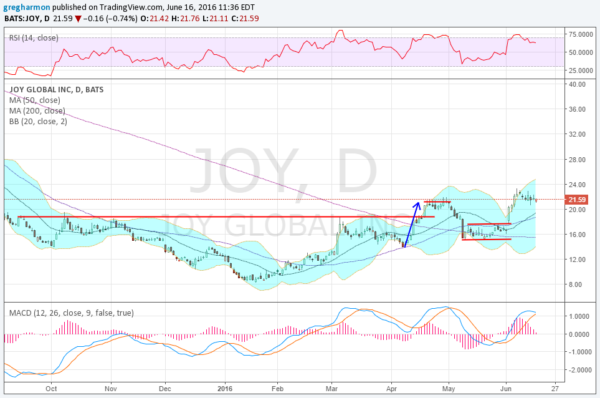

Joy Global’s (NYSE:JOY) stock price fell from a high over $64 in the 3rd quarter of 2014 to a low below $9 in January this year. If anybody needs a pick me up, it's JOY's shareholders. But it looks like the stock is on track to pull out of this downturn and continue higher. The chart below tells the story.

After a long bottoming process from September 2015 until mid April this year, the stock broke higher, making its first higher high. Smiles turned to frowns though as the breakout failed and the stock moved back lower. The consolidation over the course of May, though, established a higher low. And then the breakout to start June took the stock price to another higher high. An uptrend is emerging.

The pull back since that higher high, in a bull flag, sets up for yet another leg higher. A break to the upside gives a target to 27.50 from the current low point of the flag. Momentum indicators are holding strong in the bullish zone as it digests the latest move up. The RSI is over 60 and running sideways while the MACD is rolling flat. Even the Bollinger Bands® have opened higher to allow a move up. Look for a break of the flag higher, maybe over 22.75 to confirm the next leg up using the low of the flag as a stop.