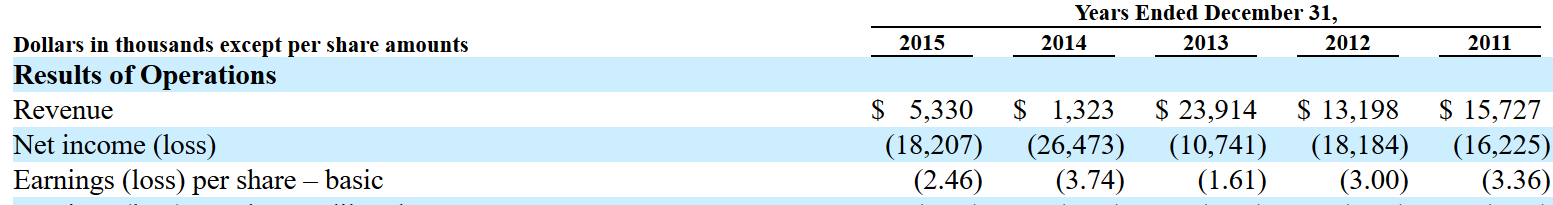

At the same time, Odyssey's working capital deficit hit $21.1 million. And, while revenue did increase to $5.3 million in 2015, net losses hit $18.2 million and a "going concern" issue continued to dog the company. The snapshot below indicates ongoing financial disappointments.

(Source: Company SEC filing)

*2. Looming Dilution

With cash burning, financial burdens mounting and a Nasdaq delisting threat still fresh in mind, the company recently inked a quick, draconian deal to borrow $3 million from Epsilon Financial at 10 percent interest.

Odyssey received $1.5 million on March 31 and will receive the remainder on April 30.

While the deal addressed cash burn for one quarter, it poses a significant risk to existing stockholders.

That's because it gives Epsilon the right to convert every penny outstanding into Odyssey stock at $5 per share.

Here is the relevant part of the agreement:

"At any time and from time to after Epsilon has advanced the full $3.0 million to OME, Epsilon has the right to convert all amounts outstanding under the Note into shares of Odyssey common stock upon 75 days’ notice to OME or upon a merger, consolidation, third party tender offer, or similar transaction relating to Odyssey at the conversion price of $5.00 per share..."

A default by Odyssey would chop the conversion price to $2.50. So, if Epsilon converted the full amount into shares, the lender would receive about 600,000 shares. If Odyssey defaulted, the lender would likely get more than 1.2 million shares.

So as the company tries to stay afloat with its mineral dredging attempts, investors could very soon face diluted shares.

But even more ominous dilution potential looms ahead, as we explain in the "Extensive Stock Dilution" section below.

*3. Blame Game

Solid companies seldom blame others for their troubles. Not so with Odyssey.

When the company submitted its 2014 annual report, the US Securities and Exchange Commission responded with questions about its initial business of shipwreck excavation. The commission asked about recent UK Telegraph reports that the Maritime Heritage Foundation had only 65,000 pounds and that the HMS Victory site where Odyssey had planned to excavate is believed not to have a treasure.

The SEC continued, "... the Ministry of Defence gave its consent to proceed with excavations and withdrew such consent in March 2015, please explain to us the reasons for the withdrawal of consent and clearly explain the nature of the Judicial Review by the United Kingdom government concerning the HMS Victory project."

Odyssey responded here, in part: "A single British citizen who is opposed to our project threatened to file for a judicial review of the UK Ministry of Defence’s (“MOD”) decision to consent to the archaeological investigation and recovery of at-risk artefacts from the HMS Victory ... In recent years, this process has been used by some pressure groups and campaigners as a delaying tactic or to generate publicity."

Odyssey then wrote that the Ministry withdrew permission but the company expected a new consent that would roll in the Judicial Review issues.

But the shipwreck business ultimately wrecked ....

*4. Most Assets Sold

That big wreck occurred last December. In exchange for cash and reduced debt obligations (see page 17), the company sold most everything - from its shipwreck database to recovered items to its headquarters.

Those assets the company didn't sell off were mostly pledged away, according to company filings. A company filing notes on page 21 those actions are, "leaving us with few opportunities to raise additional funds from our balance sheet."

Thus, Odyssey had no choice but to refocus and try to get investors to buy into the company's mineral exploration and dredging idea.

*5. Extensive Stock Dilution

Now a stock purchase deal of up to $101 million hangs in the balance. That pending conversion to stock poses extensive dilution to current shareholders.

Penelope Mining and Minera del Norte S.A. de c.v. (Minosa) inked the stock purchase agreement last year in apparent hopes that the speculative mineral dredging idea might work.

But the deal ties an albatross around Odyssey's neck. It is really debt restructuring with a long string of conditions attached.

In fact, the entire transaction depends on Penelope purchasing shares from Odyssey. But that is "heavily dependent" upon Mexico approving an environmental application for mineral exploration and dredging in Mexican waters - which is an unproven endeavor with a completely unknown outcome that will be years in the making.

*6. Stock Hype

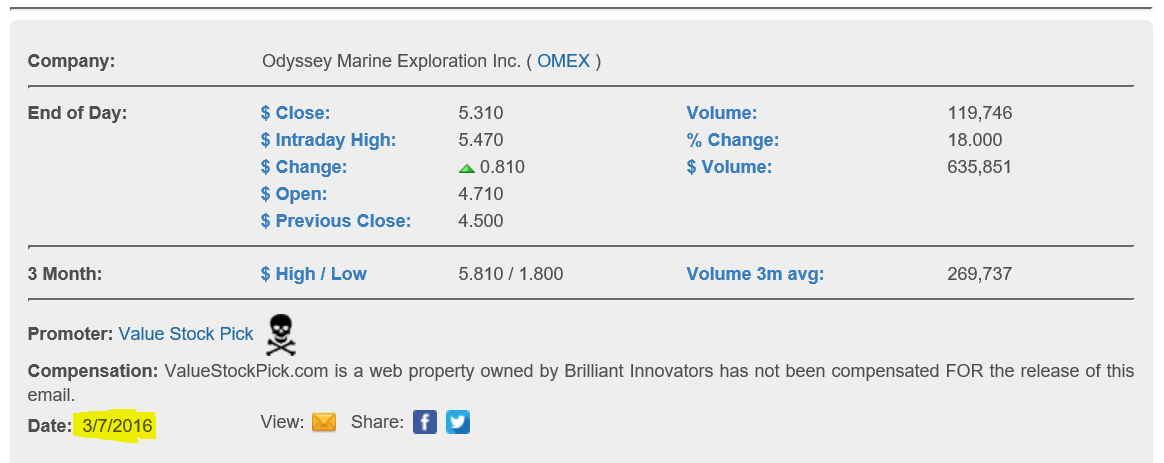

Meanwhile, the last thing a real company would want to see is a professional stock promoter pushing the company stock. But that’s exactly what has happened with Odyssey.

Stock promoters have hyped the stock in multiple campaigns over the years. A snippet from the most recent hype is below:

(Source:stockpromoters.com, click for details)

Along with last month's organized campaign, professional promoters pushed the stock in three other massive email newsletter campaigns in the fall of 2011 and 2013.

Integral to many "pump-and-dump" scenarios, stock promotions are often paid for by an undisclosed third party that suddenly sells its shares once it has successfully pushed the stock, according to the US Securities and Exchange Commission. Ultimately, investors are left holding an empty bag and the pumped company usually shrinks back into an empty shell.

Indeed, a solid company with a strong business does not need to be hyped by professional stock promoters. So a history of stock promotion is another significant risk that investors must consider.

*7. Familiar Recent Stock Action

Finally, the recent stock rally may be partially due to hype that the Mexican government might approve an environmental permit application filed by Odyssey and related subsidiaries. This approval is a critical next step for the company as it attempts the seabed dredging idea.

Yet the process has already been very long and tangled (see page 3). Odyssey hopes something will happen this year. But nobody really knows and the company has historically struggled with government regulations such as the United Kingdom's.

Indeed, Odyssey's annual report notes that the albatross is tightening its grip:

"One or more of the planned opportunities for raising cash may not be realized to the extent needed which may require us to curtail our desired business plan until we generate additional cash."

Odyssey successfully attempted to prop up the stock through a 1-for-12 reverse stock split in February. But such splits often backfire.

Great Basin Scientific (NASDAQ:GBSN) is another company that recently did a reverse stock split, which first propped up the price and then wrecked it. Check out the chart below to see what happened.

(Source: Yahoo (NASDAQ:YHOO) Finance)

So investors must decide. Is it wise to invest in a desperate, reverse-stock-split company that has essentially dumped its core business - after two decades of nearly consistent operating losses - in favor of an untried, vaguely related business idea fraught with risk?

*Conclusion

Odyssey can hold off the inevitable only as long as shareholders keep listening to that sweet music conducted by this desperate company and any promoters still hanging on for life.

But the final chords sound like heart-lurching squawks as the company struggles with a completely changed business plan that includes inevitable, tremendous dilution ahead. Time to hunt for the lifeboats.

In TheStreetSweeper’s opinion, this stock could, at best, sink to half of today's value in the very near future.

* Important Disclosure: The owners of TheStreetSweeper hold a short position in OMEX and stand to profit on any future declines in the stock price.

* Editor's Note: As a matter of policy, TheStreetSweeper prohibits members of its editorial team from taking financial positions in the companies that they cover. To contact Sonya Colberg, the author of this story, please send an email to scolberg@thestreetsweeper.org.