Investing.com’s stocks of the week

President Obama successfully saw off the challenge of Republican candidate Mitt Romney, in what was a closely fought election.

Obama secured the 270 electoral votes required (with the Florida vote still to be determined at time of writing – 0700 GMT) with the phone call to concede coming from the Republican Party HQ in Boston just before 0600 GMT. The decision was made after the critical swing state of Ohio was claimed by the Democrats.

One third of the seats in the US Senate and all 435 seats in the House of Representatives were also up for grabs today. The majority implications have a strong bearing on the influence afforded to the president. Results will be closely monitored.

Exit polls placed the economy as the dominant focal point for the majority of voters. Forty-six per cent feel the country was headed in the right direction, while 52% said it was on the wrong track. More than half of those surveyed blamed the economic mess on George W Bush. 40% said unemployment (currently 7.9%) was the most important issue, 37% said rising prices, 13% taxes with 8% citing the housing market as the biggest concern.

80% of voters said that they had made their minds up as early as September, which suggest that there was only a small amount of significance in the outcome of the debates and indeed the last minute impact and handling of Hurricane Sandy.

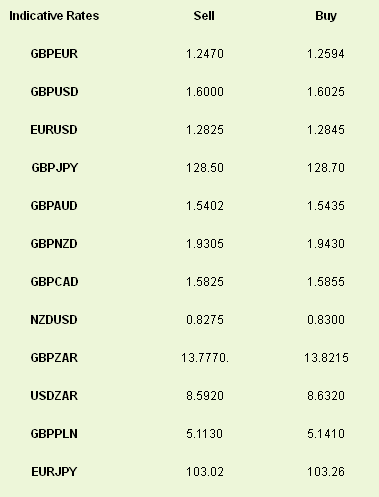

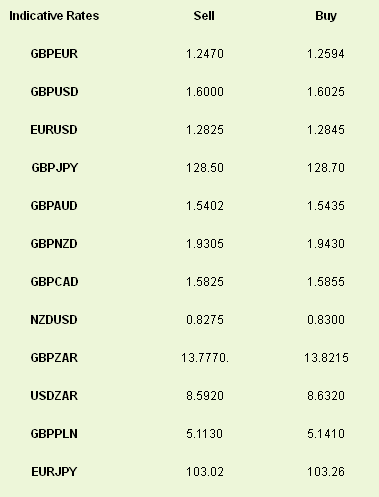

The markets will spend the day digesting the results of the election. USD has already taken a slight hit since Obama was re-elected. GBPUSD and EURUSD gained approximately 80 pips, pushing cable back above the 1.60 mark with EURUSD holding strong at 1.2870. The direct effects/implications of the presidential race on the world markets were never clear cut, while there were clear policy directives that were more favourable on the financial markets than others, things rarely go by the book these days.

At face value – a Romney win would have benefited the equity markets more favourably, attributable in large to his more business friendly policies. A republican president would have given the majority leadership (between the presidency and the two houses) to the republicans which in theory would have delivered change and policy reform more quickly (the make-up of the two houses is subject to re-balancing, pending election results, as mentioned above). The short term impact of the presidency on the FX/Equity markets is nowhere as important as the longer term implications and handling of the upcoming fiscal cliff.

The planned automatic spending cuts and tax alterations will total over USD 600 billion (4% of GDP). If all were enacted then the CBO predicts that GDP in the first half of the year would contract by 1.3% (annualised rate) and the annual growth rate for 2013 would be a disappointing.

Obama’s immediate attention will focus in full on the handling of the ‘fiscal cliff’. As soon as he is sworn in it will be back to the classroom his economic elite to curb the downside risks of the impending cliff.

Moving across the pond, the yesterday saw UK industrial Production slip by -1.7% during Sept, down -2.6% on last year, consolidating the UK’s fall from grace. Poor manufacturing and ailing services data have left the BoE no choice but to step in and increase its asset purchasing programme. GBPEUR fell below 1.25.

Services figures across the Eurozone we weak, most worryingly the figures for Germany and the EU itself which were lower than forecasted for the month.

Looking to the day at large, markets will be dissecting the results of the US elections. EU retail sales and industrial production for Germany are due out this morning. Going by yesterday’s figures we fully expect figures today to be off-kilter as well. Day two of the protests in Greece are underway, things aren’t expected to be as muted as they were yesterday.

Obama secured the 270 electoral votes required (with the Florida vote still to be determined at time of writing – 0700 GMT) with the phone call to concede coming from the Republican Party HQ in Boston just before 0600 GMT. The decision was made after the critical swing state of Ohio was claimed by the Democrats.

One third of the seats in the US Senate and all 435 seats in the House of Representatives were also up for grabs today. The majority implications have a strong bearing on the influence afforded to the president. Results will be closely monitored.

Exit polls placed the economy as the dominant focal point for the majority of voters. Forty-six per cent feel the country was headed in the right direction, while 52% said it was on the wrong track. More than half of those surveyed blamed the economic mess on George W Bush. 40% said unemployment (currently 7.9%) was the most important issue, 37% said rising prices, 13% taxes with 8% citing the housing market as the biggest concern.

80% of voters said that they had made their minds up as early as September, which suggest that there was only a small amount of significance in the outcome of the debates and indeed the last minute impact and handling of Hurricane Sandy.

The markets will spend the day digesting the results of the election. USD has already taken a slight hit since Obama was re-elected. GBPUSD and EURUSD gained approximately 80 pips, pushing cable back above the 1.60 mark with EURUSD holding strong at 1.2870. The direct effects/implications of the presidential race on the world markets were never clear cut, while there were clear policy directives that were more favourable on the financial markets than others, things rarely go by the book these days.

At face value – a Romney win would have benefited the equity markets more favourably, attributable in large to his more business friendly policies. A republican president would have given the majority leadership (between the presidency and the two houses) to the republicans which in theory would have delivered change and policy reform more quickly (the make-up of the two houses is subject to re-balancing, pending election results, as mentioned above). The short term impact of the presidency on the FX/Equity markets is nowhere as important as the longer term implications and handling of the upcoming fiscal cliff.

The planned automatic spending cuts and tax alterations will total over USD 600 billion (4% of GDP). If all were enacted then the CBO predicts that GDP in the first half of the year would contract by 1.3% (annualised rate) and the annual growth rate for 2013 would be a disappointing.

Obama’s immediate attention will focus in full on the handling of the ‘fiscal cliff’. As soon as he is sworn in it will be back to the classroom his economic elite to curb the downside risks of the impending cliff.

Moving across the pond, the yesterday saw UK industrial Production slip by -1.7% during Sept, down -2.6% on last year, consolidating the UK’s fall from grace. Poor manufacturing and ailing services data have left the BoE no choice but to step in and increase its asset purchasing programme. GBPEUR fell below 1.25.

Services figures across the Eurozone we weak, most worryingly the figures for Germany and the EU itself which were lower than forecasted for the month.

Looking to the day at large, markets will be dissecting the results of the US elections. EU retail sales and industrial production for Germany are due out this morning. Going by yesterday’s figures we fully expect figures today to be off-kilter as well. Day two of the protests in Greece are underway, things aren’t expected to be as muted as they were yesterday.