Key Points:

- Downtrend seems to have halted for now.

- Ranging phase now likely.

- RBNZ in focus in the week ahead.

The Kiwi Dollar finally began to stage a bit of a comeback last week which now begs the question, what’s next for the embattled pair? To answer this, it’s worth taking a quick look at what actually drove last week’s price action and what the technical bias could have to say about the week to come.

Starting with the week that was, the Kiwi Dollar ended last week much where one would expect given the rather strong reaction to the Fed’s decision to raise rates whilst also not offering a strong hawkish outlook moving ahead. However, things weren’t all smooth sailing as things progressed and the NZ GDP figures came in at 2.7% y/y and 0.4% m/m, both of these being short of expectations. Initially, this saw the NZD slip back below the 0.70 handle before it found its footing again which had some worried that the FOMC gains would be short-lived. Luckily, the pair recouped these losses as the US Unemployment Claims put a dampener on USD sentiment as the week began to wind down.

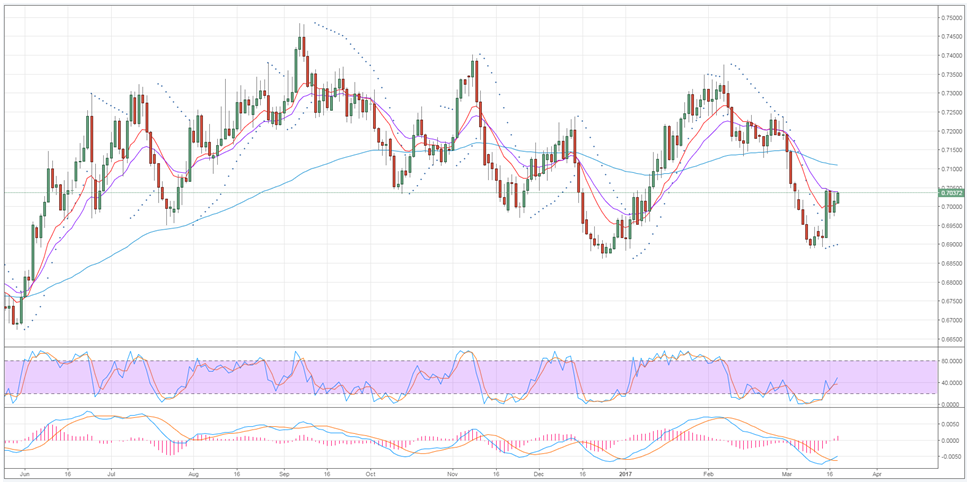

As for the technical readings, the NZD/USD now has an overall bearish bias but a solid zone of support could help to limit losses and lead to a neutral week. Specifically, the 12, 20, and 100 day moving averages are in a highly bearish configuration which will be helping to encourage selling. Conversely, the pair has also peaked at a historical zone of resistance which could limit its ability to push higher. Meanwhile, the parabolic SAR has inverted to bullish and the current support has proven to be a robust low on multiple prior occasions.

As for the impending fundamental news, the key development to keep an eye on will be the RBNZ’s announcement of the OCR. Currently, expectations are that the rate is held steady as the bank has proven reluctant to alter monetary policy. However, chances of a hike have been improving due to the admittedly slow, yet still notable, recovery of dairy prices. Moreover, the NZ government is coming under increasing pressure to cool off the red-hot housing market which could mean that Wheeler has a bit of a greenlight to follow the US example and tighten policy.

Ultimately, we should see the Kiwi Dollar range this week, likely, between the 0.6982 and 0.7047 levels. However, as mentioned above, don’t discount the chances or a surprise breakout to the upside if the RBNZ decides to have a surprise rate hike. This being said, in the wake of last week, the central bank could be taking a rather cautious approach that might also be dependent on the GDT numbers released immediately before the OCR announcement.