Most investors are aware that the 4-year cycle peak comes into play this year. What few realize is how both Washington and Wall Street are using this cycle as a fulcrum for gaining political as well as economic advantage. In this commentary we’ll look at how the hedge fund industry is manipulating certain key markets for political ends as much as financial gain, and how even the president has been forced to respond. It will quickly become apparent how the puerile and self-serving actions of the top hedge fund managers serves to create friction for everyone concerned.

Hedge funds have come a long away in the 60+ years of the industry’s history. One byproduct of the industry’s influence is its growing political clout. Consider the cover of a recent issue of The New Republic. The cover shows President Obama dodging tomatoes being hurled at him from an unseen source. The headline reveals the perpetrators of this metaphorical act: angry hedge fund managers. According to the article, Obama has raised the ire of the hedge fund industry by his proposal to raise the top marginal tax rate and increase the 15% tax on capital gains.

“The fault line that emerged was over the treatment of carried interest, the ‘hedge fund loophole,’”according to author Alec MacGillis writing in The New Republic. The loophole “allowed partners in investment firms to have their compensation – typically a 20 percent cut of profits – taxed at the 15 percent capital gains rate instead of the 35 percent top rate for ordinary income.” According to MacGillis, hedge funds and private equity firms alike protested as it became clear that Congress was intent on closing the loophole in a manner that would hit all of them in a place that hurt: their profits, should they decide to sell stakes in their firm.

The New Republic article underscores not only the growing political clout hedge funds have acquired in recent years, but also the sensitivity the industry seems to exhibit whenever Washington proposes anything that would interfere with their exorbitant profits.

What are fund managers doing to counter these perceived attacks on their “manhood”? They are fighting fire with fire. Consider S. Donald Sussman, the hedge fund manager who recently bought a stake in Maine’s Portland Press Herald. Owning an interest in a mainstream news publication is one way of shaping public opinion. Then there is Ken Griffin, who runs the Chicago-based Citadel hedge fund with more than $12 billion under management. Griffin is known to donate liberally to both major political parties, including large sums to super PACs.

Clifford Asness of AQR Capital Management has libertarian leanings but donates generously to the Democrat Party. Dan Loeb, who manages the $9 billion Midtown fund, helped raise some $200,000 for Obama in 2008. But he changed his allegiance in 2010 after Obama chastened Wall Street with his famous “fat cat bankers” remark – a statement many hedge fund managers took to heart. Loeb has since donated large sums to the Republican Senatorial Campaign Committee.

If there are lessons to be gleaned from the political activities of the hedge funds they can be summarized as follows:

Fund managers are a fickle lot and liable to change their affiliations at a moment’s notice.

They are easily offended, especially on the subject of money and economics.

They have an inflated sense of their own self-worth, both as it concerns the inherent “goodness” of their profession and their perceived importance in stabilizing the financial system.

On the latter score (#3), a statement by a senior partner at a Midtown fund quoted by MacGillis is enlightening: “Their whole life is wrapped up in their money and their whole identify is in their money.” He further explained the reason why so many hedge fund managers turned on Obama after he proposed a capital gains tax increase: “If someone takes five percent more of your money this year, it’s directly attacking your manhood. They really want to maximize their net worth, and if you’re taking five percent more out of their profits, they’ve got to do ten more good trades to get it back.”

The hedge fund world also took exception to the president speaking out against Bank of America’s new $5 monthly fee last October. His comment was made in the midst of the Occupy Wall Street protests and was interpreted by many in the financial world as a veiled attack on their industry. “You don’t have some inherent right to, you know, get a certain amount of profit if your customers are being mistreated,” Obama said. Describing the defensive reaction of many fund managers, a former Obama administration official said, “They have unbelievable memories. They remember every phrase he ever said that’s given comfort to the rabble.”

The sensitivity of hedge fund operators extends beyond politically motivated attacks on their net worth. They are especially sensitive to criticisms of their chosen profession. In the words of MacGillis, Obama’s critique of Wall Street delivers “an unmistakable judgment about the worth of the profession they have chosen. That the story they are telling themselves about their own lives is highly questionable.” Or as former House Financial Services Committee Chairman Barney Frank put it, “They don’t just want us to represent their interests, they want to be told that what they do is very good. They want to be honored for what they do for society.”

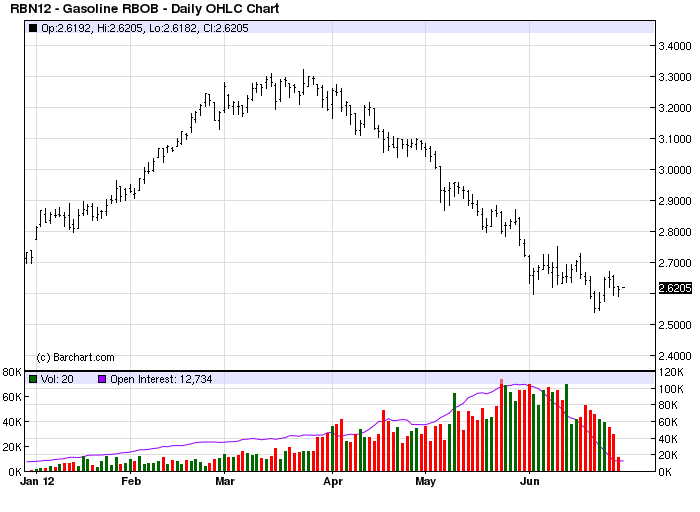

One example of how out of touch with middle America hedge funds are is the negligent way which the industry pushed energy future prices higher prior to, and after, the credit crisis in spite of weak fundamentals. The extraordinary run-up in oil and gasoline prices was purely a speculative momentum play, with billions of hedge fund dollars creating a positive feedback loop which resulted in continually rising prices from 2005 to 2008 and, in the case of gasoline futures, from 2010 to early 2012. Even in the face of diminishing demand for oil and lower gasoline sales volumes, hedge funds were responsible for pushing up gasoline prices in the early part of this year. What finally put a stop to the inexplicable rally was yet another industry clash with the president.

On March 29, Obama made remarks on oil and gas subsidies which scared the hedge fund industry and marked a turning point in the gasoline price. In his speech he spoke against taxpayer giveaways to a petroleum industry already awash in cash. This spooked the hedge fund managers who up to that time were committed to running up the gasoline futures price. As you can see in the following chart, Obama’s Mar. 29 speech coincided with a major top for the gas price.

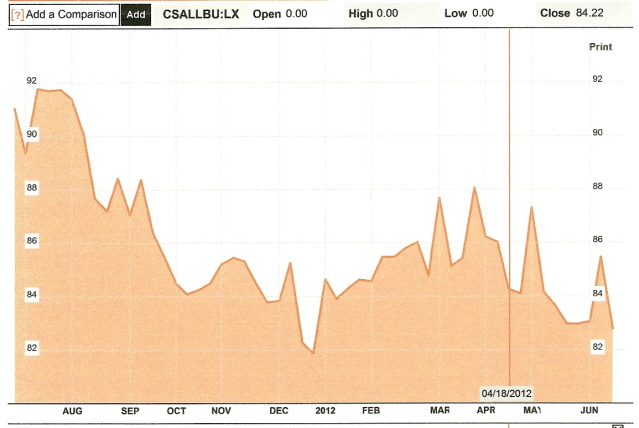

As you might expect, the hedge fund world hasn’t taken kindly to what it perceives as a politically motivated sabotage to a profitable momentum trade. It has left many fund managers with egg on their faces and a sour taste in their mouths. Moreover, the decline in energy prices since March put an even bigger dent in the industry’s 1-year performance rating as shown in the chart below.

After a stellar start in 2012, the hedge fund industry has experienced a slowdown in the second quarter. Hedge funds began the year with their best collective performance since 2000, but within a couple of months had given up much of those gains. By the end of May, the average hedge fund was down and was staring at additional losses as the second quarter comes to an end.

The hedge fund industry was down 6.4% for 2011 as measured by the Dow Jones Credit Suisse All Hedge Index and is down 8.20% on a 1-year basis as of June 23. Despite this dramatic underperformance, industry assets under management have climbed back to $2 trillion – close to the $2.1 trillion all-time high in 2007 before the onset of the credit crisis.

To recover from this blow, the financial world needs a major momentum trade now more than ever. The last hope for one while the 4-year cycle is still peaking could still occur this summer, but the window of opportunity for this is closing. An even greater chance for hedge funds to stage a comeback might just be the bearish trade after the 4-year cycle peaks this fall.

For now, in the ongoing battle between Washington and Wall Street, the “hedgies” are behind.

Price of Gold

Let’s take another look at the outlook for physical gold. A leading gold proxy, the iShares Gold Trust (IAU, 15.16), is still under its dominant immediate-term 15-day moving average and only slightly above its May low of 15.00. Moreover, the relative strength indicator for the IAU still hasn’t reversed its recent decline. The last three important signals in IAU have been preceded by reversals in the relative strength indicator, and we’re still waiting for this indicator to reverse.

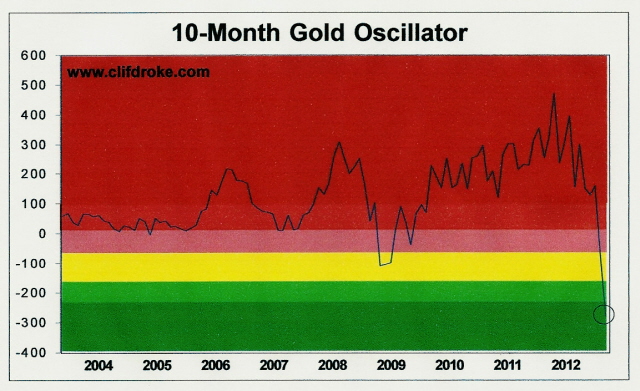

The relative strength indicator provides signals mainly for the short-term outlook. An important indicator for the longer-term gold outlook is flashing a huge signal right now, however. The 10-month price oscillator for gold as of the end of June has given its most oversold reading in the last nine years.

We talked about this indicator last month when it first entered into oversold territory – the first such instance of an oversold technical for gold since 2009. The last time this indicator was updated it gave a reading of negative 71, which on the long-term scale is only mildly oversold. As of the last trading day of June the indicator registered an even stronger oversold reading of negative 279.

It’s hard to imagine gold declining much further given the enormous oversold internal condition this indicator is flashing. The “quants” and other smart money technical traders will undoubtedly view this condition as a major opportunity to accumulate new long positions in the yellow metal in the weeks and months ahead. The implication here is that the gold market is “juiced” and the next confirmed short-term buy signal could prove to be explosive. Accordingly, we’ll be watching the relative strength indicator very closely in the coming days for an improvement.

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Obama Versus The Hedge Fund Industry

Published 07/01/2012, 04:14 AM

Updated 07/09/2023, 06:31 AM

Obama Versus The Hedge Fund Industry

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.