I won't write much about the latest details on Greece, as events are moving fast and any updates I have will be out of date within hours. Needless to say, we are down to the wire again as the Greeks have threatened to withhold their payment due to the IMF this Friday should there be no deal.

So will we have a deal (Ode to a Grecian Deal), or will the Greeks metaphorically take to the Acropolis for a last stand as the Athenians planned to do had their army had lost to the Persians at the Battle of Marathon (Acropolis Now!)?

Here are a couple ways to handicap the outcome. The chart below of the Athens General Index shows the index to be in a downtrend (solid line), but it has rallied out of a minor downtrend (dotted line). Moreover, the inability of the index to fall further on bad news and actually try to bottom has to be regarded as good news.

In other words, the stock market believes that we will see an eleventh hour deal.

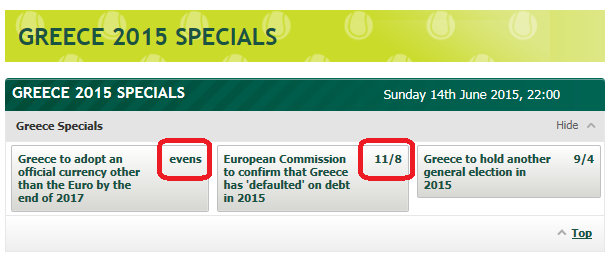

On the other hand, the latest odds from PaddyPower, where people are also putting real money on the line, shows the odds of Greece defaulting in 2015 to be 11/8, which works out to be around 40%, and the odds that Greece will adopt its own currency by the end of 2017 to be even.

The probability of Grexit in 2015, which is a less likely event than a straight default, is coming in at between 25% and 30%.

Who should you believe? I'm not sure, but there is a big divergence there between what the stock market believes and the bookmaker odds of Greek default.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.