Market overview

The October stock market selloff reversed up from the 20 month EMA. The weekly chart had 2 legs down from the September high and formed a strong bull trend reversal bar. In addition, the daily chart reversed up from a wedge bottom (see charts below). This makes a good case for an October bottom, or maybe one more brief new low, and a year-end rally.

However, the daily chart has not gone above the October 17 major lower high and it is still below the 20 day EMA. The monthly chart is bullish, the weekly chart is neutral, and the daily chart has been bearish, but is trying to reverse up. Whenever both the bulls and bears have reasonable arguments, the market usually goes sideways. That is what is most likely over the next month or two.

US Dollar forming right shoulder of head and shoulders top

The weekly chart of the US dollar futures contract shows a wedge rally. A reversal down would be from the right shoulder of a head and shoulders top.

The 8 year rally in the US dollar has stalled around 100 several times in the past 4 years. The weekly chart has a yearlong wedged shape rally. It will probably be the right shoulder of a head and shoulders top or a double top with the 2017 high. A head and shoulders top is a trading range. There is only a 40% chance of a measured move down below the neck line. However, the weekly chart is high enough up in the 4 year range to make it likely that it will start testing down soon.

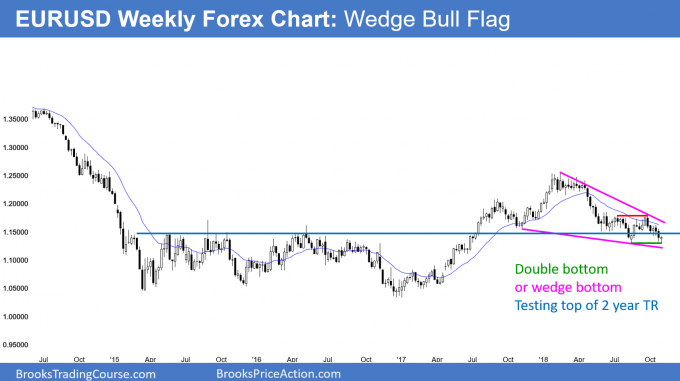

EUR/USD weekly Forex chart has wedge bull flag at support

The EUR/USD weekly Forex chart is forming a wedge bull flag as it tests the top of the 2015 – 2016 trading range.

In the Forex markets, the EUR/USD daily chart reversed up strongly on Thursday from a perfect double bottom with the August 15 low. If the bulls get follow-through buying next week, there should be a rally to the October 16 high above 1.16.

However, the bears still have a 30% chance of a 500 pip measured move down below the double bottom. If they get a break below the August low, it will probably fail within a few days. Trading ranges resist breaking out. Since the market is at the bottom of its 6 month range, a reversal up is more likely than a swing down.

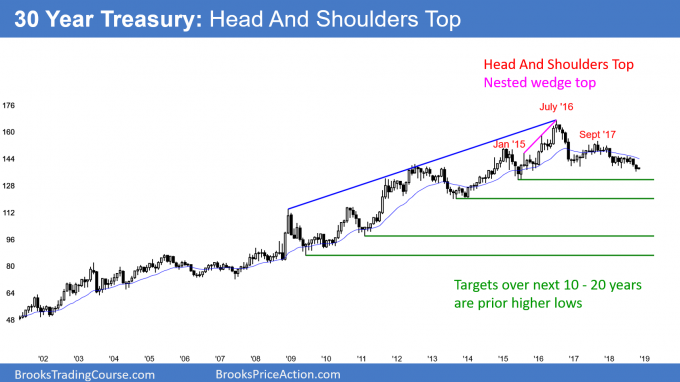

30-year Treasury Bond in early stage of 20 year bear trend

The 30 year US Treasury Bond Futures market has a 3 year wedge top nested within a 10 yer wedge top. The September high is also the right shoulder of a head and shoulders top. While the 4 year trading range can continue for a couple more years, the 2016 high will probably last at least 30 years. This means beyond your trading career.

For several years now, I have been writing about the 30 year treasury bond putting in a massive nested wedge top. That top formed in July 2016. While it might trade sideways indefinitely, no one reading this post will ever see a new all-time high. The chart will work lower over the next 20 years. Even if it were to reverse up at that point, it would probably need at least 20 more years to make a new high, if it ever makes a new high.

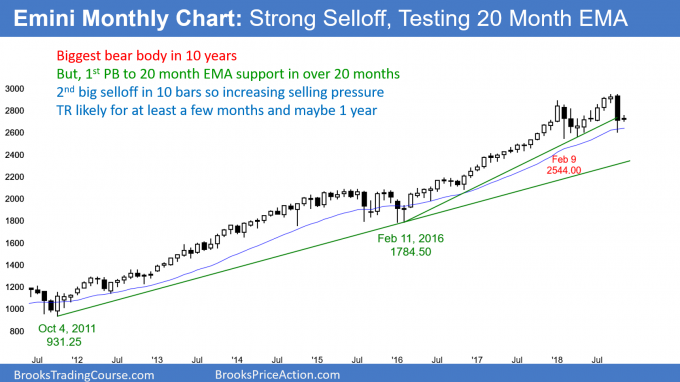

Monthly S&P500 Emini futures candlestick chart: Test of the 20 week EMA

The monthly S&P500 Emini futures candlestick chart had a big bear trend bar in October, but there was a tail at the bottom. This was the 1st pullback to the 20 month EMA in more than 20 months and therefore it is a 20 Gap Bar buy signal.

The monthly S&P500 Emini futures candlestick chart sold off strongly in October, but there were buyers at the 20 month EMA. For over 20 months, the bulls have been willing to pay an above average price. Last month, they finally got an opportunity to buy at the average price and they took it.

However, October had the biggest bear body since the monthly bull trend began 10 years ago. It is therefore significant. This is especially true because it is the 2nd strong reversal down from just below 3,000.

Although there are buyers at the 20 month moving average, they might not be strong enough to immediately resume the bull trend. Instead, they might just be able to stop the selling. That means that October might not simply be a bear trap and a sell vacuum test of support. It could be a reminder that the February selloff began a trading range, and that range is still in effect.

Double top, but minor trend reversal

Whenever there is a double top, traders wonder if there will be a bear trend reversal. The January/September double top is small compared to the 10 year bull trend. In addition, the bull trend was strong. Therefore, any reversal will probably be minor. That means a trading range is more likely than a bear trend.

But, the October selloff might be the 1st of 2 – 3 legs sideways to down. Consequently, the yearlong trading range might last another 10 or more bars (months) before the bulls can resume the trend up. Since this is a monthly chart, that means possibly another year. However, there will probably be a breakout within 6 months.

If October is the 1st leg down in a bigger bear leg in the yearlong trading range, the 2nd or 3rd legs down could easily fall below the February low. As a result, if there is a strong break below that low, the selloff would still probably be a bear leg in the trading range.

What is needed for a bear trend?

For traders to conclude that the monthly chart is in a bear trend, they would need to see either 2 big bear bars or a series of 3 or more smaller bars closing below the February low. There is currently only a 30% chance of that happening. But, as I said, while a new high is likely within a few months, the bull trend does not have to resume up soon. The trading range could last through all of 2019 before there is a new high.

I have written several times over the past 2 years that the monthly chart would probably enter a trading range, have a bull breakout, and then a Final Bull Flag reversal down. In addition, I said that the selloff will be 30 – 50%. That is how markets behave and it is still likely to be the case. That means that there will probably be one more new all-time high before there is a bear trend on the monthly chart. The final top will probably be a year or two from now.

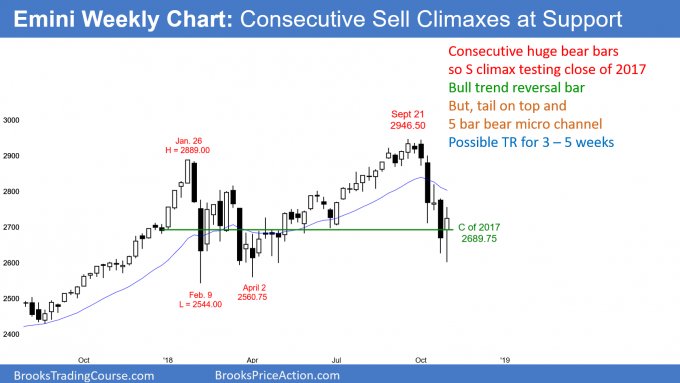

Weekly S&P500 Emini futures candlestick chart: Two legs down and a reversal up

The weekly S&P500 Emini futures candlestick chart had a bull trend reversal this week. This followed 2 sell climaxes down to support at the bottom of the 2018 range.

The weekly S&P500 Emini futures candlestick chart reversed up strongly this week after 2 legs down from the all-time high. Trading ranges often have many 2 legged moves up and down. Therefore, this might be marking the end of the current selling.

This is especially true because the reversal up this week was from the 2600 Big Round Number and from just above the May low. Therefore, the bulls will try to form a double bottom higher low with the May low. Since this week was a big bull reversal bar, it is a reasonable buy setup for a year-end rally.

However, because of Friday’s selloff, the week had a small bull body. This makes it likely that the Emini will trade mostly sideways for a few weeks. Since the bulls bought strongly below the low of 3 weeks ago, they will probably buy again below this week’s low if they get a chance.

What about the bears?

Even though this week is a good buy setup, there has not been a pullback above the high of the prior bar in 5 weeks. That is a sign of strong bears. Consequently, the 1st reversal up will probably only last 2 to 3 weeks before there is a pullback below the prior week’s low. This might take place around the 20 week EMA and a 50% retracement of the October selloff.

Once there is a week that trades below the prior week’s low, the bears will hope that it will lead to a resumption of the October selloff. But this week’s strong rally will make the bulls eager to buy the 1st selloff. This is true even if the Emini falls below this week’s low.

As a result, rather than resuming the bear trend, that 1st reversal down will probably form a higher low or double bottom with this week’s low and lead to at least one more leg up. Remember, trading ranges often have many 2 legged moves up and down. They also often have 3 legged moves, which are wedges.

What happens after a couple legs up to resistance? If this week’s rally stalls, the bears will have a 50% chance of a test below this week’s low. Furthermore, they still have a 40% chance of breaking below the February low. Finally, there is a 30% chance of a 400 point measured move down below the February low.

Daily S&P500 Emini futures candlestick chart: October wedge sell climax and bull trend reversal

The daily S&P500 Emini futures candlestick chart reversed up this week from a parabolic wedge sell climax.

I wrote last weekend that the Emini would rally over the next two weeks. I also said that it might have one more brief new low first. That came on Monday, and the Emini reversed up strongly since.

The daily S&P500 Emini futures candlestick chart gapped above Tuesday’s ioi buy signal bar after a month-long wedge bottom. The odds favor at least 2 legs sideways to up. Consequently, the bulls will buy the 1st reversal down.

However, the daily chart is still below its 20 day EMA and it has not gone above a lower high. Consequently, it is still Always In Short. Therefore, as strong as the rally has been, it is still slightly more likely to fail and test below the October 29 low. Two strong closes above the EMA or a close above the October 17 high would shift the odds in favor of the bulls.

With Friday trading above Thursday’s high and then below Thursday’s low, it was on outside down day. Friday is therefore a sell signal bar for Monday. However, this past week’s reversal up was a sign of strong bulls. Consequently, the best the bears will probably get this week is 2 – 3 days down before there is at least a small 2nd leg sideways to up.

Support and resistance in developing trading range

The bulls reached their 1st targets this week, which were the 20 day EMA and the October 24 sell climax high. The next target is the October 17 major lower high at 2819.25. That is the top of the parabolic wedge bar channel.

Bear channels typically evolve into trading ranges. Therefore, there will probably be a leg down from that high. The bulls hope it will be a brief pullback in their bull trend reversal.

However, it could lead to a deep pullback before the bulls can make a new all-time high. For example, the selloff from the test of the October 17 high might fall to the October 11 sell climax low. If the bulls got a reversal up from there, they would have a higher low major trend reversal and a head and shoulders bottom. That would give them a better chance of a new all-time high within the next 3 – 6 months.

The bears want an island top

The bears want a gap down next week. This would create an island top with Wednesday’s gap up. However, island tops and bottoms are minor reversals. An island top alone typically only leads to a week or two of selling, not a bear trend.

In addition, this week’s reversal up was so strong that it represents aggressive buying. If the Emini were to trade back down to around this week’s low, the bulls who have not yet bought will be eager to buy.

Also, the bears who are short are now afraid that the bottom is in. They are hoping for a test back down so that they can exit with a smaller loss. With both the bulls and the bears looking to buy a selloff, the odds favor at least one more leg up.