Oceans of potential

Ocean Wilsons Holdings’ (OCWSF) 58%-owned Brazilian subsidiary, Wilson Sons (WSON), has completed a US$1bn programme of investment over the past seven years, which leaves it well placed to benefit from a recovering local economy, as well as the growth in domestic oil and gas production and global trade flows. We forecast free cash flow pre-dividends improving to US$40m from 2014, a portion of which could be paid out to shareholders, as low-cost, long-term debt in Brazil is unlikely to be repaid early. With a current discount of 21% to the last reported NAV, the market may not be factoring this in, or the prospects for recovery in the Brazilian and global economies.

Company: Geared to recovery in local/global growth

OCN’s control of WSON gives it exposure to three growth drivers: international trade flows, the oil and gas industry and the domestic Brazilian economy. WSON is one of the largest integrated providers of maritime services in Brazil, with container terminal operations, towage, offshore support services, logistics and small vessel construction. OCN also manages a portfolio of international investments, with a long-term outlook and a bias towards global and emerging market equities via its subsidiary, Ocean Wilsons Investments Limited (OWIL).

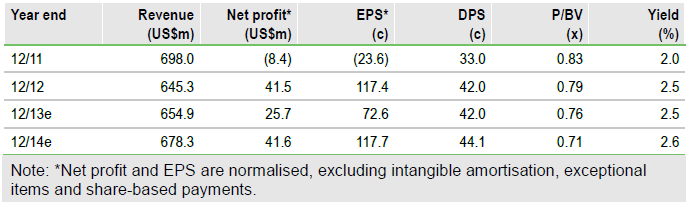

Financials: Potential for a higher dividend payout

After its huge investment programme, WSON is expecting capex to level off at c US$100m a year, which should see pre-dividend cash flows reach US$40m by 2014. WSON management does not intend to repay any of its long-term, low-cost debt, so may decide to invest free cash in further projects, or to return excess cash to shareholders, via increased dividends. The deconsolidation of a joint venture in Brazil also removed US$238m of debt from 1 January 2013.

Valuation: Catalysts for a tighter discount are in view

OCN is currently trading at a 21% discount to NAV, so arguably provides a discounted way of investing in WSON. The OWIL portfolio has a strong long-term record of performance and may benefit from its weighting towards global equities, as growth continues to recover. WSON trades at a discount to our estimated DCF valuation, though not to its peer averages. We believe further recovery in the Brazilian economy and global trade, plus an improved dividend could be positive catalysts for WSON. This would in turn enhance OCN’s NAV and dividend capacity, potentially producing a further closing of the NAV discount.

To Read the Entire Report Please Click on the pdf File Below